Time-varying rates from the get-go – not just by opt-in.

Ahmad Faruqui, Ryan Hledik, and Neil Lessem are economists with The Brattle Group, based in San Francisco. They would like to thank their colleague Sanem Sergici for her thoughtful comments on earlier drafts of this paper. Many other reviewers also read previous drafts. The views expressed in the paper are not necessarily those of Brattle. Comments can be directed to ahmad.faruqui@brattle.com.

About a third of U.S. households are now receiving electric service through smart meters but only two percent are buying the energy portion of their electric bill on a time-varying rate, or TVR. As we look at the future, it is clear that the number of customers with smart meters will continue to grow while the number of customers on TVRs will continue to stagnate. (TVRs come in several forms. For definitions of some of the more commonly used TVRs - , CPP, PTR, TOU, and VPP - see sidebar, "Common Forms of Time-Varying Rates.")

It is possible that nearly all U.S. households will be on smart meters sometime during the next decade. But how many will buy electricity through a TVR? Unfortunately, if the current regulatory logjam persists, that percentage is not likely to enter double digits any time soon.1

In other words, while the economic case for TVRs is well-known,2 it is the politics which is murky. And whether these rates should replace the default flat rates that are ubiquitous today by becoming the default tariff is the subject of vigorous debate in California and Massachusetts, as both states have opened proceedings on the topic. It will probably also enter the debate in New York at some point.3

This article lays out a simple way to overcome the barriers to TVR adoption: offer TVR on a default basis.4 If all of a utility's customers were transitioned to a TVR with the option to switch to a different, non-time-varying rate design, enrollment in the TVR would be three to five times higher than if it were offered on an opt-in basis. As a result, major cross-subsidies that are embedded in today's flat rates5 would be eliminated, utilization of generation resources would be improved, the total cost of supplying and delivering electricity would be reduced, and a customer's freedom to choose from a diverse array of rate offerings would still be preserved.

Some regions of the world are already transitioning to default TVR. All four million households in the province of Ontario, Canada have been defaulted to a time-of-use (TOU) rate, with the option to choose a different rate offered by retail supplier. TOU pricing is the default residential rate across Italy and this involves some 25 million customers.6 In Maryland and Delaware, BGE and Pepco Holdings (PHI) are currently transitioning all of their customers to a default peak time rebate (PTR), while the Massachusetts Department of Public Utilities has proposed rolling out default TOU rates over the next several years. In California, the Sacramento Municipal Utility District (SMUD) has committed to rolling out a default residential TOU by 2018. San Diego Gas & Electric (SDG&E) currently offers a default PTR program and has proposed rolling out a default residential TOU rate by 2018. The California Public Utilities Commission's (CPUC) Energy Division has issued a report with a similar recommendation for default TOU.7 Despite these examples, there is a significant gap between the regions with the metering capability to offer default TVR, and those that have elected to do so.

Our focus in this article is specifically on transitioning the energy portion of a customer's rate to a time-varying design. Fixed costs (e.g. metering and billing costs) are better collected through a fixed monthly charge. Capacity costs (e.g., generation, transmission, and distribution costs) may be better collected through a demand charge if the necessary metering infrastructure is in place. The advantages of redesigning residential rates to include these charges will be the focus of a future article.

Dispelling Myths

Contrary to some views that continue to be widely cited in the media, TVR is not expensive or unfair. That double honor belongs to flat rate pricing. We have estimated that each year American consumers are paying $7 billion more for electricity on flat rate pricing than they would be paying on TVR. Flat rates also create inequities in the form of cross-subsidies in the amount of $3 billion per year.8 Yet flat rates are the mandatory or default rate in most parts of the U.S.

There is a strongly held perception that consumers won't understand TVR. The reality is quite the opposite. The average person has encountered TVRs routinely in the normal business of life, such as when making a phone call, buying an airline ticket, booking a hotel room, renting a car, going to a San Francisco Giant's game, attending a symphony performance, going to the movies, riding the subway, or simply buying produce at the local farmer's market. And recently, TVR even has been encountered when driving on the Fast Track lane of certain freeways, crossing bridges such as the San Francisco-Oakland Bay Bridge, driving into central London on weekdays and simply while parking a car in a metered space. TVRs are ubiquitous in everyday life.

Figure 1 - Residential TOU Enrollment Rates

Figure 1 - Residential TOU Enrollment Rates

TVRs ensure the efficient utilization of capacity by minimizing peak loads and improving load factors. By so doing, average costs are lowered for everyone and congestion is better managed so that supply is available for high valued uses and rationed for less valued uses.

When it comes to electricity, we find that TVRs are pervasive in wholesale markets and in retail markets for large commercial and industrial customers. But they are virtually invisible when we review retail markets for residential and small business customers. Consequently, the annual load factor is under 60% for most utilities, with the top 1 percent of the hours accounting for 8 to 18 percent of the annual peak load. Residential load factors are even lower. Peaking generation capacity sits idle for thousands of hours a year. But it has to be paid for, and that puts upward pressure on costs and rates for all customers.

As mentioned earlier, the cost of not having TVR's is in the $10 billion a year range. So what can be done to change this expensive reality? Several fears have to be overcome. The first fear is that that consumers won't respond to dynamic pricing. However, scores of pilot programs carried out over the past decade show conclusively that consumers respond to price.9 The second fear is that consumer response won't persist. Some pilots have run across multiple years and response has persisted in most pilots. For example, pilots in California and Oklahoma ran for two years and a pilot in Maryland ran for four years. All showed persistence. Full-scale TVR programs are in place in Arizona and France and also show persistence. The third fear is that low-income customers will be harmed. The contrary has been shown to be the case. In one study, nearly 80% of low-income customers were found to be paying more under flat rates.10 After shifting load away from peak hours, the study found that they will save even more with TVR.

Making the Case

Figure 2 - Residential Dynamic Pricing Enrollment Rates

Figure 2 - Residential Dynamic Pricing Enrollment Rates

While most would be hard pressed to disagree about the benefits and efficacy of TVRs, many disagree on how they should be offered to consumers. To this end, we seek to clarify some of the rhetoric and confusion underlying this discourse. Our main points of contention are:

• "Default" is different than "mandatory,"

• A default rate is always present, and

• The aggregate impacts of a default TVR offering will always be greater than the impacts of default flat rate with opt-in TVR, even if the average impact per participant is lower.

Figure 3 - Indifferent Customers? At Least Some Will Always Respond

Figure 3 - Indifferent Customers? At Least Some Will Always Respond

The term "default" should be distinguished from the term "mandatory," which has been associated in some people's minds with the failed mandatory deployments of time-of-use rates in the 1980s and 1990s. Those rates were poorly designed and even more poorly marketed. In a mandatory rate offering, there is no choice. Customers are automatically enrolled in the rate, with no alternative.

In contrast, with default pricing customers are enrolled in a rate with the option to switch to other rate choices if they choose to do so. A default offering - importantly - allows for customer choice. In a competitive market, the term mandatory carries no meaning and is indeterminate. Customers can pick the default service if that is to their liking. Or they can shop around and go with a service offered by a competitive retailer. They have a choice. Nothing is being mandated for them. Likewise in markets without retail choice, if a menu of rate offerings exists, no one rate is mandatory.

The offering of new services on a default basis is commonly observed in other industries. In Nudge: Improving Decisions About Health, Wealth, and Happiness, University of Chicago Professors Richard Thaler and Cass Sunstein point to the benefits of automatic enrollment in retirement savings plans. Despite the "free money" that is offered through employer matching of 401k contributions, researchers find that when the plans require customers to proactively opt-in, many are delaying their enrollment or neglecting to do so altogether out of negligence or apathy, and later regretting it. With automatic enrollment participation is significantly higher and there is little difference in drop-out rates between default and opt-in enrollment offerings, suggesting that many new participants are finding that they benefit from the plan under default deployment.11

Other examples of default offerings in everyday life include default power saving settings on smart phones and laptop computers, and automatic renewal of magazine subscriptions. In countries such as Austria, Belgium, France, and Hungary, citizens are automatically enrolled in organ donor programs. These programs maintain enrollment levels of 98 to 99 percent, whereas countries with opt-in enrollment, such as Germany, the United Kingdom, and the Netherlands, have seen participation well below 30 percent.12 There is no shortage of precedent for default offerings.

Figure 4 - The Demand Response Impacts

Figure 4 - The Demand Response Impacts

The terms "opt-in" and "opt-out" are often used to describe how a TVR is deployed. The term "opt-in" obscures the fact that the there is a de-facto default rate in place, and that the default is almost always the flat rate. To create awareness of this issue, we refer in this article to default flat rates with opt-in TVR, and default TVRs with opt-in flat rates.

By and large the current system in the United States is devoid of customer choice, with customers facing either mandatory flat rates or default flat rates without a substantially different and attractive alternative. Even in those states with a long history of retail competition, the market has failed to provide residential customers with a meaningful time-varying rate option. The objectives of economic efficiency and equity have not been well served by such a rate offering. By changing the default rate from a flat rate to a time-varying rate, creative forces would be unleashed in the competitive market and the objectives of economic efficiency, equity and choice would all be enhanced.

Ideally, customers should have a menu of pricing options that allows them to choose where they want to be in the risk-reward trade-off that accompanies increasingly dynamic rates. Customers who want to avoid this uncertainty or risk can choose to pay an "insurance premium" built into flat rates. Within this menu, the default rate should be the time-varying rate. The design of the default rate matters for customer choice because many customers will stick with the default rate regardless of what it is.

Comparing Enrollment Levels

The contrast in TVR enrollment levels under a default flat rate versus default TVR offerings can be observed in a survey of full scale deployments and market research studies conducted across the U.S. and abroad. With respect to full scale deployments, our survey focused specifically on rate offerings that have been heavily marketed to customers and have achieved significant levels of enrollment. The enrollment estimates are based on data reported by utilities and competitive retail suppliers to FERC and other entities. Alternatively, the primary market research studies rely on a survey-based approach designed to gauge customer interest in TVR. It is important to note that after the surveys were collected by the market researchers, adjustments were made to account for the natural tendency of respondents to overstate their interest. Thus, they should provide a reasonable prediction of enrollment rates. The survey respondents were randomly selected from each utility customer base and confirmed to be representative of the entire class of customers. Samples were large enough to ensure statistical validity of the findings.

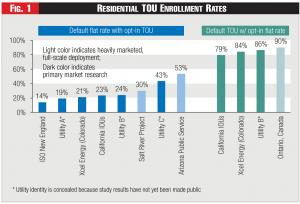

Figure 1 shows residential TOU enrollment levels for default flat rates (with the option to opt in to TOU) and default TOU rates (with the option to opt in to flat rates). Under default flat rates the average TOU enrollment level is 28 percent, while when TOUs are the default, the average enrollment rate rises to 85 percent.13 Default TOU rate offerings are likely to lead to enrollment levels that are 3 to 5 times higher than opt-in TOU offerings.

Arizona Public Service and Salt River Project (SRP), both located in Arizona, have achieved high opt-in TOU enrollment through heavy marketing of the TOU rates as well as through large users' ability to avoid the higher priced tiers of their inclining block rate by switching to the TOU.14 In Ontario, Canada, many of the customers not participating in the default TOU rate had already switched to a competitive retail provider before the TOU rate was deployed. After some initial issues with the rollout of the default rate in Ontario, the transition has been effective and system wide load reductions have been observed.15 Similarly, TOU has been deployed on a default basis across Italy.

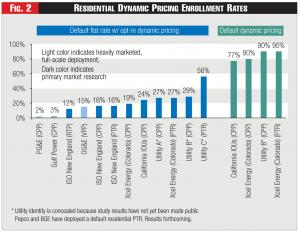

Figure 2 shows residential enrollment levels in dynamic pricing rates under default flat rate and default TVR deployments. The dynamic pricing enrollment levels are similar to those of the TOU offerings, with average dynamic pricing enrollment of 20 percent under default flat rates and 84 percent when dynamic prices are the default. Dynamic pricing options considered include CPP, PTR, VPP and Real Time Pricing (RTP).

Oklahoma Gas & Electric (OG&E) has achieved the highest level of full scale opt-in enrollment, with 15 percent of its residential customer base enrolled in its VPP rate and a target of 20 percent enrollment by 2016. This has been achieved through proactive marketing and outreach, and by offering a free smart thermostat to customers who enroll in the rate. The first residential default dynamic pricing deployments have just begun in Maryland and Delaware, where BGE and PHI are enrolling all of their residential customers in peak time rebates. Information is not yet available as to the number of customers who have opted out of these rates. SDGE and SMUD are proposing default deployments in the year 2018.

The Backlash Argument

While theory suggests that default TVR deployment would simultaneously promote equity and efficiency in rate design, concerns persist among many stakeholders in the ratemaking process that it may fail in practice. The concern rests on the supposition that default deployment could trigger a customer backlash. Furthermore, it has been argued that default TVR deployment would yield a lower amount of demand response than opt-in TVR pricing, since customers who are forced onto the default TVR tariff will choose simply not to respond.

It is probably true that the average reduction in peak demand per participating customer is likely to be smaller with a default TVR offering, compared with an opt-in offering. But as shown below, we find that the significant increase in customer participation brought out by default deployment with an opt-out right should more than offset that tendency.

First, consider that in the public debate about TVRs, there are three competing hypotheses about how customers will respond to default TVR rates versus opt-in TVR rates:

H1 (No Better, No Worse): A default TVR deployment will enroll many more customers than an opt-in deployment but they won't respond to the TVR. Thus, the aggregate impact on peak demand under opt-out TVR deployment will equal the aggregate impact under opt-in TVR deployment,

H2 (Backlash Case): A default TVR deployment will trigger a negative customer backlash since customers will object to being defaulted onto a TVR. Thus, the aggregate impact under opt-out TVR deployment will be less than the aggregate impact under opt-in deployment, and

H3 (Net Improvement Case): A default TVR deployment will reach far more customers than an opt-in deployment and they will respond to the TVR incentives. Thus, the aggregate impact under opt-out TVR deployment will exceed the aggregate impact under opt-in TVR deployment.

To resolve the debate, we put these three hypotheses to test using evidence from a number of recent studies, including both pilots and full-scale rollouts. To begin, imagine that there are three types of customers: (A) the big responders, who are heavily interested in TVR, (B) marginal responders, who are somewhat interested in TVR, and (C) those who not interested in TVR and possibly hostile to it, including those who may influence the response rates of the other two groups.

Group A consists of customers who are probably the most interested and informed in TVR and will achieve the highest impacts. Group B consists of two types of customers: first, those who are bored by electricity rates and will stick with the default regardless of what it is; and, second, those who are uninformed and will learn more about the TVR with increased exposure to it. Some of these customers will opt into flat rates under default TVR and some will opt in to TVRs under default flat rates given information and time. Empirical evidence from SMUD and Ontario, Canada shows the number of B group customers choosing to opt-in to a flat rate from a default time-varying rate to be low. The same is generally true for customers opting in to TVRs under a default flat rate with the exception of Arizona Public Service, Oklahoma Gas & Electric, and the Salt River Project, all of whom have invested heavily in educating and informing their consumers. Group C consists of customers who will benefit the most from flat rates, or who are determined to stick with the status quo regardless of the financial ramifications.

To test our three hypotheses, we build an equation for each one, indicating in each case the total impact on demand response, as derived from the combined component impacts of each of our customer groups:

H1: A * ImpactA + B * ImpactB = A * ImpactA

(i.e., ImpactB is zero)

H2: (1-θ) * A * ImpactA + B * ImpactB < A * ImpactA

where θ is the proportion of Group A customers who drop out under default TVR (i.e., the impacts from those Group A customers who drop out under default TVR (θ) outweighs the benefits from the addition of Group B customers)

H3: A * ImpactA + B * ImpactB > A * ImpactA

Let's begin with Hypothesis 2, the "Backlash" theory. This idea says that under default TVR there will be such a large customer backlash to being defaulted onto TVR that some of the Group A customers (the big responders) who would have opted-in to TVR will now opt-out. The Group B customers are unaffected since by our definition they are the customers that remain on TVR when it is the default. As discussed earlier, this hypothesis is not borne out empirically; there has been no major customer backlash against default TVR deployment and TVR enrollment has been considerably higher under a default TVR offering than under a default flat rate offering. Based on this observation, we reject hypothesis 2.

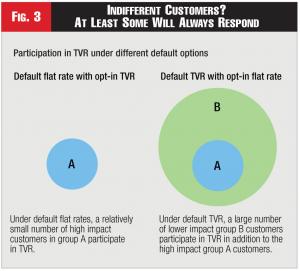

Now let's test the other two theories our hypotheses H1 and H3. Here we can see in Figure 3 in pictorial form that a default TVR with a flat-rate opt-out will outperform a default flat rate with a TVR opt-in. Group A customers (the big responders) will participate in TVR in either case, while group B customers (the marginal responders) will contribute to peak demand reduction in the default case. Thus, under hypotheses 1 and 3 a default TVR strategy will (weakly) dominate the default flat rate strategy in terms of enrollment and ultimately in terms of aggregate DR impact.16 This assertion is shown in Figure 3.

The overall demand response savings will always be greater under default TVR than a default flat rate, provided that the number of Group B customers is non-zero and their impact is positive.17 We conducted an extensive international survey of TVR enrollment rates and load impacts to test whether hypothesis 1 or hypothesis 3 holds empirically.

Quantifying Net Improvement

Now let's move from a comparative analysis to a quantitative one. How great are the potential benefits of a default TVR deployment, versus flat rates with a TVR opt-in? To find the answer, we must discover how much each of our three different groups of customers will participate in TVR pricing and contribute to demand response, according to whether TVR pricing is deployed by default, or only by affirmative option.

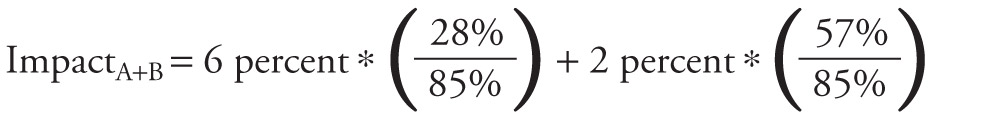

To develop estimates of likely TVR enrollment levels under default flat rate offerings versus default TVR rate offerings, we relied on the previously discussed survey of market research studies and full scale rate offerings. The average TOU enrollment level under a default flat rate was 28 percent across these studies. When TOU was offered as the default rate, average enrollment was much higher, at 85 percent. Using these estimates, Group A comprises 28 percent of the population (since all participate in opt-in TOU under default flat rates). The participation rate under default TOU is the sum of Group A and Group B. Subtracting Group A's share of the population from the default TOU participation rate, yields a Group B population share of 57 percent.18

To estimate the average customer's peak load reduction under default flat rates, we relied on Arcturus, The Brattle Group's comprehensive database of more than 200 residential TVR pricing tests that have been conducted by utilities around the globe over the past 10 to 15 years.19 These pilots took place in a rate design environment where flat rates were the default option. Customers, in most cases chosen randomly, still have to affirm their intent to participate in the TVR rates. Based on the average results across all of the TOU pilots, we estimate that the peak impact from TOU across all participants would be roughly six percent under an opt-in TOU offering. Therefore, since only Group A participates in TOU under an opt-in TOU rate offering, Group A's peak reductions are six percent.

As noted earlier, all the TVR pilots described above took place against a backdrop of default flat rate offerings. However, we need an estimate of customer response for a default TVR offering. To obtain this estimate, we have relied on a recent pilot by SMUD which featured both opt-in and default TVR offerings.20 The SMUD experiment showed that randomly selected customers who were defaulted onto TOU collectively achieved greater savings than if they had been opted into a TOU rate, rendering Hypothesis 1 false. Using data from the SMUD experiment, we were able to calculate an approximately 3:1 ratio between Group A and Group B, regarding the impacts on demand response under TOU pricing.

Applying the SMUD ratio of 3:1 to Group A's impact of six percent for TOU rates (obtained from the Arcturus database), we calculate an average peak impact for Group B's TOU participants of two percent. To get what the default would be, we just multiply Group A's enrollment rate share by their impact and likewise for Group B.

Thus:

Filling in the values we are able to infer the average default TOU impact:

=3.4%.

Using the same algebra for CPP, we calculate a Group A to Group B impact ratio of just less than 3:1 using data from the SMUD pilot. Combined with an enrollment rate of 20 percent and peak impact of 18 percent under default flat rates (from the Arcturus database) and an enrollment rate of 84 percent under default CPP, we can infer a default CPP impact of 8.9 percent.21

All of these results validate Hypothesis 3 and negate Hypothesis 1 since the Group B customers have positive impacts. This means that TVRs set as the default benefitted from having all of the high impacts from the Group A (opt-in) customers, plus the smaller impacts from the Group B (uninformed but somewhat interested) customers, which are multiplied over a much larger customer base and resulted in substantially higher overall benefits (20-28 percent of the population were Group A customers while 57 to 64 percent were Group B). The consistently large differences in TVR enrollments between default flat and default TVR rates suggest that most electricity customers would fall into the B group. In the aggregate, despite the fact that the average per-participant impact was smaller with a default TVR offering, the significant increase in participation would lead to system peak reductions that are roughly twice as high as those of the opt-in TVR deployment.

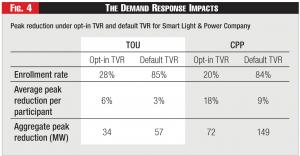

These findings are illustrated in Figure 4 for Smart Light & Power Company, a hypothetical utility with one million residential customers and a coincident residential peak demand of 2,000 MW. In this case, the peak demand reduction increases from 34 MW to 57 MW when deployment is switched from opt-in TOU to default TOU. Similarly the peak demand for CPP increases from 72 MW to 149 MW when deployment switches from opt-in to default TVR.

The remaining unknown in our analysis is the impact of the C group - those customers who could potentially react negatively to a default TVR. It will be essential to accompany the transition to a default TVR with a strong customer outreach and education program. The program should provide customers with digestible information about their new rate and the bill savings opportunities it provides. It should also make them aware of the fact that they have a choice, and can enroll in a different rate if that is their preference. The rate transition will also need to be managed carefully, to avoid sudden, dramatic changes in customer bills. There are a number of options - such as gradual changes to the rate design, or a phased bill protection scheme - that would make this possible. Where default TVR rates have been deployed, these strategies have helped to pre-emptively address the concerns of customers in the C group.

Advice to Regulators

By and large, the status quo is dominated by a flat rate, with its attendant economic inefficiency and unfairness. Switching the default from flat rates to TVR will bring about significant economic gains and reduce cross-subsidies between consumers. Furthermore, a default TVR, unlike a mandatory rate, will preserve customer choice.

Regulators should reassess the choices that are embedded in the status quo since they are not always the best choices for society as its moves forward to embrace a new energy future. In the past, the status quo has been regarded as sacrosanct. It is time to discard this view, since new technologies and pricing designs are now available to meet the needs of a new generation of customers that has a strong interest in saving money, saving energy, and protecting the environment.

Article image © Can Stock Photo Inc. / rolffimages

Endnotes:

1. The logjam is based on myths and misperceptions. For a discussion of these myths, see Ahmad Faruqui and Jennifer Palmer, "Dynamic Pricing and its Discontents," Regulation, Fall 2011.

2. Ahmad Faruqui, Ryan Hledik, and John Tsoukalis, "The Power of Dynamic Pricing," The Electricity Journal, April 2009, Vol. 22, Issue 3.

3. The proceedings in California were initiated two years ago: R.12-06-013. It is expected to run through next year. A welter of rate designs has been suggested by the dozen-plus participants in the case. Implementation of the new rates cannot begin prior to 2018 because of the provisions of a state law, AB 327. The Massachusetts DPU has issued an Order containing a straw proposal that would make TOU with CPP the default tariff and also offer PTR with flat rates: D.P.U. 14-04-B. A final Order is expected before year-end. Implementation may be eight years away because a companion proceeding focusing on grid modernization may take some five years to adjudicate. The newest proceeding is taking place in New York, under the rubric of Reforming the Energy Vision: 14-M-0101.

4. For the purposes of this discussion we ignore the meta-issue of whether a default is needed at all. In markets with retail competition, it is possible to have no default at all, just a menu of alternatives. However, even in such cases a default may be beneficial since it may affect the options offered on the menu. In restructured markets such as those in Massachusetts. Texas, Australia, New Zealand, Ontario (Canada) and the United Kingdom, retail competition has failed to offer any sort of TVR. Retailers typically anchor their offerings to customers on the existing default flat rate and offer slight tweaks such as fixed prices for various contract lengths. Retailers may stick "close" to the existing default tariff because it is difficult for consumers to make decisions between very different alternatives. Thus it may be difficult to choose between a TOU rate and flat rate, but easier to choose between a flat rate and a slightly cheaper flat rate. A variety of experiments outside of the electricity sector illustrate this problem (see Dan Ariely, . Predictably Irrational, the Hidden Forces That Shape Our Decisions, 2008). In Ontario, Canada, when the TOU rate became the default, a number of retailers offered flat rates that included very expensive hedges against price uncertainty and risk. Less than 10% of customers signed up for these flat rates and the percentage has been falling. Now as retailers and customers start to anchor to the TOU rate, we see the emergence of "Retail 2.0" with a number of retailers starting to experiment with dynamic rates that offer bigger peak-off to peak price ratios than the current standard offering.

5. For ease of exposition we use the term flat rates to encompass all non- time varying rates. This would include increasing and decreasing block rates.

6. Walter Graterri and Simone Maggiore, "Impact of a Mandatory Time-of-Use Tariff on the Residential Customers in Italy," November 14, 2012.

7. Robert Benjamin, Michele Kito, Rajan Mutialu, Gabe Petlin, Paul Phillips, Junaid Rahman, "Energy Division Staff Proposal on Residential Rate Reform," prepared by California Public Utilities Commission Energy Division Staff, January 3, 2014.

8. These estimates were derived by scaling up estimates that were developed for California in the following report: Faruqui, Ahmad, Ryan Hledik and Bernie Neenan, "Rethinking Rate Design: A Survey of Leading Issues Facing California's Utilities and Regulators," Demand Response Research Center, Lawrence Berkeley National Laboratory, August 7, 2007.

9. Ahmad Faruqui and Sanem Sergici, "Arcturus: International Evidence on Dynamic Pricing," The Electricity Journal, August/September 2013.

10. Lisa Wood and Ahmad Faruqui, "Dynamic Pricing and Low Income Customers," Public Utilities Fortnightly, November 2010.

11. Thaler, R. & C. Sunstein (2008): "Nudge: improving decisions about health, wealth, and happiness", Yale University Press, New Haven.

12. Johnson, E.J. & D Goldstein (2003): "Do Defaults Save Lives?" Science, vol. 310, pp.1338-1339.

13. In all cases, for uniformity in making comparisons across utilities, enrollment is expressed as a percentage of the entire residential customer population.

14. In California, inclining block rates are mandatory and large users cannot bypass them.

15. Ahmad Faruqui et al., "Impact Evaluation of Ontario's Time-of-Use Rates: First Year Analysis," prepared for the Ontario Power Authority, November 26, 2013.

16. In game theory, a strategy strictly dominates another strategy if it is always better than the second strategy. If it is sometimes better and always no worse than the other strategy, then it weakly dominates.

17. Since customers are extremely unlikely to increase peak consumption in reaction to a higher price, we can assume that impacts from Group B will never be negative.

18. For simplicity we exclude attrition over time.

19. Ahmad Faruqui and Sanem Sergici, "Arcturus: International Evidence on Dynamic Pricing," The Electricity Journal, August/September 2013.

20. SMUD Smart Pricing Option Pilot, Interim Load Impact Evaluation (see p.153).

21. Both the CPP and TOU rates were offered concurrently with in-home energy information displays (IHDS).