Embracing a competitive and digital future for utilities.

Jack Azagury is the global managing director for Accenture Smart Grid Services and leads Accenture’s Digitally Enabled Grid research program.

Distribution utilities are facing unprecedented challenges on multiple fronts; indeed, there’s even a debate that goes as far as questioning the distribution utility’s very survival. More specifically, we’re seeing a four-pronged threat from increasing cost pressures and regulatory mandates; rapid growth of distributed generation, including solar, storage, and microgrids; continued pressure to improve reliability and response to extreme weather events; and evolving consumer expectations with a continued decline in consumers’ trust. In fact, our research has shown that today, consumer trust in utilities is the lowest that it’s been in four years, with only 24 percent of consumers trusting their energy provider to offer advice on energy efficiency.1

These threats taken standalone are surmountable but put together they have the potential to reshape the industry as we know it. Many utilities are actively discussing the scenario where solar PV combined with storage reach grid parity (which will happen in the next 10 to 15 years in some markets). In an extreme case, this could result in a dangerous spiral where the grid is relegated to the role of backup provider and operators are forced to spread their fixed network-related costs across fewer customers, thereby driving up energy prices and further accelerating defections.

This simplistic scenario fails to factor in space limitations in urban environments to accommodate solar PV and storage at scale, as well as significant hurdles in battery technology, and the fact that many consumers will always favor the convenience of being grid connected. Nevertheless, disruptive trends represent a serious threat that many utilities have started to focus on over the past two to three years.

As is the case with most transformative change, multiple factors will need to come into alignment in order for change to occur. In other words, while solar PV alone won’t transform the industry, the alignment of solar with storage, severe weather events, electric vehicles, and new residential energy management solutions will have a transformative effect. Our prediction is that it will take some time (e.g., 15 years) for these factors (and others) to converge; but once they do, the pace of change will be dramatic.

Our research and analysis also concludes that a successful response to this challenge will include both an inward look at capabilities and operating models and an outward look to explore new products, new services, and evolved customer relationships.

Smart Grid Goes Mainstream

Figure 1 - Forecast Benefits

Figure 1 - Forecast Benefits

One thing is clear: smart grid is fundamental to addressing these challenges. While some fatigue is developing around the term “smart grid,” the concepts, technologies and ideas that it embodies are front and center in utilities’ evolution. Accenture’s Digitally Enabled Grid research confirms that 98 percent of senior executives at utilities agree that the smart grid is a natural extension of ongoing upgrades to the electricity network, with three-quarters agreeing that the adoption of smart technologies will reduce maintenance and upgrade costs by 2030.

Rather than being seen as an experimental option, smart technologies are now a core element of investment strategies. Looking to the future, only a tiny minority (2 percent) of utilities believes that by 2030 their networks will comprise predominantly traditional or conventional technologies. Nearly one-third expects their network to be characterized by pervasive use of smart technologies and distributed generation, while the majority (67 percent) believes that a hybrid approach combining traditional and smart technologies will predominate.

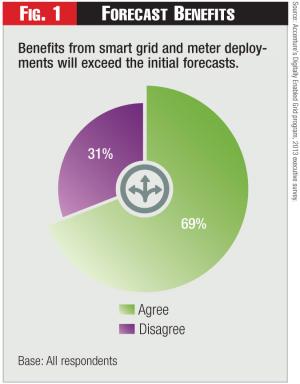

The early days of smart grid were characterized by the concern and uncertainty associated with the ability to generate adequate returns on investment; so much so that the government invested $3.4 billion in smart grid programs to accelerate the modernization of the grid. It’s therefore surprising that today more than 69 percent of utilities believe that the benefits they receive from deploying smart technologies will exceed the business case originally put forward (Figure 1).

Against a backdrop of decreasing demand, smart grid is one of the few areas that can create significant value for a utility’s bottom line and benefit its customers as well as shareholders. Additionally, utilities are realizing those benefits across the board – from customer service to integration of renewables to improved grid operations and reliability (Figure 2). For example, smart meters were largely installed with the prima facie business case of lowering meter reading costs. In fact, experience now demonstrates that the benefits flowing from smart meter installation have been broader than those conservative business cases suggested. Utilities are discovering that their smart meter installations are enabling them to be more efficient in their responses to outages, reducing energy theft, better managing their network assets and improving overall grid reliability.

Figure 2 - Deployment Value Drivers

Figure 2 - Deployment Value Drivers

Our survey indicates that analytics is the highest priority investment ahead of any other smart grid technology including advanced metering infrastructure (AMI), distribution automation and distribution management systems (DMS) (Figure 3).

Analytics is the key to unlocking the value from smart grid investments by deriving insights from the volumes of data generated by a digital grid. The value on offer from harnessing analytics is considerable. Accenture’s analysis suggests the potential value of applied analytics to a utility could approach between $40 to $70 per electric meter, per year, with significant benefits in improving asset management capabilities and migrating towards condition based and predictive based maintenance (Figure 4). However, most utilities believe they have a long way to go before becoming an analytics-led organization, as compared to the likes of Google or American Express.

Only 25 percent of utility executives believe their companies are well positioned in terms of analytic capabilities and talent. They’re only too aware of the need to enhance their IT prowess across the board. Nearly all (96 percent) recognize that data management will be critical or important for managing the complexity of the network. A similar proportion (92 percent) identify the need for advanced approaches to cyber security and privacy management, with nine out of 10 citing access to the right IT skills as critical or important to managing and integrating the increasingly large volumes of data (Figure 5).

Competitive Responses

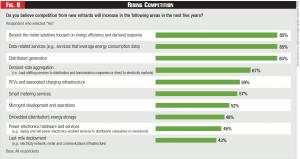

In the minds of the vast majority of utility executives in North America, the case for the smart grid’s ability to improve utilities’ internal performance appears to be soundly made. But there’s another dimension of the smart grid’s potential effect: to create new services and applications that will drive revenue growth. Smart technology opens the door for new entrants. The majority of utility executives expect to see greater competition arising over the next five years in areas including beyond-the-meter solutions focused on energy efficiency and demand response, data-related services, and distributed generation (Figure 6). Many also expect the emergence of competitors to serve areas such as electric vehicles, smart metering services, microgrid development and operations, and energy storage.

Figure 3 - Prioritizing Analytics

Figure 3 - Prioritizing Analytics

How utilities respond to that competition seems to split into three distinct camps: utilities ready to embrace new technologies and business models to drive new revenue streams; utilities that will seek to slow down change through regulatory or legislative means; and those that don’t yet have a plan. For example, 43 percent of respondents believe that distributed generation will provide more upside revenue opportunities, while another 43 percent believe it will drive a reduction in revenue (Figure 7).

Experience from other industries, such as the effect of the shift from analog to digital to wireless communication in telecoms, suggests the importance of recognizing and capitalizing on the change.

While much has been written about the impending death of the utility, the reality is that for most utilities, in most markets, this will be a medium to long-term journey that requires a carefully planned strategy.

There are two key dimensions for change that need to be considered when crafting this journey.

Figure 4 - Analytics at the Core

Figure 4 - Analytics at the Core

First, utilities will face the need to transform internal capabilities through digital or smart solutions to improve operations, customer intimacy, and reduce costs, to serve an increasingly competitive world. While many utilities have embarked on transformation and cost-reduction efforts, the application of digital capabilities like distribution automation, advanced analytics, and increased use of mobility can drive further improvements in areas such as grid operations, asset management, and customer interaction.

Second, utilities will require new external capabilities, products, and services to embrace new customer requirements and generate new revenue streams. Indeed, our research confirms that consumers’ needs are evolving with 87 percent of consumers that own a smart meter expecting additional products or services2.

These two dimensions create three broad categories of response based upon the relative emphasis placed on using smart technologies to improve both internal performance and support external growth opportunities.

The lowest risk option in the short term, yet likely to be least sustainable in the long term, is that of the “incremental traditionalist.” This approach focuses on protecting existing revenues and maintaining pace with regulatory expectations. It selects only those technologies that are proven elsewhere and is slow to drive adoption at scale.

Figure 5 - Critical Analytics Skills

Figure 5 - Critical Analytics Skills

The “smart grid challenger” follows a more advanced approach. Here the emphasis is on achieving the best possible internal performance through the adoption of smart or digital technologies.

Finally, the “smart grid embracer” is aggressive in its pursuit of new revenue streams and internal performance improvement. It’s prepared to make substantial investments in smart technologies while accepting some level of risk and positioning itself as an early adopter or fast follower. It will engage with the regulatory framework to drive change and create a new and different marketplace.

While each utility must craft its own course at a pace that makes sense based on its own geographic, regulatory, and legislative parameters it’s clear that a strategy premised on resisting technological change or worse, assuming that “this too shall pass,” is doomed for failure.

The pace of change will be gradual over the next 15 years (in most markets) though we predict a sudden acceleration in pace once key factors align. This type of medium- to long-term change is extremely challenging to plan for and even more challenging to execute as most companies thrive under immediate pressure or threat.

Figure 6 - Rising Competition

Figure 6 - Rising Competition

The digitization of the grid and the advent of increased competitive threats is upon us, and industry winners are the ones that will proactively embrace this reality and start the transformation process today.