Some may wince at the term, but let’s not run away.

Patty Durand serves as the executive director of the Smart Grid Consumer Collaborative.

A prominent thought leader from the power industry told me recently over lunch at a major conference that people "wince" at the term "smart grid."

His point? Perhaps we should give up on those words and replace them with something different.

Why do I mention this?

The perception is that the smart grid has not yet produced results, namely because because people don't have "smart pricing" information to match their smart meters - data that can help them adjust their energy consumption and save money. That said, consumers are enjoying reduced outages and improved utility communications.

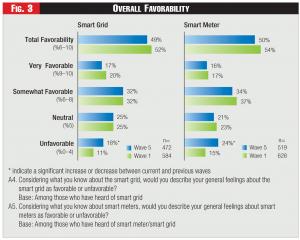

In our experience at the Smart Grid Consumer Collaborative (SGCC), and in the research we've conducted, we have found a small but statistically significant uptick in the number of people who express negative views of "smart grid" and "smart meters." Anti-smart meter activists may be gaining some traction, while those with a stake in educating and engaging consumers over smart grid have not.

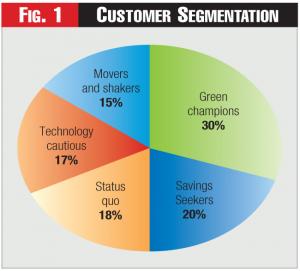

Figure 1 - Customer Segmentation

Figure 1 - Customer Segmentation

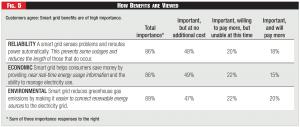

Nevertheless, as our research shows, while consumers may not have heard these terms, when we test awareness of the benefits that smart grid technology brings, consumers say that their utility has improved - in terms of reliability, communications, access to green energy, and help in managing bills (see Figure 5).

The takeaway says that while consumers may not understand the terms smart grid and smart meter, they see the benefits of investments in modernization.

And so my message to the power industry is this: Let's not run away from the term "smart grid," now that we have an opportunity to get traction on it. People love technology and the ubiquity of smart phones is a testament to that. People are flocking to purchase smart TVs and smart watches. There is no reason they won't also flock to purchase smart appliances and enroll in their utility's "smart grid" programs when available.

All the same, the SGCC intends our research to be inclusive, not prescriptive. Even if a utility (or the entire industry) decides to abandon the terms "smart grid" or "smart meter," our research still holds value.

Figure 2 - Tailoring the Message

Figure 2 - Tailoring the Message

In fact, spending time talking to actual customers can yield insight on how to get them interested in smart energy programs. And the greater their interest, the more they're willing to participate.

That's what we've learned at the Smart Grid Consumer Collaborative (SGCC), where we've been conducting research on consumer knowledge, attitudes, and preferences pertaining to the smart grid and its benefits.

Our latest research report, "Consumer Pulse and Market Segmentation Study - Wave 5," (http://smartgridcc.org/research/sgcc-research/sgccs-wave-5-consumer-puls...) provides a fresh look at U.S. residential electric consumers. Who's out there? What do they want? What do they know about smart grid benefits - the technology and programs?

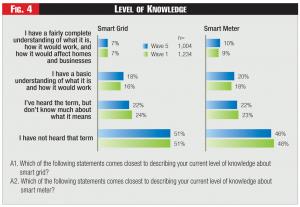

On one hand, SGCC's Wave 5 research report shows that 50 percent of consumers have never heard the terms "smart grid" and "smart meter." Twenty-five percent have heard these terms, but don't know what they mean. That leaves 25 percent who have some degree of understanding of these terms or have heard of them, and a majority of this group is neutral or positive on the terms.

Figure 3 - Overall Favorability

Figure 3 - Overall Favorability

Yet, when taken in a different light, this research also shows that consumers who hold a negative view of "smart grid" or "smart meters" make up only a minority - a minority of the minority who've heard these terms. We shouldn't give a disproportionate amount of attention or concern to a distinct minority that holds negative views. The vast majority of consumers say they care about the environment, saving energy, and managing energy use, providing an opportunity for utilities to engage customers about things that interest them. We have known for some time now that concern about the environment has gone mainstream. Our research confirms it.

We know from our research that consumers give high marks to smart energy benefits such as improved reliability, a cleaner portfolio mix, and better communications with their utility. And while consumer knowledge about grid modernization generally remains low, interest in learning more is high. The key, however, is consumer segmentation. By understanding and pinpointing their values and interests, we can establish a clear path to engage consumers - to design the sorts of messages and programs that lead consumers to get their feet wet and actually participate in the many products and services that come with a smarter grid.

Segment and Conquer

SGCC has conducted its Consumer Pulse studies since 2011, based on the idea that a rigorous survey of actual consumers offers the best way to begin any useful discussion of smart grid policy among power industry stakeholders. Without this input, stakeholders are left only to guess at how to go forward - a strategy that may only reinforce their own biases and echo conventional wisdom that, in many cases, runs counter to the actual evidence. For "Wave 5," our most recent effort, we conducted a national telephone survey in October 2014 of over 1000 U.S. residential consumers, giving us a 95-percent confidence interval with a 3-percent margin of error.

Figure 4 - Level of Knowledge

Figure 4 - Level of Knowledge

Customer segmentation provides a good place to start. Here's a snapshot of our take on the five major customer segments that we've identified.

1. Green Champions. At 30 percent of consumers, this group represents our largest segment. Customers belonging to this group share an enterprising and progressive attitude: "Smart energy technologies fit our environmentally aware, high-tech lifestyles." This segment demonstrates strong interest in smart energy programs, early technology adoption and environmental values. Yet its members may not consider their utility the best provider of such innovative services. "Green Champions" marks the youngest segment and second most affluent group.

2. Savings Seekers. This group (20 percent of customers) tends to ask: "How can smart energy programs help us save money?" This segment remains open to pricing programs that save them money by using less energy. "Savings Seekers" represents the segment with the lowest income. Utility satisfaction is low as well.

3. Status Quo. These customers (18 percent) say: "We're okay. You can leave us alone." This segment demonstrates the lowest interest in smart energy programs, perhaps because it is characterized by low energy consumption and high satisfaction with its utility. Comfort is more important than conservation.

Figure 5 - How Benefits are Viewed

Figure 5 - How Benefits are Viewed

4. Technology Cautious. This segment (17 percent of customers) will typically say: "We want to use energy wisely, but we don't see how technologies can help." Those who qualify as "Technology Cautious" claim knowledge on energy savings and display concern for the environment, but they exhibit little interest in participating in related programs.

5. Movers and Shakers. The remaining 15 percent are thinking something like this: "Impress us with smart energy technology and maybe we will start to like the utility more." This most-affluent segment includes early technology adopters. It displays high interest in new energy technologies but only moderate interest in smart energy programs and services.

These segments will overlap each other, of course, because they're inhabited by real people. Each segment has numerous attributes that bear further consideration, yet every utility is likely to have its own unique mix of these segments.

Success Stories

Many utilities have effectively applied the lessons of consumer segmentation to their customer base and we've documented their stories in SGCC's 2014 report, "Segmentation Successes." (http://smartgridcc.org/research/sgcc-research) As a result, those utilities are reporting high program enrollment rates and improved customer satisfaction.

San Diego Gas & Electric, Pepco and Oklahoma Gas & Electric, in particular, have achieved high enrollment rates for smart energy programs. In a recent SGCC webinar, Commonwealth Edison in Chicago reported a rise in customer satisfaction as a result of its high-touch approach to engaging and educating its customers on smart meters as it rolls them out across "Chicagoland."

In order to find value in segmentation, utility marketing costs and efforts should target priority segments based on how those segments' interests and concerns line up with a utility program or service offering - not all segments must be addressed at once. Yet we also see from our survey results that there's receptivity in every segment to a properly crafted message.

Green Champions, for instance, exhibit the highest interest in pricing options and may be a priority for utilities offering critical peak rebates. Savings Seekers also like pricing options to save money. That example might call for one program to be messaged differently to two different segments. (See Fig. 2 on "Segment Opportunities.") Thus a consumer segmentation approach with segment-appropriate messaging should enable utilities to create tailored messaging for non-tailored programs, meeting two goals: consumers receive a message appropriate to their values and interests, and utilities save marketing dollars by limiting exposure to consumers most interested in their messages.

Building Trust

We've learned from our research that consumers are drawn to specific programs and benefits rather than the enabling technologies. And so when smart grid-related benefits are laid out for all to see, consumers tend to find them appealing. This tendency offers a useful way for utilities to build trust among their customers, particularly during technology rollouts.

Trust, however, requires accurate messaging. For instance, while consumers generally exhibit high interest in programs that offer innovative pricing, utilities should remain cautious. Don't raise expectations too high. Avoid over-promising benefits.

Yet utilities must continue to earn and build trust. While four of five consumers say they're "satisfied" with their utility, and consumers report improved utility performance from five years ago, only slightly more than half (58 percent) say their utility acts in their best interest.

Lead image © Can Stock Photo Inc. / mindscanner