The CEO Power Forum: TXU's Wilder nets $55 million package.

Edward Metz is director of SNL Energy, an information media firm that provides energy industry news and data through a variety of newsletters and electronic products. SNL is headquartered in Charlottesville, Va., with offices in Washington, New York, London, and Boulder, Colo. Contact Metz at emetz@snl.com.

Power and utility companies had a good year in 2004, as did their investors. Energy stocks broke away from the pack during the second half of the year and ended up doubling the performance of the overall market (see Chart). This marks the second consecutive year of positive returns for the SNL Energy Index; however, in 2003 the index underperformed the broader market. Although industry operating revenues were up just 2 percent (from $22.1 billion to $22.5 billion), operating income rose 7 percent to $3.4 billion. Companies continue to embrace the back-to-basics strategy, and investors seem to think that it is paying off (see “Industry Metrics,” after article).

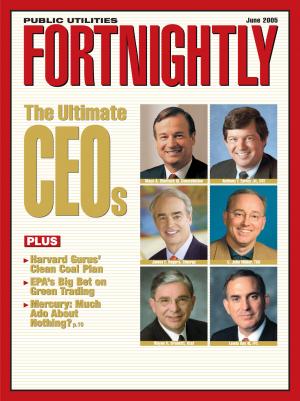

The strong stock returns and improving profitability led to large compensation packages. TXU was at the top of the pack with a 177.7 percent increase, far ahead of all other power and utility stocks. As a result, CEO John Wilder also became the top paid executive in the industry, garnering a heady $54.7 million in total compensation for the year.

Back in the go-go trading days of 2000, former Enron CEO Jeffery Skilling’s compensation package was $72.5 million. No one has seen such a hefty pay day since, but Wilder’s compensation package is one of the highest ever in the industry. The number two and three power and utility executive compensation combined don’t equal Wilder’s pay package.