Lessons learned for U.S. utilities – drawn from first-person fact-finding.

John Pang (johnpang@scottmadden.com) and Chris Vlahoplus (chrisv@scottmadden.com) are partners with ScottMadden, Inc. John Sterling (jsterling@solarelectricpower.org) is Senior Director, Research & Advisory Services at the Solar Electric Power Association. Bob Gibson (bgibson@solarelectricpower.org) is Vice President of Education and Outreach at the Solar Electric Power Association.

The German Energiewende (energy transformation) has been discussed in many academic and trade publications, all heralding either the transformational, unparalleled successes of the program, or else the dismal failure and shortsighted focus of politicians and policy makers in designing and executing the transition.

On one hand, the Energiewende has successfully brought on substantial levels of solar and wind energy in Germany. However, rising electricity rates for residential consumers, coupled with the huge losses in market capitalization for the incumbent German utilities, have raised significant questions on how successful the policy has been and whether it will be sustainable over the long term. The result is much confusion about the true nature of the Energiewende and, more importantly, what lessons learned can be applied in the U.S.

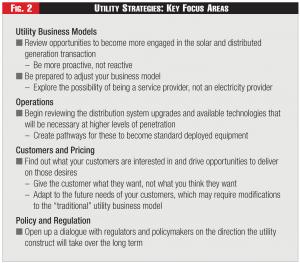

To learn first-hand from German experts on what really has occurred and how it can be applied in the U.S., the Solar Electric Power Association (SEPA) and its partner ScottMadden, Inc., led a fact-finding mission for a group of U.S. utility executives, solar developers, and other key stakeholders to Düsseldorf, Germany. The group facilitated discussions with German utilities, government officials, and solar developers to shed new light for American executives on the why's and how's behind Energiewende. They laid a foundation for how these lessons learned could be applied proactively at utilities back home. Four specific impact areas were identified and highlighted in the various discussions held among the participants: Utility Business Models; Operations; Customers and Pricing; and Policy and Regulation.

Utility Business Models

The utility business model changed rapidly with the energy transformation in Germany, and the incumbent utilities didn't react nimbly enough to weather this change. The eight largest utility companies in Europe have lost a combined €300 billion of market capitalization since the end of 2007. A majority of these losses are tied directly to holdings in fossil-fired and nuclear central station generation. Nevertheless, other utility operations generally remained healthy (see Sidebar, Germany's Energy Delivery Market). Very few, if any, of the original utilities or policymakers predicted the rapid decrease in the overall cost of solar, which led to the explosion of the distributed solar marketplace. Also, with no restrictions on system size and a healthy Feed-in Tariff (FiT), a proliferation of solar systems surged onto the German system. Currently, there is nearly four times as much interconnected solar capacity in Germany as there is in the U.S., although Germany is a country roughly the size of the state of Montana in land mass and has a population of approximately two times that of California. The solar resource potential in Germany is also far less than that of the majority of the U.S. Germany has similar solar irradiation to that of the U.S. Pacific Northwest.

The huge, rapid influx of solar, coupled with the growth of wind, severely impacted the earning potential of the traditional generators. The electricity market in Germany features a merit order that favors renewables as the resources with the lowest marginal costs. On days when solar and wind production is substantial and demand is low, not only do renewables dominate the dispatch order, but the impact of subsidies for the renewables also causes the value of wholesale power to be negative (not unlike some regions in the Midwestern U.S. with high wind penetration). This circumstance has devastated the financial well-being of the utility companies that own and operate coal, natural gas, and the remaining nuclear generation fleet. While the impact of renewables on the generation market merit order led to a loss of market share for traditional generation, the utilities recognize that it was their own poor investment choices that prevented them from taking advantage of the growth in the renewables market. Not only did the utilities pass on any significant investment in distributed renewables, but they also chose to invest heavily in new coal and gas generation as the replacements for the planned phase-out of nuclear.

Figure 1 - Current and Future Goals

Figure 1 - Current and Future Goals

One of the reasons the utilities failed to pursue distributed renewables was that their investment strategies needed to meet their weighted average cost of capital (WACC) hurdle rates. Non-utilities and other entrants leveraged low interest rates to justify their investments in distributed solar, but requiring proposed projects to meet WACC hurdle rates prevented the utilities from investing in distributed solar. Instead, many invested heavily in new natural gas generation. Unfortunately for the utilities, however, one of the unintended consequences of the energy transition has been a stronger reliance on lignite generation. The low cost of carbon in Europe has made lignite generation more economical than natural gas, effectively putting even highly efficient combined-cycle gas generation out of the money today.

With the established non-utilities dominating the distributed solar market, utilities attempting to enter the market at this juncture will face a significant challenge. German utilities are now looking for renewable investments outside of Germany to help diversify their portfolios. In addition, German utilities are looking for strategies to deliver holistic energy services for the end consumer, as part of the energy delivery market, which could re-open channels for proactive engagement and re-establish the utility company as a key part of the energy transaction.

Operations

Germany has integrated large amounts of renewables onto its electric grid - mostly wind and distributed solar photovoltaics (PV) - without adverse effects on grid integrity, reliability, or resilience. In the first three quarters of 2014, 28% of Germany's total electricity was renewable energy. On May 11, 2014, a record 74% of Germany's total electricity came from renewables.

Originally, Germany's electric grid was very reliable and able to withstand high penetrations of variable generation, which were quickly added to the system. Currently, Germany's grid experiences only about 7% of the outage minutes of the U.S. grid, and SAIDI in the U.S. (System Average Interruption Duration Index) is significantly higher than in Germany (lower is better). In fact, the German outage criteria far exceed the U.S. standards. Distribution System Operators (DSOs) face financial punitive measures when outage times exceed certain levels: 2.5 minutes on the low-voltage system and 13.5 minutes on the medium-voltage system.

Figure 2 - Utility Strategies: Key Focus Areas

Figure 2 - Utility Strategies: Key Focus Areas

The impressive reliability delivered by the German grid, achieved in spite of the large penetration of distributed solar resources, is the direct result of two key attributes of the German grid, the first being that the vast majority of the German distribution system is much younger than the U.S. grid and is primarily underground. (In fact, mission participants struggled to find evidence that the distribution system even existed.) The robustness of the grid was a direct result of the damage done during World War II and the need to construct a new electricity grid. One German solar executive joked: "You Americans did a good job during the War-everything was destroyed. So we had to build a new grid and we did it right." This upgrade has led to a much more reliable grid than even top-tier SAIDI utilities in the U.S. are able to achieve. The robustness of the grid also facilitated the quick expansion of distributed solar, as the interconnection process is much simpler and is completed in days because it doesn't require significant studies, analysis, or upgrades.

The second key factor in facilitating a reliable system is that operators have utilized advanced technology to help maintain reliability targets. Specifically, operators have launched smart inverters that automatically trip distributed solar generators offline and return them to service based on randomized, time-delayed set points.

Originally, all inverters had the same frequency set points and would trip offline and return en masse, potentially causing significant disruption and instability in the system. Now, however, the manufacturers have pre-set randomized set points, as well as randomized time delays to return to service. These two factors help maintain grid stability, but they do come with reduced production on the solar assets - a fact not lost on system owners today. Grid adaptation is viewed as a key component to Energiewende by the DSOs, and it will be a focal point for utility investment going forward.

Customers and Pricing

One of the greatest criticisms of the Energiewende has been that the program has caused a significant increase in household electricity retail rates in Germany.

Typical residential customers have seen their rates almost double from approximately 14 eurocents in 2001 to approximately 28 eurocents in 2013. The bulk of this rate increase is the direct result of taxes and surcharges imposed specifically on the residential sector. Commercial and small industrial rates are roughly half that of residential rates. The largest energy users are mostly exempt from many of these added charges and are, in fact, paying roughly the wholesale price for energy today.

At first pass, this apparent "taxation" of residential customers to fund the Energiewende program seems misguided. However, upon further investigation, it appears that this cost operates as a deliberate price signal to consumers to decrease consumption - one of the three pillars of Energiewende. In fact, this arrangement has proved very successful.

To illustrate, the average German residential consumer uses a scant 300 kWh per month - roughly a quarter to a third of the average U.S. residential customer. Importantly, although the residential rates have increased, electricity's share of expenditures in Germany has remained relatively consistent, at approximately 2% of household spending since 1990. And while many articles have negatively capitalized on the stark increase in residential rates, overall the German public remains very supportive of the Energiewende program (see following section on Policy and Regulation). It's apparent that customers have a strong desire to move toward cleaner technologies and choices, and the utilities have failed to provide those alternatives in a timely manner.

Policy and Regulation

The underlying concept of Energiewende appeared in a 1980 study and proposed that economic growth could be achieved even as energy consumption was intentionally curtailed. A plan was developed to reduce energy (through energy efficiency), move to a predominance of clean, renewable energy sources, and accomplish this through investments in a stronger, more resilient grid. The details of this plan lay out both near-, mid-, and long-term targets around climate change, renewable energy penetration, and energy efficiency.

It has been postulated that the total cost for the Energiewende program will exceed the cost of the reunification of East and West Germany. However, the majority of the German population perceives this will be a worthwhile expense over the long term.

The German citizenry is strongly supportive of Energiewende. Data provided by the Federal Ministry for Economic Affairs and Energy shared a recent poll that showed 66% supported the decision to carry out Energiewende from today's perspective. Architects of the Energiewende suggest that the right foundation has been laid for a stable future, despite the rise in residential rates and the significant financial commitment to renewables. The long-term view remains that a competitive advantage will emerge in the future as the costs of fossil fuel continue to rise. Three inter-related facts underscore this position.

First, Germans, as well as the European Union, believe climate change is a critical threat and addressing it is a top priority. Second, energy security is a pressing concern for a country dependent on Russian gas supply, thus strengthening the commitment to efficiency and renewables. Finally, the anti-nuclear sentiment, which began with the environmental movement and was reaffirmed by the Chernobyl disaster in 1986 and Fukushima in 2011, is very strong.

U.S. Utility Action Items

With more than two dozen utility and industry leaders in attendance, the focus for SEPA and ScottMadden was not simply to ascertain what has and hasn't occurred in Germany. Rather, the goal was to identify real, measurable action items that executives could bring back to their utility companies, which might help drive the future of the U.S. electric industry. Utilities in the U.S. are very diverse in their operations, structure, regional regulation, and constraints, such that finding specific actions which could be universally applied to all may be impossible. However, several "no regrets" directives have emerged that, if embraced, will allow the U.S. utility community to reduce its reliance on reactive policies and move toward proactive opportunities with customers.

While the underlying sentiments that drove the policy decisions in Germany are not as strong in the U.S., Germany's Energiewende provides a real and measurable road map against which to base the future of the U.S. utility construct and energy transaction. Taking these lessons learned and applying them now will allow the U.S. utility industry to successfully transition through the energy transformation that has begun in the U.S.

Germany's Energy Delivery Market

Although Germany's "Big Four" utilities (E.ON, RWE, EnBW, and Vattenfall) have lost substantial market share attributable to their investments tied to conventional generation fleets, these utilities have each retained a healthy share of the transmission and distribution markets following the deregulation in 1998. Unfortunately, however, the increased returns in the energy delivery market (transmission and distribution) have not come close to offsetting the losses in generation, and deregulation allowed new entrants to enter the market space.

Currently, there are approximately 800 DSOs managing the delivery of power, including subsidiaries of the "Big Four" (now smaller private companies), and many municipal systems serving specific cities. The retail market also includes thriving energy cooperatives and collectives competing in that space. -The Authors