It is more certain now than it was a year ago that the United States will regulate carbon emissions from power plants in the future. The details surrounding this regulation, however, are still very uncertain, and present a problem for utilities as they attempt to plan for an uncertain future. Power generation companies, particularly electric utilities, can no longer ignore the potential for future carbon regulation.

The legal arguments surrounding the Environmental Protection Agency (EPA) regulations suggest the EPA likely will propose a sector-wide cap on carbon emissions relatively equivalent to a 17 percent reduction in 2005 emissions; this level of emission reduction also matches President Obama's stated goal for the nation. Modeling indicates that under this scenario, carbon allowance prices are expected to rise sharply in the outset of the policy and then experience a lower growth rate after the 2020 timeframe. Utilities likely will need to rely on natural gas and renewable generation more heavily under a carbon policy scenario than under a scenario in which no carbon policy exists.

Policy Background

In the 2007 case Massachusetts v. EPA, the Supreme Court ruled that greenhouse gases (GHG) are covered under the definition of an air pollutant in the Clean Air Act (CAA).1 Two years later, in 2009, the EPA issued an endangerment finding, stating that GHGs, including carbon dioxide, "threaten public health and welfare." This endangerment finding, originally used to regulate greenhouse gas emissions in the transportation sector, also requires regulation of the GHGs from other sources covered by the CAA. Also in 2009, Pres. Obama pledged to reduce GHG emissions to 17 percent below 2005 levels by 2020, and to 83 percent below that same level by 2050. 2

In his 2013 State of the Union Address, Obama stated that if Congress does not act on the energy climate issue, he would be forced to take action through the executive branch. After action in the 111th Congress, with the House passing the Waxman-Markey cap-and-trade bill, action by the 112th Congress has stagnated. With Congress deadlocked on the issue, Obama revealed his Climate Action Plan (CAP) on June 25, 2013. The plan highlighted carbon-reducing actions his administration had already made as well as future actions designed to meet his earlier pledge to cut GHG emissions by 17 percent below 2005 levels.

One central tenet to the president's CAP is the regulation of carbon emissions from fossil fuel power plants. The CAP directs the EPA to issue carbon regulation for fossil fuel power plants under the following timeline:

- Proposal for a carbon standard for new units in September 2013

- Proposal for a carbon standard for existing units by June 2014

- Final carbon standard for existing units by June 2015

- Deadline for states to submit implementation plans by June 30, 2016

The EPA has already met the first requirement.3 The standard for existing plants, to be proposed in June, will fall under section 111(d) of the CAA. Under this section of the CAA, the EPA will not issue a nation-wide carbon emission standard, but will instead issue guidance on a carbon emission standard, and individual states will design a state implementation plan (SIP) in response to that guidance. The EPA will then approve or disapprove each state's SIP. If the EPA disapproves a SIP, or if a state fails to submit a SIP, the EPA will implement a Federal Implementation Plan (FIP) in place of a SIP in that state.

The structure of section 111(d) of the CAA contributes to the uncertainty surrounding the EPA's regulation of carbon from existing power plants and will affect utility planning and ultimately the grid. Currently, it is unclear what the EPA can or will include in its guidance, which must be based on a best system of emission reduction (BSER). Suggestions on what can and should be considered a BSER range from efficiency improvements at the regulated unit level to system-wide approaches that include changes to low carbon energy sources and carbon reductions from energy efficiency measures. A second major area of uncertainty arises from the fact that SIPs likely can pull from a range of compliance options which, in similar fashion to the BSER options, range from plant-specific to system-wide.

While the fuel mix varies geographically across the U.S., the nation's electricity is predominately generated using fossil fuels. In 2012, fossil fuels (coal, oil, and natural gas) represented 59 percent of installed generation capacity and contributed 68 percent of electricity generation.4 Carbon dioxide (CO2) is emitted during the combustion of fossil fuels for electricity generation; the amount of carbon dioxide emitted varies by fuel, with coal-fired sources typically emitting more than double the CO2 per megawatt-hour (MWh) than natural gas-fired sources.

Modeling Carbon Scenarios

For this exercise, the EPA's regulation of carbon from existing plants was modeled as a national requirement for power sector emissions to be reduced 17 percent from 2005 levels (in line with Pres. Obama's stated goal). Even though the EPA likely will provide guidelines for states to develop their own policies, the assumption is made that states will set up a national trading platform like the Regional Greenhouse Gas Initiative (RGGI), leading to a single, national carbon price. The assumption is also made that while RGGI will be superseded by the national policy, California will keep its existing cap-and-trade program (known as CARB), as it is stricter than the modeled carbon policy.

All cases are presented relative to a business-as-usual case (BAU), in which there is no carbon price. Significant renewable resource construction is driven by renewable portfolio standard (RPS) mandates even in the BAU case; all cases assume the production tax credit (PTC) that ended in 2013 is not renewed. The modeling was completed using Navigant's proprietary Portfolio Optimization Model (POM), with the study running from 2014 through 2034, and the carbon policy going into effect in 2018.

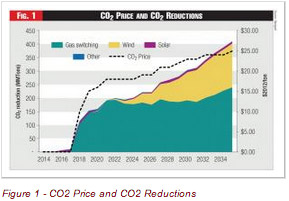

The results of the modeling exercise show that in order to meet the 17 percent reduction in power sector CO2 emissions from 2005 levels, the trading price of carbon (in 2012 dollars) will rise from $10 per ton in 2018 to $16/ton in 2020 before slowly growing to $25/ton in 2035. Figure 1 shows the modeled carbon price overlaid on an area graph of the means that utilities use to reduce their carbon emissions.

During the first 5 years of the policy, the vast majority of the carbon emissions reductions from the BAU result from switching from coal generation to natural gas generation. This is unsurprising as it costs more to build new renewable resources than it does to increase capacity factors of natural gas plants. Starting in the mid-2020s, pressure on the gas supply system, combined with significant emissions costs (even for efficient combined cycle units), drives growth of a wave of new wind resources to fulfill a large percentage of the emissions reductions. And by 2035, wind resources are the source of about 40 percent of system wide reductions.As noted, the modeled carbon policy interacts with other existing policies such as RPS mandates. The carbon reductions shown in Figure 1 are incremental reductions, and the renewable swathes of the reduction are due to renewable construction that is incremental to the BAU. There are several observations that can be made. First, in the Western U.S., RPS mandates tend to be stronger - and easier to meet because of the availability of resources - than they are in the rest of the country. This means that most incremental CO2 reductions are expected to occur in the East and in ERCOT, where fossil fuel generation is relatively higher in the BAU. Second, both BAU and the modeled cases include strong growth in solar power generation. The modeled carbon policy drives a small amount of incremental growth over the BAU as most of the solar power is incentivized by RPS and favorable accounting for distributed generation.

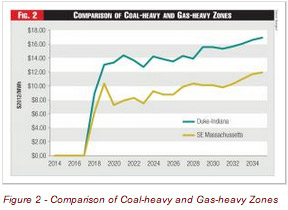

Figure 2 gives an illustrative example of the relative price effects of the modeled carbon policy compared to the BAU case. Comparing the projected wholesale electricity price in the Duke-Indiana zone to the Southeast Massachusetts zone shows that the policy has a greater effect on energy prices in coal intensive regions than in natural gas intensive regions. In general, the price differential between coal-heavy and gas-heavy zones declines over the forecast.

Figure 2 gives an illustrative example of the relative price effects of the modeled carbon policy compared to the BAU case. Comparing the projected wholesale electricity price in the Duke-Indiana zone to the Southeast Massachusetts zone shows that the policy has a greater effect on energy prices in coal intensive regions than in natural gas intensive regions. In general, the price differential between coal-heavy and gas-heavy zones declines over the forecast.

One important outcome of the carbon price is that, over the long term, even in the absence of a PTC extension, the incremental cost of high-quality wind resources reaches parity with the incremental cost of high efficiency natural gas-fired combined-cycle plants.

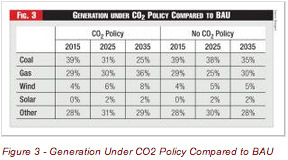

Figure 3 summarizes the generation share by technology and year in the two cases. In both cases, the share of coal generation declines and is replaced by a combination of gas and renewables. The switch is primarily driven by renewables in the BAU case, as coal generation is relatively less expensive than natural gas generation, and RPS mandates result in increased renewable penetration. Under the CO2 policy, coal generation declines precipitously, and is replaced by natural gas, wind, and solar.

Figure 3 summarizes the generation share by technology and year in the two cases. In both cases, the share of coal generation declines and is replaced by a combination of gas and renewables. The switch is primarily driven by renewables in the BAU case, as coal generation is relatively less expensive than natural gas generation, and RPS mandates result in increased renewable penetration. Under the CO2 policy, coal generation declines precipitously, and is replaced by natural gas, wind, and solar.

With the carbon policy driving large changes in the generation landscape, there is cause for concern about the ability of the natural gas supply infrastructure to support the switch from coal to natural gas. There likely will be a need for new natural gas transportation as well as the means for financing it. Also, wind integration issues likely will arise. The growth in wind resources is not uniform across the country but is strongly centered in ERCOT and the Midwest, as wind approaches a 15 percent share of capacity in both areas. Thus, there is likely to be a need for investment in both energy storage and transmission to support this growth.

Carbon Policy and Utility Planning

EPA regulation of CO2 from new and existing power plants greatly increases the risks and difficulties associated with generation planning for utilities. Many utilities, and even a few non-utility companies, use forecast carbon costs such as those presented here for future planning.5

The carbon price makes coal generation less economical and will force more coal plant retirements. Retrofitting coal units to reduce CO2 emissions is not a cost-effective means to meet the CO2 standard as modeled here. While the effect of the carbon policy is still a few years out, coal intensive utilities face the shorter-term question of how to meet EPA regulations on NOx and SO2. The economics of retrofitting units to comply with NOx and SO2 regulations will change if the long-term economics of those same units are reduced by the introduction of a carbon policy.

Utilities will need to determine the mix of generation resources to replace retiring coal units, but the growth in natural gas generation and the resulting stresses on natural gas supply infrastructure could force difficult choices. Existing natural gas transportation infrastructure likely is insufficient to handle the resources needed for new natural gas generation under this policy. Utilities might have to sign additional firm transportation contracts in order to guarantee fuel reliability and incentivize natural gas pipeline construction.

Under a carbon policy that allows trading, utilities will need to understand the risks and rewards of the carbon allowance market. They will also need to maximize the value of their allowances (assuming they are distributed) and minimize the short-term risks associated with price volatility. Utilities will need to decide when to invest in lower carbon options based on exposure to both short-term carbon market risks and requirements to reduce emissions or procure sufficient allowances in the long-term.

For small utilities, the traditional integrated resource planning considerations of baseload, intermediate, and peaking units while procuring a small amount of renewable energy are unlikely to be sufficient in a carbon constrained industry. Renewable resources will reach economic or near-economic parity with thermal units, meaning that resource planners will be forced to include a wider range of resource portfolios with a wider range of costs and benefits.

For all utilities, customers facing higher energy bills are more likely to invest in energy efficiency and distributed generation. Both resources disrupt the traditional utility business model, and as a carbon policy increases projected energy prices, it is likely to speed up the disruption faced by the utility sector.

ABOUT THE AUTHORS: Maggie Shober (maggie.shober@navigant.com) is a Managing Consultant in Navigant's Global Energy Practice. She coordinates Navigant's regional energy market overview reports as well as the integration of environmental regulations into Navigant's energy market models. Matthew Tanner, PhD (matthew.tanner1@navigant.com) is an Associate Director with Navigant's Global Energy Practice, and works extensively in energy market analysis, regulatory filings, and asset planning.

Endnotes:

2. At the 15th Conference of the Parties (COP) of the United Nations Framework Convention on Climate Change (UNFCCC) in Copenhagen, Denmark.

3. 2013 Proposed Carbon Pollution Standard for New Power Plants, released Sept. 20, 2013.

4. EIA AEO 2014 Early Release.

5. For a discussion of these see CDP Use of Internal Carbon Price by Companies as Incentive and Strategic Planning Tool, December 2013.