Southern Company, AGL Resources File Request with New Jersey Regulators for Merger Approval

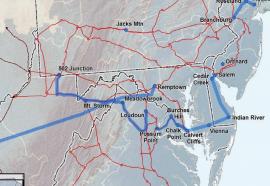

Submitted by aburr on Tue, 2015-11-10 12:51In a joint filing with the New Jersey Board of Public Utilities, Southern Company and AGL Resources requested regulatory approval of the companies' proposed merger. AGL Resources is the parent company of Elizabethtown Gas. When completed, the combination of Southern Company and AGL Resources is expected to create the second-largest utility company in the U.S. by customer base.