A proposal to remove the bottlenecks on grid investment.

Rana Mukerji is vice president and general manager at ABB Electric Systems Consulting. He can be reached at rana.mukerji@us.abb.com.

Investments in the U.S. transmission grid have been declining since the early 1970s.1 Reasons include: 1) regulatory uncertainty; 2) onerous and multiple regulatory jurisdictions; 3) an extremely complex and time-consuming siting and permitting process; 4) uncertainty in the basic “who pays” vs. “who benefits” equation; and 5) shortcomings in the regional-planning processes.

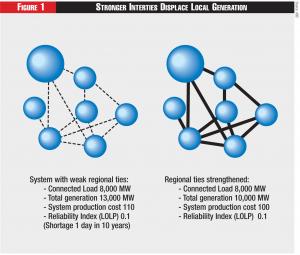

Figure 1 - Stronger Interties Displace Local Generation

Figure 1 - Stronger Interties Displace Local Generation

The U.S. bulk transmission system now is stretched to the limits of its capacity. System operators are doing a remarkable job day in and day out of keeping the system in a secure state while squeezing out the last megawatt of transfer capability. Not investing in the bulk transmission system leads to congestion costs. More generation should be designated as RMR (reliability must-run generation) and higher reserve margins are necessary. In the longer term, lack of investment in transmission limits our ability to incorporate green, low-cost energy sources such as wind power into the grid. A study by ICF Consulting reported in Public Utilities Fortnightly clearly establishes that the benefits of transmission investments far outweigh the costs.2