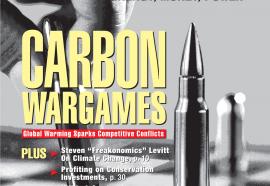

The Politics of Carbon

The 2008 elections portend federal regulation of greenhouse gases by 2010.

The outcome of the 2008 elections will determine how the nation deals with greenhouse gas emissions. With the presumptive nominees for president for both parties supporting mandatory GHG regulation, a cap-and-trade system likely will become U.S. law. How soon and how tough depends on the choices voters will make in November.