Over the last several years, a confluence of political and market developments have made capital for renewable energy projects harder to come by, which has affected the ability of unregulated affiliates of public utilities (unregulated utilities) to finance or refinance new and existing renewable energy projects. As unregulated utilities search for capital, they are increasingly considering the use of tax-efficient public capital vehicles such as real estate investment trusts (REIT), master limited partnerships (MLP), and umbrella partnership C corporations (Up-Cs). These three vehicles have important similarities and differences, and they can play a helpful role in satisfying the current and future capital needs of unregulated utilities.

Over the last several years, a confluence of political and market developments have made capital for renewable energy projects harder to come by, which has affected the ability of unregulated affiliates of public utilities (unregulated utilities) to finance or refinance new and existing renewable energy projects. As unregulated utilities search for capital, they are increasingly considering the use of tax-efficient public capital vehicles such as real estate investment trusts (REIT), master limited partnerships (MLP), and umbrella partnership C corporations (Up-Cs). These three vehicles have important similarities and differences, and they can play a helpful role in satisfying the current and future capital needs of unregulated utilities.

Current Political and Market Developments

In analyzing the sources of capital for renewable energy projects, it is difficult to evaluate political developments without also considering market conditions, and vice versa, because the two are so intertwined. Indeed, the political discussion around renewable energy starts with a simple market truth: Although most people would prefer to obtain their energy from renewable sources rather than burn fossil fuels, the upfront capital costs of renewable energy projects often make these projects unfeasible from an economic perspective. Put simply, consumers are eager to go green until it costs them too much green, at which point they are more than happy to burn fossil fuels. Thus, if the government wants to increase consumer reliance on renewable energy, it must find a way to subsidize that reliance.

Just as market conditions have driven political considerations on renewable energy programs, political considerations have affected the market for renewable energy capital. In order to subsidize the development of renewable energy projects without committing political suicide, American politicians have opted to rely on temporary renewable energy tax-reduction incentives, such as tax credits that reduce the tax liability of renewable energy investors, rather than direct cash payments to businesses that produce or rely on renewable energy or heavy taxes on fossil fuel users. But given the current political environment, the likelihood that these renewable energy tax breaks will be extended beyond their current expiration dates is uncertain.

Just as market conditions have driven political considerations on renewable energy programs, political considerations have affected the market for renewable energy capital. In order to subsidize the development of renewable energy projects without committing political suicide, American politicians have opted to rely on temporary renewable energy tax-reduction incentives, such as tax credits that reduce the tax liability of renewable energy investors, rather than direct cash payments to businesses that produce or rely on renewable energy or heavy taxes on fossil fuel users. But given the current political environment, the likelihood that these renewable energy tax breaks will be extended beyond their current expiration dates is uncertain.

As unregulated utilities have historically had significant federal tax liabilities, it shouldn’t be surprising that many of the largest portfolios of renewable energy projects are owned by unregulated utilities desiring tax breaks. Nor is it surprising that, in light of the pending expiration of the renewable energy tax incentives and the corresponding increase in economic costs associated with a renewable energy investment, many unregulated utilities are searching for new sources of low-cost capital.1

In their search for new sources of capital, unregulated utilities are finding that the political decision to structure renewable energy subsidies as tax breaks has created a market dynamic that has encouraged historic renewable energy investors to leave the renewable energy space while financial market conditions simultaneously lay the groundwork for new investors to enter. For example, because the American system for subsidizing renewable energy investments depends on investors having positive income that can be shielded with tax breaks, the system starts to break down when, as happened in 2008 and 2009, those investors suffer massive losses that wipe out their tax liabilities for the foreseeable future. Industry sources seem to agree that this simple fact has drained significant capital from new renewable energy projects and has increased the cost of the capital that does remain available. Thus, even in the absence of a pending expiration of renewable energy tax breaks, unregulated utilities searching for new capital for their project would have to start looking beyond the traditional investor base in order to obtain that capital.

Interestingly, in the search for new capital, unregulated utilities may find that, although the global financial crisis of 2008-2009 contributed to an investor migration away from renewable energy projects, the aftermath of the crisis is attracting to the renewable energy space a new group of nontraditional yield-hungry investors—e.g., tax-exempt entities such as pension funds and college endowments, foreign portfolio investors, and U.S. individuals. These yield-seeking investors have not traditionally played a role in the renewable energy space because, for various reasons (most of which are arcane), they could not enjoy renewable energy tax incentives and, at the yields they were historically demanding, could not compete with the traditional providers of renewable energy capital. But as the world’s central banks responded to the global financial crisis by flooding capital markets with new liquidity and driving interest rates to previously unthinkable lows, yield-seeking investors began to look for yield anywhere they could find it. This search for yield has driven up not only prices in the government and private bond markets, but also prices in the REIT and MLP equity markets. Asset prices and yields move inversely to one another, meaning that the increase in REIT and MLP equity prices has correspondingly driven down the yields on public REIT and MLP equity instruments. In many cases, this enables publicly traded REITs and MLPs to raise capital from public investors at attractive rates (i.e., high equity prices that reflect low yields) and provide capital to private users at an attractive price (i.e., at rates that, although they reflect a mark-up over the yield demanded by the entity’s public investors, are still low by historic standards). This has created an incentive for owners and operators of yield-producing assets that can be owned or financed through a public REIT or MLP to consider seeking capital from those sources.

With the future of renewable energy tax incentives uncertain and the traditional providers of renewable energy capital hard to come by, it is only natural that unregulated utilities have begun to consider alternate sources of capital for new projects. To the extent that the yields demanded by nontraditional investors are low enough, it may make sense for unregulated utilities to seek capital from those investors. This article will explore the ways in which an unregulated utility can use REITs and MLPs as capital vehicles to access those nontraditional investors, and will also discuss a less common, but no-less viable, Up-C structure as well. The main thrust of the article is that, while perhaps not ideal capital vehicles by historic standards, these vehicles are ready and available sources of capital that, with some tinkering, may provide unregulated utilities with a helpful source of capital in a market and political environment that was unforeseeable six years ago.

Although REITs, MLPs, and Up-Cs are all promising capital vehicles for an owner of a renewable energy project, they have a number of differences, and the best choice for a given project will depend on the owner’s particular operating and financing model.

The REIT Vehicle

A REIT is, from a commercial and legal perspective, just like a regular corporation. But REITs have a crucial advantage over other corporations: unlike other corporations, REITs don’t pay federal corporate income tax on REIT-level income that is distributed to shareholders. Thus, for example, if a REIT earns $100 of income and makes a $100 distribution to its shareholders, the REIT isn’t subject to tax. And because a REIT is required by the tax law to distribute at least 90 percent of its income every year, a REIT is, by definition, a yield vehicle.

In order to qualify as a REIT, an entity must meet a number of requirements, the most important of which are the REIT asset tests and the REIT income tests.

The REIT asset tests, which must be satisfied at the end of each calendar quarter, consist of three parts. First, at least 75 percent of a REIT’s assets must consist of cash and cash items, U.S. government securities, and real estate assets such as interests in land, buildings, and other permanent structures (including fee ownership, easements, and leases), and loans secured by mortgages on real estate (real estate securities). Second, not more than 5 percent of a REIT’s assets may consist of the securities of a single issuer. Third, a REIT can’t own securities representing more than 10 percent of the voting power or value of a single issuer. The 5-percent and 10-percent asset tests don’t apply to real estate securities or the securities (including stock) of a taxable REIT subsidiary (TRS), which is a regular—and thus generally fully taxable—corporate subsidiary of a REIT.

Previous IRS guidance is insightful on the question of which renewable energy assets qualify as real estate assets. For example, the IRS has ruled that a system for the transmission of energy from a generation source to end users can qualify as a real estate asset to the extent it consists of “physically connected” and “functionally interdependent” immovable assets. The qualifying components of such a system generally include interests in land (as described above); towers or poles that are permanently affixed to the ground; lines or wires attached to the towers or poles or buried underground (including gathering lines); substations, switching stations, and distribution transformers; electric meters that are affixed to buildings; and interconnection systems (collectively, “gathering and transmission assets”). Similarly, under the IRS’s past rulings, certain components of a power generation facility (a facility) are likely to qualify as real estate assets. In particular, wind towers and the pads on which those wind towers sit likely qualify as real estate assets. So, too, do the permanently affixed racking structures that support PV solar panels. But the tax status of other components of a acility, such as the turbines, blades and nacelles of a wind acility and the inverters of a solar acility, is much more uncertain.2

In addition to the three REIT asset tests, a REIT is subject to two gross income tests that must be met on an annual basis. First, at least 75 percent of a REIT’s gross income must consist of real estate related items such as mortgage interest, rents from real property, and gain from the sale of real property and mortgages on real property. Second, at least 95 percent of a REIT’s gross income must consist of sources that qualify for the 75-percent income test and other passive income such as corporate dividends (including dividends from a TRS), interest on non-real estate debt, and gains from the sale of non-real estate securities.

Four salient points on the income tests are worth highlighting for renewable energy investors. First, if a renewable energy REIT receives rental income from a TRS, that income is treated as bad income for purposes of both gross income tests. Thus, no more than 5 percent of a REIT’s gross income can consist of rent received from a TRS and other sources of bad income. If, however, a REIT receives real estate mortgage interest from a TRS, that income qualifies for both income tests. Accordingly, in order to comply with the REIT income tests, a commercial relationship between a REIT and its TRS should, if possible, be structured as a creditor-borrower relationship rather than a landlord-tenant relationship.

Second, because TRS dividends are good income for purposes of the 95-percent income test, a TRS can be used to convert bad 95-percent income into good 95-percent income. And although TRS dividends aren’t good income for purposes of the 75-percent income test, a TRS allows a REIT to effectively net its bad 75-percent income against TRS deductions, rather than account for that bad income on a gross basis as it would have to do if it earned that income directly. A TRS can thus be an effective tool for managing the REIT income tests.

Third, any rental or mortgage interest income that is contingent on the net income of the tenant or borrower is treated as bad income for purposes of both income tests. If, however, such income were contingent on the gross income of the tenant or borrower, then the income would be treated as good income.

Fourth, as much as 15 percent of a REIT’s rental income may be attributable to personal property (e.g., machinery and equipment) if that personal property is leased in connection with a lease of real property. For example, assume a REIT owns and leases a wind facility that consists in part of real property (e.g., the land on which the facility sits and the tower and pad) and in part of personal property (e.g., the blades, turbines, and nacelles). If the value of the personal property is 15 percent or less of the value of the facility as a whole, all of the rental income earned by the REIT under the lease of the facility will be qualifying income for both REIT gross income tests (the “limited personal property exception”). If, however, the value of the personal property exceeds 15 percent of the value of the facility as a whole, the entire amount of rent that is attributable to the personal property will be non-qualifying income for both REIT gross income tests.

The MLP Vehicle

Generally speaking, an entity that is publicly traded—including an entity that would otherwise be treated as a partnership for tax purposes—is taxed a corporation that will be subject to the 35-percent corporate income tax unless the entity qualifies for taxation as a REIT or a mutual fund. MLPs, however, are an exception: they are publicly traded entities that are nevertheless taxed as partnerships and thus aren’t subject to entity-level taxation.

The requirements for being an MLP are much less onerous than the requirements for being a REIT. An MLP is subject to only one test: 90 percent of its income must consist of passive income, including income that qualifies under either of the REIT gross income tests (with the exception of interest income earned as part of an active lending business). There is no asset test and no distribution requirement. Therefore, other than engaging in active loan origination—which is distinguished, albeit by a sometimes blurry line, from passive trading in debt securities—an MLP can do everything a REIT can do, and then some.

The Up-C Vehicle

The primary benefit of REITs and MLPs is that they’re not subject to corporate-level tax. The Primary drawback of REITs and MLPs is that they’re subject to a number of technical requirements that limit their flexibility and usefulness. The public entity in an Up-C structure, on the other hand, is a regular “C” corporation, which means that its operations, though not limited by tax requirements, are subject to corporate-level tax. The main tax attraction to an Up-C structure is its ability to facilitate the tax-free acquisition of an unlimited variety of assets that can be operated without regard to the technical tax requirements imposed on REITs and MLPs.

In particular, in an Up-C structure, a public C corporation holds all of its assets through a partnership or LLC or other entity taxed as a partnership (either way, an “operating partnership”). The use of the operating partnership allows the C corporation to acquire assets on a tax-free basis in acquisitions that might otherwise be taxable if done directly by the C corporation. Acquisitions are typically accomplished through contributions of assets to the operating partnership in exchange for operating partnership units (OP units), which are structured to be the economic equivalent—including in terms of liquidity—to the publicly traded C corporation stock.

Comparison of Renewable Energy Capital Vehicles

None of the renewable energy capital vehicles described above is better or worse than the others—each one may be the right choice for a given unregulated utility, depending on how that utility plans to conduct its business and finance its operations.

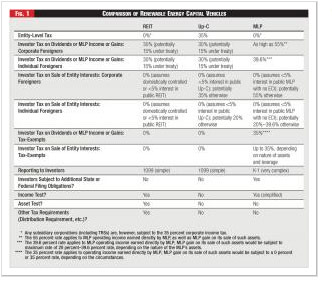

One question does, however, deserve additional attention: If MLPs are so much more flexible than REITs, why would a REIT ever be used instead of an MLP? The answer is that, although REITs and MLPs share the advantage of not paying corporate-level tax, REITs are much more investor-friendly vehicles in the case of certain classes of investors, namely tax-exempt investors, foreign investors, and U.S. retail investors:

- Tax-Exempt Investors: REITs eliminate tax exposure. If a tax-exempt investor were to invest in renewable energy assets through an MLP, it would generally be subject to the 35 percent unrelated business income tax (UBIT) on operating income and, in certain circumstances, could be subject to the UBIT on a portion of the gain realized on exit. If, however, the tax-exempt investor holds the renewable energy assets through a REIT, then the UBIT generally will not apply to either distributions received by the investor from the REIT or gain recognized by the investor on the sale of REIT stock. When combined with the REIT-level exemption from tax, the use of a REIT to hold renewable energy assets reduces the tax exposure of a tax-exempt investor on both operating income and exit gain from 35 percent to 0 percent.

- Foreign Portfolio Investors: REITs substantially reduce tax on operating income and potentially eliminate tax on exit. If a foreign portfolio investor (e.g., a foreign pension or sovereign wealth fund) were to invest in renewable energy assets through an MLP, it would generally be treated as recognizing “effectively connected income” (ECI). As a result, the investor would be subject to U.S. tax at varying rates as high as 55 percent on both operating income and gain realized on exit3 and would generally be required to file U.S. tax returns. A foreign investor in a REIT, however, is generally not required to file U.S. returns as a result of its investment and, depending on its circumstances, can enjoy two types of tax-rate benefits, one that applies to operating income and another that applies to gain realized on exit. First, distributions made by a REIT to a foreign investor will be subject to either 30-percent or 15-percent withholding tax, depending on whether the foreign investor is eligible for tax treaty benefits. Second, a foreign investor in a REIT enjoys two exceptions to the tax that is generally imposed on foreigners that sell U.S. real property investments. Under the first exception, a foreign shareholder is not subject to tax on the sale of stock in a “domestically controlled” REIT (i.e., a REIT more than 50 percent of the value of which is owned by U.S. persons at all times during a 5-year look-back period). Under the second exception, a foreign shareholder than owns less than 5 percent of the stock of a publicly traded corporation, including a public REIT, is not subject to tax on the sale of that stock even if the REIT is foreign controlled. Thus, from the perspective of a foreign investor, holding renewable energy assets through a REIT can reduce the tax on operating income from as much as 55 percent to as little as 15 percent and the tax on exit from as much as 55 percent to as little as 0 percent.4

- Retail U.S. Investors: REITs provide simplified tax reporting. For a retail U.S. investor, an investment in REIT stock enables a retail investor to enjoy simple and timely tax reporting, because a REIT reports dividend income to shareholders on Form 1099-DIV. By contrast, an investor in an MLP will receive a Form K-1 which, in addition to being significantly more complex and cumbersome than a Form 1099-DIV, often requires retail investors to obtain federal tax return filing extensions every year and to file tax returns in every state in which the MLP owns assets or conducts business. For this reason, many retail investors prefer REIT investments over MLP investments.

In many cases, the benefits conferred by REITs for tax-exempt, foreign, and U.S. retail investors will be worth the additional restrictions and accompanying administrative burden imposed on REITs.

Figure 1 provides a very general comparison of the key factors that should be considered in choosing between a REIT, an MLP, or an Up-C as the capital vehicle for a renewable energy project. Download a pdf of Figures 1 through 7 here.

Capital Raising Strategies: Sale-Leaseback vs. Borrowing

There are many different capital-raising strategies available to an unregulated utility, and this article will explore the two basic building blocks of those strategies: the sale-leaseback financing and the traditional secured borrowing.5 Because, as described below, the different capital vehicles are not equally effective at accommodating different capital-raising transactions, an unregulated utility’s decision between a sale-leaseback financing and a traditional borrowing will inform its decision about which capital vehicle to use.

Besides the business and economic differences between being a non-owner tenant (as in a sale-leaseback structure) and an owner-borrower (as in a traditional borrowing structure), one practical consideration is worth mentioning here: borrowings are relatively simple, easy transactions, whereas sale-leasebacks can be more complicated and may require more creative tax planning. Thus, all else being equal, a taxpayer that has little appetite for complexity may prefer a traditional borrowing over a sale lease-back transaction. The right choice for any given renewable energy project will, however, depend on all the facts and circumstances.

REIT Operating Models

REITs can accommodate either a sale-leaseback or a traditional borrowing using one of three operating models: the landlord model, the lender model, and the hybrid landlord-lender model.

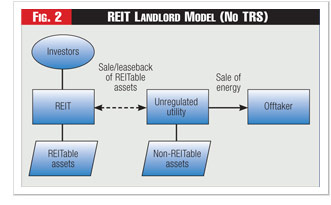

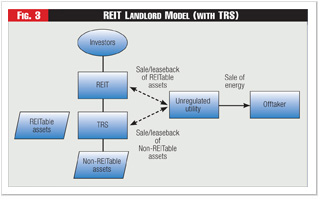

Under the landlord model, which would be used for sale-leaseback transactions, the REIT will typically buy from the unregulated utility (i) the gathering and transmission assets, (ii) the land underlying the facility, and (iii) any other components of the facility that may be owned by the REIT without jeopardizing its REIT status, including, for example, facility components that are treated as real estate assets (e.g., wind towers and pads or solar racking structures) and, subject to the REIT rules, certain facility components that aren’t real estate assets (the assets described in clauses (i) through (iii), collectively, REITable assets). Any components of the facility not purchased by the REIT (non-REITable assets) would continue to be owned either the unregulated utility or would be purchased by a TRS of the REIT.6 Figures 2 and 3 (Download a pdf of Figures 1 through 7 here) illustrate the landlord model with and without a TRS, respectively.

If a TRS isn’t used, the REIT would lease the REITable assets to the unregulated utility, and the unregulated utility would use those leased assets, together with any non-REITable assets that it already owns, to produce and sell energy to a buyer (commonly referred to as an “offtaker”). Alternatively, if a TRS is used to hold the non-REITable assets, the REIT and the TRS would jointly lease their respective assets to the unregulated utility, which would use the leased assets to produce and sell energy to an offtaker. In either case, the rents payable by the unregulated utility to the REIT may be contingent on the unregulated utility’s gross income from the use of the leased assets.

If a TRS isn’t used, the REIT would lease the REITable assets to the unregulated utility, and the unregulated utility would use those leased assets, together with any non-REITable assets that it already owns, to produce and sell energy to a buyer (commonly referred to as an “offtaker”). Alternatively, if a TRS is used to hold the non-REITable assets, the REIT and the TRS would jointly lease their respective assets to the unregulated utility, which would use the leased assets to produce and sell energy to an offtaker. In either case, the rents payable by the unregulated utility to the REIT may be contingent on the unregulated utility’s gross income from the use of the leased assets.

As described above, it is possible, subject to limitations, for a REIT to own those components of a facility that aren’t treated as real property for purposes of the REIT rules. The REIT asset tests, for example, would allow up to 25 percent of the REIT’s assets to consist of a combination of personal property and securities.7 In addition, the limited personal property exception would allow the REIT to own, and to lease to the unregulated utility, a significant amount of personal property without violating the REIT gross income tests. Specifically, if the value of the personal property components of a facility is less than 15 percent of the value of the facility as a whole, then all of the rental income received by a REIT upon a lease of the facility—even the portion of the rent attributable to the personal property—would be treated as qualifying “rents from real property” for purposes of both REIT gross income tests. If the personal property components exceed this 15-percent threshold, the REIT could nevertheless qualify for the limited personal property exception by causing the excess to be held through a TRS.

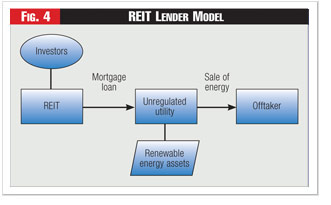

The lender model, which is illustrated in Figure 4 (Download a pdf of Figures 1 through 7 here) and would be used for traditional borrowers, is a traditional secured lending transaction under which the unregulated utility continues to own the renewable energy assets, and the REIT makes a mortgage loan to the unregulated utility secured by those assets. The REIT will receive mortgage interest payments, some of which may be contingent on the unregulated utility’s gross income. The unregulated utility would then sell energy to an offtaker.

The lender model, which is illustrated in Figure 4 (Download a pdf of Figures 1 through 7 here) and would be used for traditional borrowers, is a traditional secured lending transaction under which the unregulated utility continues to own the renewable energy assets, and the REIT makes a mortgage loan to the unregulated utility secured by those assets. The REIT will receive mortgage interest payments, some of which may be contingent on the unregulated utility’s gross income. The unregulated utility would then sell energy to an offtaker.

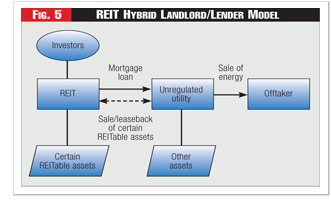

As the name suggests, the hybrid landlord-lender model, which is illustrated in Figure 5 (Download a pdf of Figures 1 through 7 here), is a combination of the landlord model and the lender model and can therefore accommodate at the same time a sale-leaseback transaction and a traditional borrowing with respect to different assets. Under the hybrid landlord-lender model, the REIT will enter into two commercial relationships with the same unregulated utility. In the first relationship, the REIT will buy certain REITable assets from the unregulated utility and then lease those assets back to the utility. In the second relationship, the REIT will make a mortgage loan to the unregulated utility secured by any remaining assets owned by the utility. The rent and mortgage interest received by the REIT may be contingent on the unregulated utility’s gross income from the use of the leased assets or the use and sale of the mortgaged assets, respectively.

MLP Operating Models

The MLP capital vehicle is in some ways more flexible than the REIT vehicle but in other ways less. It is more flexible with respect to the landlord model but less flexible with respect to the lender and hybrid landlord-lender models.

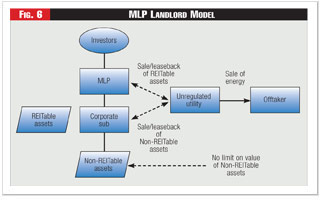

In particular, because an MLP isn’t subject to an asset test or the equivalent of the REIT 75 percent gross income test, and MLP can use the landlord model without a limit on the value of personal property (e.g., machinery and equipment) held indirectly through corporate subsidiaries of an MLP. There is thus no limit on the amount of indirect economic exposure that an MLP may obtain in the personal property components of a facility. This economic exposure, of course, comes at the expense of a corporate-level tax on the corporate subsidiaries of the MLP, but the tax bill can be managed by leverage at those subsidiaries. Figure 6 (Download a pdf of Figures 1 through 7 here) illustrates the landlord model in an MLP structure.

On the other hand, because an MLP generally cannot engage in active loan origination, the lender model is not viable for an MLP, and the hybrid landlord-lender model is viable only if the lender portion of the model is strictly limited.

As a result, an unregulated utility that is primarily interested in sale-leaseback financing should give MLPs a close look. An unregulated utility that is primarily interested in borrowing, however, will likely find REITs to be more promising.

Up-C Operating Models

Up-C Operating Models

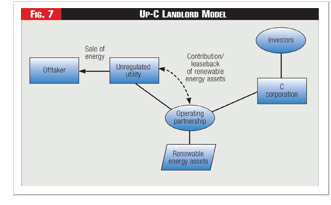

As described above and illustrated in Figure 7 (Download a pdf of Figures 1 through 7 here), the basic Up-C structure involves a publicly traded C corporation that holds all of its assets indirectly through an entity treated as a partnership for tax purposes. Although it is certainly possible for an Up-C to be a lender, the Up-C vehicle, which was designed to allow a public C corporation to acquire ownership of appreciated assets on a tax-free basis, is most useful for effecting a variation of a sale-leaseback transaction—namely, a tax-free contribution-leaseback. In particular, favorable tax rules govern contributions of appreciated property to a partnership in exchange for interests in that partnership. Such a contribution is generally tax-free, which is often not the case for contributions of property to a publicly traded corporation. A public C corporation can capitalize on the favorable partnership rules by acquiring, on a tax-free basis, appreciated property through a contribution of that property to an operating partnership of the C corporation. The basic use of an operating partnership to effect a tax-free acquisition in an Up-C structure is illustrated in Figure 7. It should be noted that a REIT can use the same operating partnership structure to acquired appreciated assets on a tax-free basis. The REIT version of an Up-C structure—the so-called UPREIT structure—would generally be the same as the Up-C structures shown in Figure 7, only with the REIT in place of the C corporation and a TRS situated underneath the operating partnership, if necessary.8

Although a contribution to a privately held operating partnership in exchange for OP units isn’t, as a legal matter, equivalent to a contribution in exchange for publicly traded corporate stock, the typical OP unit is structured so that it is economically fungible with a share of publicly traded corporate stock. In particular, a REIT or Up-C that utilizes an operating partnership will ordinarily hold all of its assets through the operating partnership, and a holder of an OP unit will generally have distribution and liquidity9 rights that are substantially identical to the rights of a holder of stock in the REIT or public C corporation. As an added benefit, an operating partnership will often be able to make leveraged distributions to holders of OP units on a tax-free basis, an option generally not available to a REIT or C corporation that wishes to make distributions to its shareholders. For these reasons, a contribution of property to an operating partnership will generally yield substantially identical economic results, but superior tax results, as compared to a contribution of property directly to a REIT or C corporation.

Accommodating Renewable Energy Tax Incentives

As alluded to above, several renewable energy tax incentives have been available to investors in renewable energy projects. These incentives include a production tax credit (PTC) that is contingent on the amount of energy produced and sold by the project, an investment tax credit (ITC) for money invested in certain energy property, and accelerated depreciation for certain types of machinery and equipment used to produce renewable energy.

The renewable energy tax incentives vary in the nature of the benefits they confer, the requirements for achieving those benefits, and their suitability for a particular project or ownership structure. Although a detailed description of the renewable energy tax incentives is beyond the scope of this article, one important point bears mentioning here: each of the renewable energy tax incentives provides tax benefits for only a limited period of time, after which the benefits are exhausted and cease to apply.

Two structural considerations follow from this point. First, those projects that have exhausted their renewable energy tax incentives can be transferred to any of the capital vehicles described above without the need for any special structuring considerations related to the incentives. Because there are no remaining tax incentives, they cannot be wasted by transferring the relevant project to an entity, such as a REIT or an MLP, that does not pay taxes.

Second, if a project’s renewable energy incentives have not yet been exhausted, preserving the use of those incentives is potentially much more important to the structuring process. An unregulated utility has a couple of options for preserving those incentives within a REIT, MLP, or Up-C structure. In an Up-C structure, the public entity is itself a taxpaying C corporation that may be able to use the tax incentives. But even in a REIT or MLP structure, the assets whose incentives have not been exhausted can be held through a TRS of a REIT or a taxable corporate subsidiary of an MLP. Once the incentives have been exhausted by that TRS or MLP subsidiary, the assets could be transferred to the REIT or MLP (subject to compliance with the relevant requirements), where the income generated by those assets will no longer be subject to corporate-level tax.

Another option, which is available to all three capital vehicles, is to hold the non-exhausted assets in a partnership with other tax equity investors—i.e., investors that have sufficient taxable income to make use of the renewable energy tax incentives associated with the project. Within limits, the tax rules permit a disproportionate amount of renewable energy tax incentives to be allocated to the tax equity investors, which may increase the amount that those investors are willing to pay to join the partnership. Once the benefits have been exhausted, the assets would revert back to the public vehicle.

Financing Alternatives

A complex interaction of political and market forces has led unregulated utilities to search for new capital at a time when traditional investors have been exiting the space. This has forced unregulated utilities to think outside the box and consider nontraditional sources of capital for renewable energy investments.

Fortunately for unregulated utilities, three nontraditional capital vehicles—REITs, MLPs, and Up-Cs—may be able to provide low-cost financing for renewable energy investments. Although these nontraditional vehicles may not have been suitable sources of capital under market conditions as they existed five or 10 years ago, the conditions today may make them suitable. An unregulated utility that is not satisfied to wait on the sidelines in hopes of a return of past conditions should take a close look at the benefits that REITs, MLPs, and Up-Cs have to offer.

Endnotes:

1. In the past couple of years, rumors have abounded regarding unregulated utilities seeking to sell interests in their renewable energy portfolios in order to monetize their investment in those portfolios and to find a partner to share the future development costs associated with those portfolios. For example, in 2012, Duke Energy sold a 50 percent interest in two of its wind farms to Sumitomo Corp. of America, and AES Corporation reportedly was in talks to sell its U.S. wind assets to State Grid Corp. of China. See Press Release, “Duke Energy and Sumitomo to Jointly Own Kansas Wind Farms,” Mar. 27, 2012; Wan Xu & Don Durfee, “China’s State Grid in Talks to Buy AES’ U.S. Wind Assets,” Reuters, Feb. 27, 2012.

2. One taxpayer has publicly disclosed in its SEC filings that it has received a ruling from the IRS that loans secured by certain renewable energy assets are qualifying real estate assets—which would necessitate a finding that the underlying renewable energy assets themselves are “real estate assets”—but the exact nature of the assets covered by the ruling isn’t clear from the description in the SEC filings.

3. A foreign investor would generally be subject to regular federal income tax on income and gains associated with the renewable energy assets. Thus, a non-corporate investor would currently pay tax at a maximum rate of 39.6 percent on operating income and 20 percent on capital (sale) gains. A corporate investor would pay tax at a maximum rate of 35 percent on both operating income and capital (sale) gains and, in addition, would pay a 30-percent branch profits tax on the amount remaining after the imposition of the 35-percent tax. Thus, the effective tax rate for a foreign corporate investor that is subject both to the regular federal income tax and to the branch profits tax is approximately 55 percent. The U.S. tax rates imposed on foreign investors may be reduced by tax treaties.

4. Foreign governments and sovereign wealth funds investing through a REIT structure may be eligible for additional tax exemptions that reduce their tax on both operating income and exit gain to 0 percent. A discussion of those exemptions is beyond the scope of this article.

5. Although an unregulated utility can certainly also sell its renewable energy project without continuing to operate that project through a leaseback or otherwise, the utility is likely to desire to continue to operate the project. This article thus focuses on structures that accommodate that desire.

6. The REIT may own all, or any portion, of the TRS’s stock. Placing the non-REITable components of a Facility in a TRS allows the REIT to gain indirect economic exposure to those components, which it wouldn’t have if those components were owned by an unregulated utility. Such a structure would, however, require careful monitoring to ensure compliance with the REIT rules.

7. It should be remembered that stock of a TRS isn’t a real estate asset and thus must be added to all other non-real estate assets when testing a REIT’s compliance with the 75-percent REIT asset test.

8. Any assets to be held by the TRS would generally be first contributed by the project owner to the operating partnership and then by the operating partnership to the TRS.

9. Liquidity is achieved by allowing OP unit holders to convert their OP units into shares of the REIT or public C corporation, which may then be sold on the public markets.