A challenging year brings a change in the rankings.

Michael T. Burr is Fortnightly’s editor-in-chief. He acknowledges the editorial contributions of the C Three Group and Accenture.

If the Fortnightly 40 report tells us nothing else about the U.S. utility industry, it reminds us about two immutable facts.

First, after all is said and done—after all the strategic positioning and planning, after all the talk of transformation and customer engagement—utility financial performance comes down to customer demand for energy. If demand is flat, then utility performance will be flat.

Second, it reminds us that utilities are the quintessential asset business. Power and gas companies really have only one way to deliver greater value for shareholders, and that’s by growing the asset base—either through expansions or acquisitions.

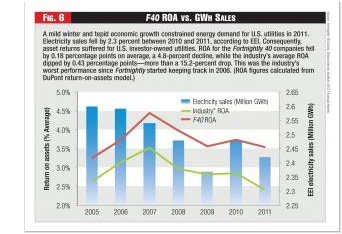

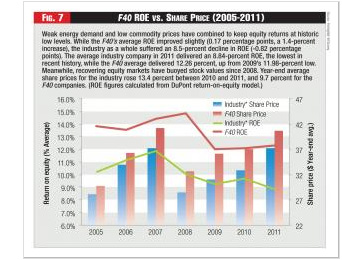

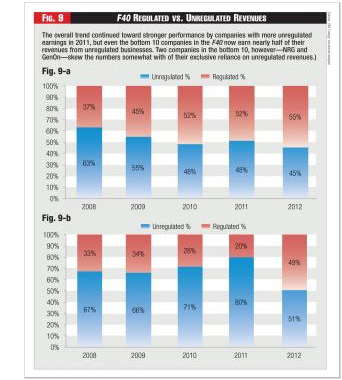

If these facts sometimes get lost in the haze, this year’s Fortnightly 40 brings them into stark relief. In 2011, meager economic growth combined with a warm winter to yield flat demand in most parts of the country. Accordingly, the industry’s production levels sank, and returns suffered. Specifically, U.S. electric output fell by 0.6 percent overall, compared to 2010 production. And the industry’s average return on assets (ROA) dipped to its lowest level—2.4 percent—since Fortnightly began keeping track in 2006 (see Figure 6). Trends in return on equity (ROE) (see Figure 7) and free cash flow tell similar stories.

“How do you make money as an investor-owned utility? You put more assets into the ground,” says Jean Reaves Rollins, managing partner of the C Three Group in Atlanta, which developed the Fortnightly 40 model and provides financial analysis for each year’s report. “There’s a huge rush to build electric transmission projects, and utilities are busy working on gas pipeline replacement programs, especially in older service areas. In the near term these investments hurt cash flow, but in the long term they increase the rate base.”

Amid these facts, however, the industry’s financial leaders also demonstrate the importance of effective operational execution. “A lot of it is nuts and bolts,” says Caroline Dorsa, CFO and executive vice president at Public Service Enterprise Group—this year’s #2, and among the top 10 for three years running. “When you’re an operationally excellent company, focusing on delivering for your customers, you’ll get new opportunities. But the best planning in the world doesn’t do anything if you don’t deliver operational performance.”

The need for solid blocking and tackling becomes even more important when times are challenging, like they’ve been lately. And those challenges seem unlikely to abate any time soon. Even when demand rebounds, utilities still will be dealing with major changes affecting the core of their business proposition—from uncertain environmental policies to a historic shift away from coal and toward natural gas in the resource mix. Thus the industry’s financial winners and losers ultimately will be differentiated by their operational performance.

“Positioning in the value chain is key, but execution is just as critical,” says Jack Azagury, Accenture’s North American Management Consulting lead for the resources industries. “And the more volatile the industry environment—the more change you’re subjected to—the more critical execution is.”

Making Big Moves

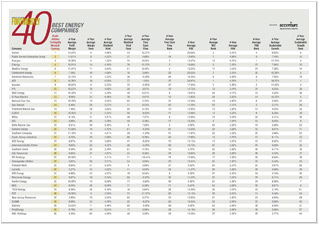

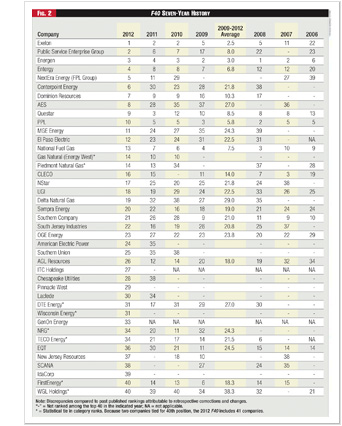

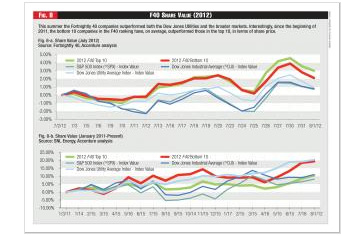

Last year’s Fortnightly 40 report highlighted a slow pace of change in the industry, in terms of which companies provide the strongest returns for shareholders. We called it a “veritable showcase of the industry’s stability,” and pointed out that among the top 10 companies, only two names changed—one of them being Mirant, which disappeared when it merged with RRI Energy to become GenOn (this year’s #33). The 2012 ranking still showcases the industry’s stability, as most companies in the top 40 have held onto their positions—give or take a few places (see Figures 2 and 3). For instance, Exelon moves up from its previous #2 position into the #1 spot, Public Service Enterprise Group (PSEG) goes from #6 to #2, Energen goes from #4 to #3, etc.

However, a closer look reveals some remarkable and even dramatic moves. For example, DPL—which had claimed the #1 spot for three years running—was acquired by AES last year, and AES in turn takes the #8 position in this year’s F40, up from #28 last year. This is the first year AES has ranked higher than the high 20s—a remarkable jump in rank from one year to the next. And AES’s ascent was unrelated to its DPL acquisition, since the utility’s numbers weren’t integrated into AES until 2012.

Likewise, Centerpoint Energy jumped from its previous #30 position into this year’s #6. And less dramatic, but still remarkable, is NextEra Energy’s ascent to the #5 spot, up from last year’s #11 position, and #29 before that. Also, Pinnacle West leaped onto the F40 for the first time, coming in at #29.

A few companies, meanwhile, slid substantially in the rankings—several of which recently completed big mergers and acquisitions (M&A). Consider PPL, which has firmly held positions in the top 5 every year since 2006, and this year slips back to #10—still an outstanding ranking, to be sure, but a noteworthy drop for the perennial leader. PPL’s decline might be related, in part, to the effects of acquiring E.On US, which owns Louisville Gas & Electric and Kentucky Utilities. Another example is AGL Resources, #12 last year, sinking to #26 this year after acquiring Nicor, last year’s #29. But perhaps most notable is FirstEnergy’s decline from #14 last year to #40 this year, after it acquired Allegheny Energy.

But not all the declines are related to merger hangovers. National Fuel Gas has always been in the F40 top 10, but this year it sank to #13. Same with Gas Natural (formerly Energy West)—last year’s #10, now coming in at #14. A few others suffered steeper drops; examples include South Jersey Industries, TECO Energy, and DTE. And some companies dropped out of the top 40 altogether, including: RGC Resources, #30 last year; Edison International, #33; Alliant, #37; and Northwest Natural Gas, #38.

The F40 is based on a four-year model, using multiple metrics, which should moderate the effects of one-time events. So when many companies’ ranks are abruptly changing, it suggests something big is happening. Aside from extraordinary costs related to mergers, no single reason can explain the overall volatility in performance; different companies are differently affected by the forces that are battering all players in the business. However, two factors seem to be having a particularly substantive effect on many companies’ performance. First is exposure to fuel prices, both natural gas and coal. And second is the opportunity to invest in infrastructure, especially transmission lines.

Coal, Copper, and Cash in the Bank

On the fuel side of the equation, price risk weighs heavily on financial performance. Pure-play utilities, including distribution companies and integrated utilities with their generation assets in a regulated rate base, are relatively insulated from the industry’s fuel shift. But to the degree a company’s fortunes depend on market prices for natural gas or electricity, its profits and returns generally are suffering. Examples include the aforementioned National Fuel Gas, and also EQT (now #36, previously #30); as well as NRG, GenOn, and also FirstEnergy—whose acquisition of Allegheny Energy included a coal-heavy power fleet, selling into PJM.

Fuel price risks aren’t only affecting merchant players. Regulated companies with heavy reliance on coal-fired assets also have suffered, as price trends have put their assets out of the market. “Anyone with big exposure to coal has gotten killed,” says Reaves Rollins of the C Three Group. “With gas prices as low as they are, the way companies have been operating their power plants is just bizarre. They’ve been running gas-fired peaking units flat-out, 24/7, while baseload coal-fired plants are sitting idle.”

Indeed, during the past year, natural gas for the first time displaced coal as the biggest fuel source for power generation in the United States. Southern Company, for example, previously dependent on coal for 70 percent or more of its generation, now burns natural gas for 50 percent of its power, and runs its coal boilers half as much as it used to. The imbalance of coal and gas in its portfolio, combined with Southern’s large capital program, has weighed on the company’s cash flow and kept its F40 rating in the 20s—where it’s been for three years, after holding positions between #11 and #8 every year before that.

The second factor involves transmission development, which is happening at a remarkable pace across the country. For example, Edison International—the industry’s leader in terms of capital spending (see Figure 5)—is directing half of its capital budget toward transmission. Southern Company, the number-two spender, is investing more than $4 billion on transmission upgrades. Xcel and Dominion plan to spend $3.8 billion and $2.4 billion, respectively, on transmission—34 percent and 22 percent of their capex budgets.

Transmission investments are providing utilities an opportunity to pursue asset growth during otherwise lean times. “During the 2000s, investor-owned utilities made money through organic growth,” Reaves Rollins says. “They were adding meters left and right. But after the housing crash in 2007 and 2008, suddenly there’s no growth, and no distribution expansion. Building generation can be risky. But you have NERC saying the grid must be more reliable, and FERC approving excellent returns on projects under their jurisdiction. Many transmission projects are like cash in the bank.”

Such investments haven’t yet buoyed companies in the F40 rankings—except for ITC, of course, which enters the top 40 this year at #27—but several are reaping profits. For example, Sempra (#20) says its earnings from SDG&E increased by fully one-third, primarily on the strength of higher earnings from the utility’s Sunrise Powerlink transmission line. And AEP (#24) forecasts that by 2015, 39 percent of its earnings will be derived from its transmission businesses.

As strong as these trends appear to be, however, every company’s market position is different, and each is pursuing a different strategy to deliver shareholder value at a tumultuous time for the industry. “We’re entering a period of unprecedented change in this industry in the next 10 years,” Azagury says. “The economic, regulatory, and commodity issues will remain challenging, and the technology changes will be no less challenging. The advent of photovoltaics (PV) and electric vehicles (EV) will create challenges especially for distribution utilities.”

As this year’s F40 leaders demonstrate, the key to success is to invest capital in a disciplined way—toward assets that serve the needs of customers first and foremost—and to manage those assets as efficiently as possible. Because after all, in the long term, front-line operations ultimately will make or break a utility company’s value proposition.

AES: Platform Jumping

AES achieved its performance by producing the industry’s best ROE and sustainable growth figures over the past four years, as well as the 7th-best ROA and the 16th-strongest profit margin. Its ranking was weighed down by the facts that AES doesn’t issue dividends, and its free cash flow ranks 37th on our list.

Looking beyond the numbers, it becomes apparent that AES also is a strategic outlier in the industry, because a large share of its earnings and assets are in fact located outside the United States. That’s also the basis for the company’s strong growth profile, compared to the rest of the F40. “Over the past four years we’ve had good growth in our Latin American companies,” says Andrés Gluski, CEO at AES. “The largest is AES Gener in Chile, which experienced CAGRS exceeding 20 percent in that time period. We also did very well in Brazil.” Gluski himself hails from Venezuela, where he led La Electricidad de Caracas before joining AES.

Looking beyond the regional picture, Gluski attributes the company’s strong growth and returns to its power generation investments in multiple markets. “We’ve built a number of new plants in Chile, Panama, and Bulgaria,” he says. “We also built some wind capacity in the United States. We’ve been very efficient in terms of building our fleet, operating it more effectively—and selling off the assets that didn’t fit our model.” Recently the company sold 222 MW of wind generating assets in France, and earlier this year it sold a 1,199-MW gas-fired combined-cycle plant in Spain, as well as combined-cycle plants in New Jersey and Pennsylvania, totaling another 1,537 MW. The company’s AES Eastern Energy subsidiary filed for chapter 11 bankruptcy protection in January 2012, a move that AES says won’t affect its outlook. AES Eastern operates four power plants in New York, totaling about 1,000 MW, acquired in May 1999 from New York State Electric & Gas.

Gluski says AES’s plant divestitures are part of its effort to redeploy capital into areas that allow the company to build on its strongest businesses. “We want to be in less markets than we have been in the past,” he says. “We’re selling out of markets where we don’t think we have a competitive advantage.” Chief among those advantages, he says, is the ability to achieve economies of scale. “We buy about $2 billion worth of coal around the world. By aggregating that, we can work on blending different coals, adjusting contracts with suppliers in different regions, and getting lower freight costs. Even a 5 or 10 percent improvement can increase returns substantially for our coal plants.”

The company’s strategy isn’t just about power plants, however—and that’s a departure from its early roots as a pure-play independent power developer. “AES’s value proposition used to be about building power plants anyplace we could get a contract,” Gluski says. “Now, with all the changes around the world, it’s more difficult to build IPPs, and so we’re moving toward a value proposition based on platforms—having a critical presence in key markets.” The company’s acquisition of DPL last year, and Indianapolis Power & Light in 2000, are part of that strategic approach. “What differentiates AES is how we take our unmatched footprint to create a value proposition for the customers we serve,” Gluski says. “We have a unique footprint in some great markets, and we are focused on building from those existing platforms.”

And the fact that it still doesn’t pay a dividend doesn’t bother most investors, who are satisfied with the value they receive from a company whose strategy is oriented toward consistently strong returns and stable growth instead of producing annual payouts.

El Paso Electric: Pure-Play Performance

Like AES, El Paso Electric has ascended dramatically in the F40 this year—rising to #12 from its earlier position in the 20s and 30s. But that’s about where the similarity ends.

El Paso Electric is a pure-play integrated utility serving West Texas and southern New Mexico. Its strong showing this year is attributable to its sustainable growth (#4) as well as solid ROE and ROA performance. But a key factor that might otherwise go unnoticed is the company’s dividend yield. While the 0.48 percent yield is very low by industry standards, El Paso Electric’s dividend is remarkable because it’s the first one the company has issued since the company emerged from bankruptcy in 1996.

“Over 10 years coming out of bankruptcy, we were able to reduce our debt and build up our equity,” says David Carpenter, CFO. In 2010, the company’s rate case ended a rate freeze that had lasted about 15 years, allowing the company to increase rates to pay for plant investments. At the same time, it rolled into rate base those assets that generated off-system sales—which according to Carpenter had tied the company’s earnings to market prices. “When we took away that commodity risk, we felt our earnings were more stable, so we issued a dividend to shareholders—22 cents a share in 2011, increasing to 25 cents per share in 2012,” he says.

The company expects to continue growing its dividend, targeting a payout ratio of about 45 percent. This outlook is justified by solid growth rates in the El Paso Electric service territory—particularly at Fort Bliss, a major U.S. Army base that’s grown from 9,500 to 30,000 soldiers since 2007—and with billions in additional infrastructure. “That has benefited us with a multiplier effect,” Carpenter says. “You bring in new troops, they bring their families, and buy things in the El Paso Electric service territory, and that helps us. Our sales have grown four times faster than the industry average for the past five years.”

In addition to installing new lines and meters, El Paso Electric added a 288 MW combined-cycle power unit at its existing Newman site. The company built the new capacity in stages, first installing two gas turbines in 2009, and then adding an HRSG and steam turbine in 2011. Now it’s taking a similar approach in adding a $75 million simple-cycle gas turbine unit at its Rio Grande plant. In this way, Carpenter says, El Paso Electric is expanding its assets in a measured and efficient way. “You earn ROE and ROA by managing growth,” he says. “We work hard to manage our costs and build plant when it’s needed. We don’t want to add capacity in lumps and have excess generation.”

During the next five years, El Paso Electric expects to invest about $1.5 billion in capital projects, 60 percent of which will go toward generation expansions and 35 percent into transmission and distribution. Plans also include a 2.5-MW solar project at the company’s Newman site, and 20 MW of photovoltaic (PV) capacity at Fort Bliss. The company won’t have to invest much in emissions controls, because its power capacity is mostly nuclear and gas-fired—45 percent and 35 percent, respectively. At some point, as capital spending tapers off, Carpenter says its increased rate base will allow the company to put more earnings into paying dividends.

“We’re a fairly simple utility,” he says. “We’re not diversified, and we’re not big into energy trading. While that might limit the upside, it also limits the downside. The key is that we’re a growing utility, and we’re also a low-risk investment. We’re maintaining a very strong capital structure, so shareholders can expect dividends plus growth in their investment going forward.”

MGE Energy: Community Growth

Madison, Wisc., lies in the heart of the upper Midwest’s breadbasket, within a few hours’ drive of both Chicago and Milwaukee. But while Milwaukee is a city of heavy industry (and beer), and Chicago is the city with the broad shoulders (and thick pizza), Madison is more like the Berkeley of the Midwest. In particular, the University of Wisconsin-Madison hosts 42,000 students—nearly 14 percent of the city’s population—and has a well-earned reputation for left-leaning political activism. That reputation, moreover, seems to infuse the city. Most recently, the Occupy movement got a boost when hundreds of activists camped on the Wisconsin state capitol grounds last year to protest Gov. Scott Walker’s move to reduce the collective bargaining power of public employee unions.

What does all this have to do with the utility industry? Plenty.

The city of Madison is served by Madison Gas & Electric, whose holding company, MGE Energy, this year ascended to the #11 position in the Fortnightly 40 ranking of shareholder value performance, from #24 last year. MGE’s strong rank is driven by industry-leading numbers for free cash flow (#8), return on assets (#10), and profit margin (#17). According to Jeff Newman, CFO, the company achieved those numbers with a straightforward proposition: it focuses on providing the service that its uniquely progressive community wants, within the framework of a conservative regulated business enterprise. This strategy allows MGE to invest in things like distributed generation (DG) and electric vehicle (EV) charging stations, and to exceed its state-mandated renewable portfolio requirements, while it also delivers top-tier financial returns for shareholders.

“Above all, in Wisconsin our regulatory model rewards reliability—not only operational reliability, but also financial reliability,” Newman says. “We stay very close to a triple-A bond rating, because if you have strong credit quality and a strong capital structure, you will be successful in the utility business. Our model is a model of reliability.”

In addition to its credit ratings, another measure of MGE’s conservative financial management is the fact that it’s raised its dividend every year since the mid-’70s. Its 3.79-percent dividend yield is unremarkable, ranking #48th among the companies in our survey, but Newman says that just illustrates the company’s careful approach. “Sometimes utilities extend themselves too far and then have to cut their dividend,” Newman says. “It’s better to increase the dividend, and that means you can’t get ahead of yourself. It goes back to our conservative roots. We try to manage within a range”—namely, about 60 to 70 percent of earnings, he says.

MGE’s focus on a conservative financial strategy belies the company’s focus on serving its progressive-minded customers. “We think of ourselves as a community energy company,” says Lynn Hobbie, senior vice president for Madison Gas & Electric. “The focus of our business is on paying attention to the needs of our regulated service territory—but also casting an eye to the future, for new opportunities that arise.” Case in point: MG&E provides a green pricing program that Hobbie says is among the most successful in the industry, with about 10 percent of customers choosing to purchase a renewable-heavy power supply. And as a result, the company has invested in rate-regulated renewable facilities, and now generates more than 12 percent of its retail electricity from renewable resources—already exceeding the state’s goal for the year 2015 by a fifth.

Another example is distributed generation. The company provides backup generators for commercial and industrial customers who need redundant generation. “We own the DG, we operate and maintain it,” Hobbie says. “When we need it, it’s available for the community, and when the customer needs it, the DG is there for them. It’s a tariffed service, but it’s also a partnership that helps the customer relationship.” Similarly, the company built a 150-MW onsite cogeneration facility for UW-Madison, providing electricity as well as steam for the university’s heating and evaporative cooling needs.

“It’s what the customer wanted,” Newman says. “The customer got value, and so did our shareholders.”

Other examples include investments in 29 EV charging stations throughout Madison—a huge number for a small city, especially one in the northern tier where EVs are just now entering showrooms. Further, the company now is planning to build public refueling stations for compressed natural gas (CNG) vehicles. “Our service territory is a very progressive one, and the number of EVs appearing here is higher than most,” says Scott Schmitt, director of finance and business planning for MG&E. “We’re hoping our network of stations will help customers feel more comfortable adopting the technology.”

To determine what customers want, the company makes a point of asking them. In the early 2000s, MG&E foresaw a growing need for generating capacity, and it sought input from the community about how it should meet that need. “We invited all the customers in our service area to talk with us about energy supply planning, and we got their perspective and feedback on what we should do,” Hobbie says. “We used that for our decisions going forward. It’s always a balancing act, of course; some customers will value one thing, and others value something diametrically opposed. But we give them a chance to give us input.” That process led the company to invest in 30 MW of wind power capacity in Iowa, as well as a 100-MW share of two new supercritical coal-fired units at We Energies’ 1,230-MW Elm Road site, which started operating last year near Milwaukee. MGE also switched fuels at its Blount plant in Madison, from coal to natural gas.

MGE’s cash flow and profitability also is buoyed by its stake in American Transmission Co. (ATC), created in 2001 to own and operate the transmission assets of numerous utilities in Wisconsin and the upper Midwest. ATC is working on a host of new lines and upgrades, as part of a plan that envisions up to $4.4 billion in investments through 2020. “That asset growth has helped each utility in Wisconsin, including MGE,” Newman says.

And by turns, it has helped MGE to meet its customers’ demand for things like renewables and EV charging infrastructure. “If we stay financially strong, we can be all those things for the customer,” Newman says. “That’s how we operate this company, and it’s why we continue to move up in the Fortnightly 40 numbers.”

NextEra Energy: A Tale of Two Strategies

In some sense, the past couple of years have been the best of times and the worst of times for NextEra Energy.

Best, because NextEra produced industry-leading four-year performance in free cash flow (#4), ROE (#11), profit margin (#11), and sustainable growth (#14). Strength like that, across a range of metrics, lifted NextEra into an elite #5 position in this year’s Fortnightly 40 ranking—the highest position the company has ever achieved, up from #11 last year and #29 in 2010.

But it was among the worst of times for the same reasons that challenged so many other companies in the industry. “We’ve never seen a period with so much uncertainty, around so many factors,” says NextEra CFO and Vice Chairman Moray Dewhurst. “The economy is uncertain and hesitant; commodity prices are very low and volatile; there’s uncertainty about energy policy; and uncertainty about technology. Never in 100 years have we had more rapid development on technologies that could have a major influence on our industry.”

All these uncertainties have set the stage for rising tension between utilities and their regulators, especially when utilities ask for rate increases to recover capital costs. NextEra’s regulated subsidiary, FP&L, encountered such conflict in 2010, when the Florida Public Service Commission rejected all but $75.5 million of its requested $1.3 billion rate request. The highly politicized ruling prompted a housecleaning at the PSC; four of five commissioners were replaced, and in early 2011 FP&L reached a settlement with the PSC that would freeze the company’s rates through 2012, but would allow pass through of certain costs related to storm damage restoration, as well as capital costs for FP&L’s new, $900-million West County Unit 3 combined-cycle plant—but only those costs that are offset by projected fuel savings. In the bargain, FP&L’s allowed ROE declined from 12.5 to 10 percent.

Now it’s 2012, and FP&L is seeking rate recovery for its capital costs, most notably investments that Dewhurst says will benefit customers by improving the fuel efficiency of its generating portfolio. “How we come out of that rate case is an important factor in determining how well we’ll perform in subsequent years,” Dewhurst says. FP&L plans to invest about $15 billion in capital projects through 2014, including new gas-fired plants at Cape Canaveral, Riviera Beach, and Port Everglades, scheduled for startup in 2013, 2014, and 2016, respectively, as well as an ongoing advanced metering infrastructure (AMI) rollout. The company already has installed smart meters at about 3 million sites, and is working to install another 1.5 million by the end of 2013.

In a settlement agreement FP&L proposed to the Florida PSC in mid-August, the company asked for $378 million in rate recovery—reduced from an earlier $517 million request. In exchange, it would cut its requested ROE to 10.7-percent, from 11.5 percent, and would agree to freeze rates for four years. The deal would benefit FP&L customers, Dewhurst says, because it would cost only a few cents a day, while saving $1 billion in fuel costs over the operating lives of the new plants, which will operate more efficiently than the company’s older units. “If the commission were to grant 100 percent of our request, our customers still would have the lowest typical bills of all utility customers in the state,” he says. “So it’s not a question of jeopardizing the most affordable service in Florida.”

At the same time, NextEra’s other primary business unit—NextEra Energy Resources (NER)—faces shifting winds in the renewable energy business. As the country’s largest operator of wind turbines, and the developer of the biggest solar project in the country, NER’s prospects have been closely linked to federal and state energy policies that encourage renewable power investments. With the U.S. Congress currently in a stalemate over whether to extend some renewable production tax credits (PTC) beyond the end of the year, the opportunities for further development might seem to be drying up. Not so, according to Dewhurst.

“At NextEra Energy Resources, we have a tangible growth path driven by new investments in renewable projects,” he says. “Today we have the largest backlog of projects in the industry, and it doesn’t depend on any extension of the PTC.” The company expects to begin operating 1,300 MW of new wind generation in the next year, and has another 900 MW of solar capacity in development through 2016. Dewhurst says about two-thirds of the company’s assets operate under long-term power purchase agreements, and one-third are exposed to market prices. “Any business with exposure to merchant power markets is struggling right now, and our assets are no different,” he says. “We have to do the best job we can, squeezing performance out of those assets, and running them reliably. Earnings growth from the investments we are making is more than enough to offset the headwinds we’re seeing from declining commodity prices.”

Even so, the company is exploring alternatives to wind and solar. “We’re in early stages of considering other growth paths,” he says. “We have clear sight now on our growth through the first half of the decade. What we’re talking about now is what will power the organization’s growth through the second half of the decade. We have a lot of arrows in the quiver.”NER’s assumptions don’t include any new wind projects entering the pipeline after 2012, but Dewhurst says he’s optimistic that some form of tax credit will allow continued development. “It might not be at the historic level, but we expect to enjoy pretty strong policy support for renewables,” he says. “Certainly the public supports renewables, and that’s reflected in policy support. But until renewables can play on a level playing field, and the negative environmental attributes of fossil fuels are priced in, we’ll have to fall back on the second-best solution of policy support.”

Taken together, the two sides of NextEra’s business provide strong prospects for growth, but the company still seeks to maintain about a 50-percent payout ratio for its dividend. The company’s dividend yield ranks low in the F40 rankings—which isn’t too surprising, given NextEra’s current capex program. But Dewhurst says the company’s strategy aims to produce a strong total return for shareholders, by investing in ways that serve its customers’ needs.

“We have to continue delivering reliable and affordable service; that’s the whole value proposition,” he says. “We focus on operational metrics that drive low costs and high reliability over time. We’re in the largest capital spending wave in our history, creating a path for potential earnings growth by doing what’s right for our customers. If we execute well on that, we’ll give customers a better deal for the long haul.”

PSEG: Hitting Benchmarks

Public Service Enterprise Group (PSEG) has ranked among the top 10 companies in the Fortnightly 40 for three years, and this year it rises all the way to the #2 position. The company’s performance is driven by strong ROA and ROE figures (#5 and #7 in the industry, respectively), as well as leading profit margins (#9) and sustainable growth (#13). And for CFO and Executive Vice President Caroline Dorsa, those accomplishments effectively summarize the company’s strategic focus.

“The metrics are working as they should,” Dorsa says. “They’re measuring the financial outcome of our operational focus, which drives us to make good investment choices, get the most out of our assets, and manage our cost structure and capital allocation. Those are the tenets of our strategy, the pillars of our company. If you do those things right, if you invest in ways that create shareholder value, you’ll do well on margin and you’ll get sustainable returns.”

PSEG’s returns come from two primary businesses—Public Service Electric & Gas, its New Jersey regulated utility, and PSEG Power, which runs a large portfolio of fossil and nuclear plants, as well as the company’s energy trading operation. Dorsa views these two businesses as complementary, even though PSEG Power is struggling in the current commodity market. “Despite the challenge in power prices, PSEG Power continues to be an important contributor to our earnings—but more importantly, it’s a significant contributor to our free cash flow,” she says. “PSEG Power has lower capital investment needs than it did in the past, because we already stepped up and made the environmental investments that others are now starting to make. Cash flow in excess of expenses gives us the ability to invest in other areas of the utility—including solar, energy efficiency, and perhaps more gas infrastructure.”

Like many other companies in the industry, PSEG has embarked on a major capex program, totaling $6.5 billion from 2012 through 2014. “That’s more than we’ve ever spent in a three-year period,” Dorsa says. About $3.5 billion of the total is going into transmission investments, under formula rates with returns totaling 11.7 percent or higher. Additional spending is aimed at renewable and energy efficiency investments, as well as maintenance projects, all of which would generate a 10.3-percent return for PSE&G. And PSEG Power would invest about $1.1 billion in a combination of peaking power facilities and a possible uprate at the Peach Bottom nuclear plant, which the company owns in partnership with Exelon. And having already spent $1 billion on emissions controls, PSEG considers itself well positioned to compete against other generators when regulatory and market uncertainties are resolved. “We know environmental regulations are coming,” Dorsa says. “We hope to see the new EPA rules get promulgated, particularly as they relate to mercury and acid gases. They really are needed for public health, and they could lead to coal plant retirements by others. That would affect where we stand in the balance of energy supplies.”

In addition to the current $6.5 billion capex program, PSE&G recently proposed to spend an additional $883 million on rate-base solar projects, which Dorsa says would earn a 10.3-percent return if approved by the New Jersey Board of Public Utilities. “We’re very happy to make investments in solar, but solar is expensive,” she says. “The state of New Jersey is interested in having a strong renewable energy profile, as part of the energy master plan. We support making those investments efficiently, at brownfield and greenfield sites, and on rooftops and pole tops. We see it as part of the future, but it’s not something we’d do outside the state’s master plan, because it can’t compete without subsidies yet.”

Dorsa says the key to PSEG’s performance over the long term has been its determination to keep costs in check and to invest in a disciplined way, in both regulated and unregulated assets. Part of that discipline involves balancing capital spending and dividends in its financial strategy. Toward that end, PSEG this year changed its dividend policy. Now, instead of targeting 40 to 50 percent of earnings, PSEG says its future dividend payouts will be based on the company’s cash flow and opportunities for growth at the utility. This year that equated to a 3.6-percent increase in the dividend, or about a 60-percent payout ratio.

Finally, according to Dorsa PSEG seeks to maintain its disciplined approach by continuously measuring its performance in all operational areas. “We benchmark pretty much everything we do,” she says. “Operational excellence and discipline is a license to be at the table, to make new investments. It’s never going to happen with financial engineering alone. It has to start with operational performance.”

![““We’re considering other growth paths [at NextEra Energy Resources]. We have a lot of arrows in the quiver.” - Moray Dewhurst, NextEra Energy “We’re considering other growth paths [at NextEra Energy Resources]. We have a lot of arrows in the quiver.” - Moray Dewhurst, NextEra Energy](http://www.fortnightly.com/sites/default/files/1209-FEA1-Dewhurst2.jpg)