Mirage on the Ocean?

Dr. Laura Olive is senior consultant at National Economic Research Associates, NERA, in Boston. She received her Ph.D. in economics from Northeastern University.

The United States is poised to become one of the largest exporters of liquefied natural gas, LNG, in the world.

Industry press reports claim players expect that U.S. gas is about to change the global LNG market forever, fueling European gas-fired power plants in the near future.

Indeed, as of June 2016, FERC had approved converting eight abandoned LNG import terminals into export terminals. Five were under construction at the time. Fourteen more proposals are under review or are in the pre-filing stage.

Several facilities are already proposing expansions to their original projects. The entry of the U.S. as a major exporter in the market will definitely have an effect on LNG world trade.

However, the vision for U.S. LNG exports to spark a true commodity market, like oil, does not take into account the unique features in regulatory and cost structures that fog that vision.

Worldwide Oil Market versus Regional Gas Markets

Figure 1 - World Oil Price Benchmark Prices, 2000-2015

Figure 1 - World Oil Price Benchmark Prices, 2000-2015

There are just three key oil market hubs. Brent. West Texas Intermediate. DME Oman.

Brent is named for the Brent Field in the North Sea. West Texas Intermediate is based on landlocked pipelines that terminate in Cushing, Oklahoma. DME Oman is traded with a physical loading point at the Mina al Fahal terminal in Oman.

Oil companies, financial derivative traders, and governments use these hubs as benchmarks for the spot trade, for futures contracts and for contract price formulas. Except for occasional local constraints, the three international spot indexes move together.

See Figure 1.

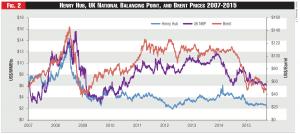

Figure 2 - Henry Hub, UK National Balancing Point, and Brent Prices 2007-2015

Figure 2 - Henry Hub, UK National Balancing Point, and Brent Prices 2007-2015

There are many so-called gas-trading hubs. But only the Henry Hub, located in Erath, Louisiana, is anything like the world’s oil trading hubs. The Henry Hub is a fully “financialized” physical trading point for New York Mercantile Exchange gas futures, NYMEX, where the financial markets trade in gas price risks like they do at the three oil trading hubs.

The facilities, owned by Sabine Pipeline LLC, connect to nine interstate and four intrastate pipelines. NYMEX chose this location as virtually tailor-made for pricing gas futures because of its physical links to so many sources of supply.

By contrast, gas trading hubs in Europe are “notional” in that they do not refer to a specific physical point. European Union member states created these hubs to comply with the EU’s regulatory requirements for the separation of gas commodity sales and pipeline infrastructure.

Prices at the world’s various gas trading hubs differ substantially, because gas is still a regional commodity heavily influenced by unique local social, political, and economic institutions. Despite the many gas hubs, there is no worldwide gas price.

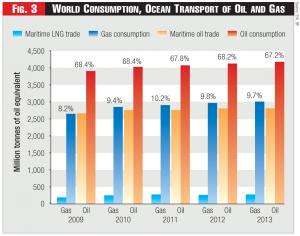

Figure 3 - World Consumption, Ocean Transport of Oil and Gas

Figure 3 - World Consumption, Ocean Transport of Oil and Gas

See Figure 2.

Realization of a global gas market, like the one for oil, would mean a significant change from the current LNG market where transactions typically rely on long-term contracts between the buyers, sellers, and governments involved in production, liquefaction, shipping, regasification, and distribution.

Relative to demand, and compared with oil, only a small proportion of gas is shipped over the ocean.

See Figure 3.

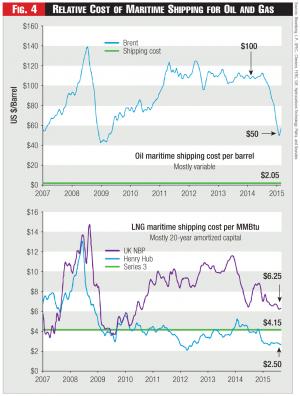

Figure 4 - Relative Cost of Maritime Shipping for Oil and Gas

Figure 4 - Relative Cost of Maritime Shipping for Oil and Gas

Some may see buyers’ desire for increased volume and destination flexibility as evidence of the imminent arrival of a global LNG market hub. However, two barriers to such a hub exist.

First, the LNG product requires large upfront capital investment, meaning long pay-off periods. Second, competitive access to buyers in Europe is difficult given the complexities of regulation.

Fixed Costs of the LNG Trade

For the LNG trade, liquefaction in particular requires large upfront capital investments. Long-term contracts are typically the vehicle through which investors plan to recoup those investments. By contrast, crude oil shipment comprises mostly the variable costs of loading and unloading the easy-to-store commodity, plus rent and fuel for the tanker.

The cost of shipping a barrel of oil is approximately $2.05, or $0.37 per million BTU. This is about 5 percent of the value of a barrel of oil at current prices.

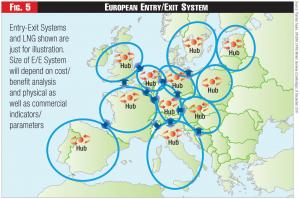

Figure 5 - European Entry/Exit System: Entry-Exit Systems and LNG shown are just for illustration. Size of E/E System will depend on cost/benefit analysis and physical as well as commercial indicators/parameters

Figure 5 - European Entry/Exit System: Entry-Exit Systems and LNG shown are just for illustration. Size of E/E System will depend on cost/benefit analysis and physical as well as commercial indicators/parameters

For LNG shipments making a typical trip from the U.S. to Europe, it costs on average $4.15 per million BTU. That’s 150 percent of the price of gas in the U.S. And almost the same as the current price of gas in the U.K., for liquefaction, shipping, and regasification costs.

See Figure 4.

Investments with such high fixed costs are well suited to long-term contracts. They are ill-suited for a spot market where recoupment of investment is not guaranteed.

Competitive Access to the U.S. Coast

The U.S. has a competitive gas market because of years of work undertaken by the FERC, gas distributors, and pipeline owners. The restructuring of the interstate gas pipeline system removed pipeline interests as barriers to competitive gas trade.

Interstate pipelines remain regulated entities, prohibited from owning the gas that they transport or subsidizing new capacity through existing rates. There exists a secondary market for well-defined pipeline capacity rights that is unregulated, and it allows for competitive trade amongst pipeline shippers.

This regulatory structure means that the U.S. natural gas pipeline industry exhibits the four characteristics of a competitive market. Homogenous goods with licensed pipeline capacity. Perfect information due to FERC-mandated electronic platforms to ensure transparency. Free entry and exit of pipelines. Buyers and sellers as price takers, with cost-based tariffs.

This transparently physical configuration of gas transport supported the development of the Henry Hub for U.S. gas derivatives trading.

The competitive market, relying on well-defined property rights, means that it is relatively simple for gas to reach the coast through pipelines. Every proposed natural gas pipeline or LNG project goes through a rigorous certification process with the FERC including analysis of environmental, economic, and technical/engineering considerations.

The U.S. experience, first with LNG import facilities, and now with the export facilities, shows the competitive nature of the market. In August 2007, when the U.S. was expected to import the gas, there were only four existing onshore gas regasification terminals. But there were thirteen FERC approved terminals and nine more proposed to enter the market.

Now, with the shift to U.S. exports, there are twenty companies vying to enter the market. The Sabine Pass Liquefied Natural Gas plant in Louisiana just started sending out cargoes reaching South America, Asia, the Middle East, and Europe.

There are currently five FERC-approved terminals under construction. Three more projects are approved but are not under construction as of yet. Five more are proposed projects with nine in the pre-filing stage.

Difficulties Accessing EU Gas Consumers

Energy policy in the European Union and the role of natural gas is very much a work in progress, with various economic and political goals that are sometimes in conflict. Economical gas supply. Security of supply, usually meaning security from an overly-dominant Russian supplier in Eastern Europe. Sustainability, meaning a political push for renewable energy supply, even if it falls out of the normal merit order for power generation.

Emphasis on the differing goals of economical gas supply, security of supply, or sustainability, seems to shift based on where and when the talk of overall goals comes up.

In addition, there has been a great growth in new types of gas industry regulation in the EU centering on a new type of entry and exit organization in each member state.

Despite the underlying flow of gas, the Third Legislative Package of 2009 requires each member state to make its own “network code,” to have its own set of tariffs (that treat the whole member state or parts of it like a large tank with entry tariffs and exit tariffs and a notional trading point, and specific procedures for dealing with cross-border congestion and markets for balancing gas).

This all takes place with imperatives for the individual member state regulators to do their best to coordinate, but with no particular sanction if they do not. There is no body like FERC in the EU to compel a single EU standard.

This makes connecting member-state gas markets difficult, because each country is understandably protective of its own interests. As would be the case in the U.S. if the Constitution’s commerce clause did not prevent the individual states from looking out for their own interests versus those of the continental market as a whole.

See Figure 5.

It shows the complexity of the EU gas regime, where the shipping of LNG inland would require the confrontation of these regulatory works in progress at the border of every member state. Rather than point-to-point contracting that facilitates LNG producers reaching the U.S. coasts, each member state creates a notional hub where gas is injected at various entry points, and taken off the system at exit points.

This model separates buyers and sellers and abstracts from physical gas flows. It requires oversight by transmission service operators in each country to ensure balance in the system.

The uncertainty and evolving nature of regulation in the EU means that U.S. LNG exporters will have difficulty reaching inland gas consumers. Regulations that would promote a competitive market for inland gas transport are essential to creating a global gas market. Current EU policies do not result in such a market.

Robust Contracting Remains Important

European regulatory policy is a work in progress. And the costs of LNG are ill-suited to spot market transactions. These two factors mean that LNG will likely remain dominated by long-term contracts for the foreseeable future.