First Climate-Change Bankruptcy

Priti Patel is Vice President and Chief Transmission Officer, Great River Energy, Maple Grove, MN. Rabeha Kamaluddin is Partner, Dorsey & Whitney LLP, Washington, DC. Paul Beck is Associate, Dorsey & Whitney LLP, Minneapolis, MN.

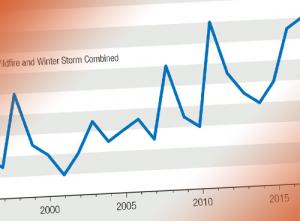

The 2017 and 2018 California wildfires and related accidents have captured the world's attention; their devastating impacts to life and property cannot be quantified. The most recent Camp Fire in California resulted in the abrupt bankruptcy of Pacific Gas & Electric Company — one of the largest utilities in the country — under the crushing weight of liability associated with the wildfire.

PG&E estimates well over twenty billion dollars in potential liabilities, with an additional seventy-five to one-hundred-and-fifty billion more to comply with judicial orders, in what the Wall Street Journal called the first climate-change bankruptcy.

The PG&E bankruptcy is partly the result of a unique state legal landscape, in particular, California's application of inverse condemnation. Inverse condemnation is the theory under which PG&E and other California utilities have been held liable for wildfire damages.

The state constitutional provision upon which the inverse condemnation doctrine is based is not unique to California. However, California courts' application of the law is unique: public utilities are strictly liable for damages caused by their systems, regardless of who is at fault.