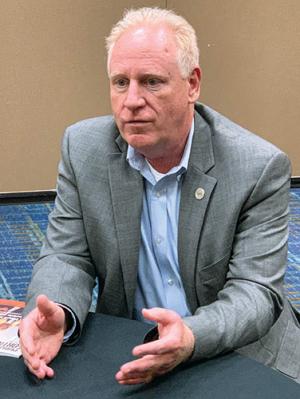

NRECA Annual Meeting

Tony Campbell is the CEO and Denise Foster is the Vice President of East Kentucky Power Cooperative. Marcus Harris is the CEO of Old Dominion Electric Cooperative. Charles Bayless is the Vice President of North Carolina Electric Membership Corp. Pat O’Loughlin is the CEO of Ohio’s Electric Cooperatives.

Ten CEOs of cooperative utilities sat down with PUF in one of three roundtable discussions at NRECA's Annual Meeting in New Orleans. In this roundtable, the CEOs of East Kentucky Power Cooperative, Ohio's Electric Cooperatives, and Old Dominion Electric Cooperative talked with PUF about FERC's Minimum Offer Price Rule, along with Vice Presidents from East Kentucky Power Co-op and North Carolina Electric Membership Corp.

PUF: On the Minimum Offer Price Rule or MOPR, why is this subject so important to your utilities and the industry overall?

Denise Foster: The ruling made it more important than it previously was. EKPC integrated into PJM in 2013 for the benefit of the capacity market among other benefits that we derive from the regional grid operation and wholesale market. At the time, the market rule allowed us, as an electric cooperative, to participate as self-supply and that rule effectively didn't apply to us.

As a self-supply entity, we offer all of our supply assets into the capacity market, and, at the same time, we purchase from the market, capacity, to satisfy our full load obligation. As a winter peaking utility, EKPC must have enough assets to cover our winter peak; PJM is summer peaking. The ability to sell the delta between EKPC's winter and summer peak loads into the market is a tremendous benefit for our customers. The revenue we receive from the market offsets the cost of the supply assets we must have to meet our winter peak load.

Tony Campbell: Consumers want more control over how their energy is generated and how they can use demand response to manage costs. But this rule could affect the economics of our ability to do that.

Tony Campbell: Consumers want more control over how their energy is generated and how they can use demand response to manage costs. But this rule could affect the economics of our ability to do that.

PUF: Then what happened?

Denise Foster: The rule is intended to ensure the competitiveness of the market. It was initially geared toward new natural gas resources and again, we were self-supply, so the rule allowed for EKPC to be exempted. The December 2019 FERC order expanded the MOPR to apply to all resources FERC deemed to be subsidized by state policies in order to ensure all resources participating in the market are doing so on a level playing field.

In so doing, FERC defined a state subsidy broadly, and swept in the electric cooperative business model. All of the assets that we own or build in the future are subject to the MOPR now through this broadened definition. However, FERC exempted existing resources of electric cooperatives with an understanding, I assume, that companies like ours relied upon the existing rules in making asset investment decisions prior to December 2019.

EKPC integrated into PJM after the capacity market was established with the self-supply exemption, so we integrated with the expectation that the self-supply exemption would continue into the future.

Denise Foster: FERC expanded the MOPR to apply to all resources FERC deemed subsidized by state policies to ensure all resources participating in the market are on a level playing field. It defined state subsidy broadly and swept in the electric co-op business model.

Denise Foster: FERC expanded the MOPR to apply to all resources FERC deemed subsidized by state policies to ensure all resources participating in the market are on a level playing field. It defined state subsidy broadly and swept in the electric co-op business model.

PUF: Could this be deleterious for East Kentucky Power Cooperative?

Denise Foster: Absolutely. As we seek to build new resources, to replace our retiring resources, those new resources would be subject to the rule with the risk of their market offers being reset to a price that's higher than what the market would clear. This applies to new technologies or demand response resources that we might advance to meet consumer demands.

PUF: Tony, it's almost like you don't own your own assets. You have to bid them in and then you have to buy them back. Is that what is happening here?

Tony Campbell: We depend on the capacity market to recover the fixed costs of our generating assets. EKPC bids all of its generating assets into the capacity market and then we buy back from the market what we need to meet load. EKPC has bid its assets at competitive levels to ensure that they clear the market, and we accept the market's clearing price, and that has worked well.

Marcus Harris: As co-ops, or G&Ts responsible for supplying load, we need ability to build plants, and know we have good, solid regulatory rules to build those under without risk of having our members pay twice for capacity.

Marcus Harris: As co-ops, or G&Ts responsible for supplying load, we need ability to build plants, and know we have good, solid regulatory rules to build those under without risk of having our members pay twice for capacity.

FERC's new rule means any new assets may be priced at a level that they may not clear the market because the cost of new entry could be much higher than other resources, like coal. Those new assets could still be bid into PJM's energy market and be dispatched, but the energy market will not generate enough revenue to recover fixed costs.

For EKPC, the other aspect of this situation that creates a real dilemma is the fact that our state Public Service Commission requires utilities to have hard assets - steel in the ground - to cover all of our load. Otherwise, a utility cannot recover costs over the highest cost of generation.

As existing assets are retired or load grows, EKPC may have to build or buy new assets to comply with the state PSC. Then, because of the FERC rule, those new assets may not clear the capacity market. In that case, EKPC would pay twice; first, for the capital cost of the asset, and then, for the market cost of capacity to cover all of our load.

And, as Denise mentioned, consumers want more control over how their energy is generated and how they can use demand response to manage costs, and we want to help meet their needs. But this rule could affect the economics of our ability to do that.

Charlie Bayless: If NCMC built a new plant and we weren’t able to clear the market, we would still have to pay for the new plant, but we would also have to buy an equal amount of capacity from the market. That’s how double counting occurs.

Charlie Bayless: If NCMC built a new plant and we weren’t able to clear the market, we would still have to pay for the new plant, but we would also have to buy an equal amount of capacity from the market. That’s how double counting occurs.

PUF: Charles, you're from North Carolina Electric Membership Co-op. Would it be as bad for you all as for East Kentucky or is it a different situation?

Charlie Bayless: It's the same for NCMC. We also utilize self-supply, but not nearly to the same extent as Kentucky. We only have three hundred and fifty megawatts of load in PJM, but those are all self-supply.

If NCMC built a new plant and we weren't able to clear the market, then we would still have to pay for the new plant, but we would also have to buy an equal amount of capacity from the market. That's how double counting occurs, utilities bid into the market, assuming that a plant will clear so that the amount they get paid offsets the amount they have to pay.

NCEMC bids in three hundred and fifty megawatts of generation for three hundred and fifty megawatts of load. We get paid whatever the market clearing price is. We then turn around and pay that amount, so it's a wash. If you can clear the same amount of capacity as you have in load, it's a zero-sum game basically.

Pat O’Loughlin: They’ve put capacity markets in place intended to pick up the fixed cost of generation, so companies have incentive to build and own competitive generation. That’s one market goal, but the structure of the market hasn’t delivered on that objective.

Pat O’Loughlin: They’ve put capacity markets in place intended to pick up the fixed cost of generation, so companies have incentive to build and own competitive generation. That’s one market goal, but the structure of the market hasn’t delivered on that objective.

If the plant doesn't clear, then you have to pay for the plant and still go to the PJM market and buy that corresponding amount of capacity. The self-supply issue has come to FERC before and FERC has upheld the self-supply exemption three or four times in the past decade.

The ability to self-supply has been an important part of the PJM market, so there have been a lot of economic decisions made upon the continuance of self-supply. Now that self-supply is in jeopardy the business model for many utilities is also in jeopardy.

PUF: Marcus, now you have a similar problem as East Kentucky.

Marcus Harris: We also self-supply most of our load. The vast majority of our load is supplied by capacity we own, and we've built that capacity under a regulatory construct where we understood we would recover those costs through a capacity charge without risk of having our members double-pay for capacity.

We operate our business on a not for profit basis. In our business, we build capacity for the benefit of our members, to hedge our costs for capacity and energy. Owned capacity not only hedges our energy costs, but also our capacity costs going forward for years beyond the PJM capacity auction.

There's good reason for our members to want to do that because they want to see a fairly predictable price for capacity and energy going forward not just in the next year, or the next three years, but for the next ten, twenty, thirty years in the future, and they want to be able to predict those costs.

The plants we built and would build in the future hedge our costs for those members. That's different than the for-profit model because they have a different incentive. They have incentive to build new plants in order to increase capital and the associated return. Who they recover these costs from and how much they need to recover is not nearly as important for them as it is for us.

Even among the self-supply community, for those of us who do have responsibility to supply load, the co-ops always have been and will continue to be different. As co-ops, or as G&Ts responsible for supplying load, we need the ability to build plants, and to know that we have good, solid regulatory rules to build those under without risk of having our members pay twice for capacity.

PUF: Pat, you're in Ohio. Do you have a similar problem?

Pat O'Loughlin: We do, and I'd like to add to Marcus' perspective. We're all in different states with different circumstances and weather patterns. But we all work as part of a business model in which consumer-owned cooperatives got together to form a generation transmission provider.

We provide distribution cooperatives with price stability. It's no coincidence that we've all adopted a self-supply model because that delivers on the promise that we've made to consumers. We own the assets in exchange for providing a stable price over time and co-ops take on the risk of incurring fixed costs to do that; however, the game's changed a bit.

To some extent, the legitimacy of price stability as a reasonable goal for consumers and for cooperatives has been taken out of the mix. Our ability to add generation to meet our future needs is in jeopardy from the duplicate pay problem that everybody has talked about, in which we paid to build capacity to provide price stability.

That's a promise to our consumers. We don't get paid for it, but we still have to buy generation from the markets. We pay twice and it just raises the cost to consumers. It doesn't give us an outlet to return to our original business model that we've had for decades - self-supply and price stability, which keeps us competitive. We need to return to that model in order to run our utilities competitively.

PUF: Why did FERC do this?

Pat O'Loughlin: There's another fundamental problem. They've put these capacity markets in place that are intended to pick up the fixed cost of generation so that companies have incentive to build and own competitive generation. That's one of the market goals, which is reasonable, but the structure of the market hasn't delivered on that objective.

The prices that have come out of the market structure have been set up but are too low. It hasn't provided for recovery of costs. That's been a concern of people who have managed the markets - to create a clearer price signal that matches the cost of new generation, so that it would be a new entry, and new competition, which is needed.

That's a good goal, too. We have multiple goals and sometimes they compete against each other and sometimes they get left behind or forgotten. In my view, the price stability part of the equation has been left out of consideration.

PUF: Wasn't the order anticipated?

Denise Foster: The docket has spanned a fairly lengthy time period. It's been in active litigation for over two years, but the issue of self-supply had not been challenged. It surprised the industry when FERC, in its order, basically took the self-supply exemption away. It wasn't an issue that was actively debated at the last stage of this proceeding, so it came as a surprise to all of us.

Pat O'Loughlin: The good news is that we get to maintain self-supply on our existing resources. They didn't completely pull the rug out from under us. I don't know what the reason was, but we're allowed to keep it for our existing resources; however, anything new is in jeopardy.

For the time being, it's no big problem, but as you look to the future, it's problematic as to how that's going to work.

Denise Foster: There are over thirty requests for a rehearing in the docket, raised by interests different from ours. There were a variety of elements in the order the different interests found offensive.

Pat O'Loughlin: A lot of states, like Ohio, have put forth incentives to certain kinds of generation, whether those are renewables or nuclear generation. The new ruling trips those incentives and it says that they're now considered a subsidy. In your analysis, you know you've got a problem with the market drop.

Tony Campbell: For Kentucky, it is a matter of being able to make decisions to protect the interests of the people in Kentucky. That is true for other states. Each state is trying to assure reliable, economical energy for their people. Leaders in Kentucky feel like their right to make decisions in the interests of their constituents is being trampled upon. Like EKPC, they are against this rule.

Marcus Harris: There are various states and utilities who are considering leaving the PJM capacity market through the mechanism known as the FRR, the fixed resource requirement. The FRR process allows you to pull both load and resources out of a particular area and sort of self-supply under the FRR construct in the current tariff.

It's a construct that goes back several years that was originally designed for utilities operating under a cost-based rate structure, but there are states and utilities who are considering pulling out of the market and making the market stand without them. That move to the FRR construct will drastically change the PJM capacity market.

PUF: Since this PJM RTO was created in the late nineties that would be a major step back? Is that a good way to look at it?

Charlie Bayless: FRR was originally created when AEP joined PJM.

However, widespread use of the FRR could drastically shrink the number of remaining participants, which may jeopardize efficient market operations.

Tony Campbell: PJM has been around since the 1920s, but it has been in the last few decades that PJM has taken the form we recognize today. I have served as CEO of a utility in another RTO, and that was not a good experience. PJM is a good, mature market. But FERC is stepping in and changing the rules in a fundamental way. In doing so, I hope FERC does not do irreparable damage to the RTO.

Pat O'Loughlin: It's been probably a little better, but it looks like a wrench in the gears.

PUF: Where's this going to go? Is it on track to get fixed?

Denise Foster: I can talk to the timeline. PJM has an obligation to make a compliance filing in March based on the direction FERC gave them in the order. They also received over thirty requests for rehearing and clarification, and they have to make a decision on those as well.

The thought is that FERC may not do that in the same order as the order on the compliance filing. We need the order on the rehearing and clarification, the final order from the administrative agency, to be able to take it to a further court for appeal.

In the interim, since PJM has an auction that it didn't run in 2019 May and another one it would have been running in 2020 May, they would be running an auction before the legal challenges are resolved. They have to address the timelines for both of those auctions in their March compliance filing, and also think about how the change in the timeline for those two auctions affects future ones.

It's possible that we'll see a couple of auctions run before we have the final order from FERC and the appeals resolve. There is some uncertainty that's going to still linger until this policy is set.

PUF: It seemed like it was fairly unpopular.

Pat O'Loughlin: I don't know who's in favor of the MOPR other than some of the folks on FERC's staff. You've seen PJM come out with some of the same concerns we've talked about. We agree with what PJM, as an organization, has said about their own market to FERC.

I also have to believe that FERC has had a long time to think about it. FERC didn't just slip on a banana peel. FERC considered it - maybe not well, but purposely. The issue will probably be resolved through litigation.

There are some thorny legal issues. What they're calling a subsidy is, in effect, a bilateral voluntary contract that we entered with our members and now all of a sudden that's considered a subsidy. Other people are going to be allowed to enter long-term contracts and they're not considered subsidies. We're going to be years dealing with it.

PUF: What would be a way to take care of this problem right away?

Charlie Bayless: We need clarification from FERC on a number of issues including what is a state subsidy. We just heard the rehearing process is going to slowly work its way through FERC.

FERC has no timeline on how long it can take for rehearing. It can take two to three years easily for FERC to issue an order of rehearing before the issue can move on to the D.C. Circuit.

A number of utilities may have leeway on when to build power plants, but others are going to face difficult decisions on generation while the order is being finalized. Depending on the outcome of the rehearing there could also be a large impact on state renewable goals.

Renewables are where a lot of the battles are going to be in the upcoming years with states like New Jersey or Maryland with high renewable goals.

It could mean Virginia, with the legislation that is being passed, and their possible inclusion in RGGI would be considered a state subsidy. It would be hard to meet those renewable goals if they are considered a subsidy and can't be included in the capacity market. Clarification on the FERC order as soon as possible would be good for the upcoming year.

Marcus Harris: You mentioned the Virginia legislation. It's important, because I think about how this MOPR order and the PJM market interplay with the requirements of the legislation.

Legislation in Virginia, if it's finalized, mandates that the Commonwealth's largest IOUs shut down some of their coal plants quickly. It also mandates that they retire all fossil units, including gas by 2045.

The legislation mandates they build up to five thousand, two hundred megawatts of offshore wind. It demands the installation of over sixteen thousand megawatts of solar energy in the state and more than three thousand megawatts of energy storage. In less than thirty years, all non-nuclear energy must come from renewable resources for the largest IOUs.

It requires the Virginia Commission to approve all of those as prudent. From a market perspective, there are dynamics that aren't quite as pure as the co-op motive. We're going to supply three thousand megawatts of load with three thousand megawatts of capacity, and we simply want to be sure we can match resources with load and not pay twice for capacity.

There are motives that would say, let's go retire a whole lot of older resources so we can go build a whole lot of new stuff with a good rate of return. Yeah, let's encourage the state to mandate that we do that going forward.

There are different dynamics between the different entities who supply load and we get thrown into that group of folks who want to do all these things. We don't want to do that to our member-owners. We want to have enough capacity to supply our load economically, and we want good assurance that our member-driven model works now and in the future.

Roundtable Discussions:

- Roundtable on Microgrids and Resilience

- Roundtable on Broadband

- Roundtable on FERC's Minimum Offer Price Rule

Lead image: From left, East Kentucky Power Cooperative VP Denise Foster, East Kentucky Power Cooperative CEO Tony Campbell, North Carolina Electric Membership Corp. VP Charles Bayless, Old Dominion Electric Cooperative CEO Marcus Harris, and Ohio’s Electric Cooperatives CEO Pat O’Loughlin.