Indiana State Senate

Jim Robb is the CEO of NERC. Tim Gallagher is the CEO of ReliabilityFirst.

The Indiana Senate Utilities Committee, chaired by Indiana State Senator Eric Koch, met on January twenty-seven for a briefing by NERC on Reliability Issues and the Transforming Grid: A Regional Focus. It built on an informational session held there in March 2021 on Lessons from Texas in Winter Storm Uri, found in the April 2021 issue of PUF.

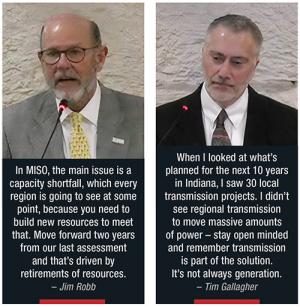

Presentations were made by Jim Robb, CEO of the North American Reliability Corporation, and Tim Gallagher, CEO of ReliabilityFirst Corporation. Enjoy these excerpts.

Utilities Chair, Indiana State Senator, Eric Koch: Under a year ago, we held our lessons from the Texas hearing, following the big freeze and we had MISO, PJM, the Commission, industry, and others to talk about what we needed, to make sure that what happened in Texas doesn't happen here in Indiana. Today's meeting builds upon the foundation of our lessons from the Texas hearing. We're going to talk about reliability.

CEO, North American Reliability Corp., Jim Robb: We're at a historic time in the evolution of the power grid across North America. Tim Gallagher, who leads ReliabilityFirst, and I will take you through our perspectives on the reliability issues that are going to be increasingly important for state legislatures and policymakers.

The grid is transforming in three important ways. The first is that the grid is becoming increasingly decarbonized. Most of the new resources added to the grid are wind, solar, and natural gas. We are seeing a decline in the traditional generation that built up the industry since World War II, with large coal and nuclear plants.

It's lowering the environmental impact of the industry. But it brings with it issues. Particularly with wind and solar, the availability of fuel is never assured in any particular moment.

The grid is also becoming more decentralized. More resources are being added to the distribution side of the industry. In many cases it's behind the meter, such as rooftop solar. That's terrific because the economics of solar have improved substantially over the last ten years.

The cost of that is grid operators no longer have clear visibility into the resources that are on the system. We don't know what loads are as much anymore because they're masked by rooftop additions.

Third, the grid's becoming more digitized. This gives great operating efficiencies, visibility, and data available for system operators to work with.

But it also increases the cyberattack surface for our adversaries. It's something to remember that all changes bring with them benefits, as well as risks that need to be thought through and managed.

As part of our reliability assessment mission, we produce four major assessments a year and I'll talk about two of them. We do two seasonal assessments, one for summer season, and one for winter. In December, every year we do a ten-year reliability outlook. This is a quick summary of what we see from what we call the LTRA or the Long-Term Reliability Assessment.

We see two kinds of risks evolving as the system evolves. The first are concerns around resource adequacy and importantly, energy sufficiency. One of the important concepts is the electric industry has always focused on capacity and ability to serve peak load, the highest load day of the year. We always felt if we could serve the highest day of the year, we'd be able to serve every other day during the year.

With the changing fuel mix on the grid, that assumption is no longer valid. While capacity becomes an important reliability consideration, it's no longer sufficient. A lot of attention needs to be turned to the energy side, which is the ability to serve customers twenty-four hours a day, seven days a week, fifty-two weeks a year.

We see in the MISO area in California and Ontario, a looming capacity shortfall that's being driven by retirements of conventional generation and the pace at which new generation can be added to replace the kilowatt hours. In California, and the U.S. northwest and southwest, we see energy deficiencies where we have plenty of capacity in those regions, but at times, potentially not enough fuel to operate reliably.

Other parts of the country, Texas, California, and the northwest have extreme weather risk. You referenced the Texas event earlier in 2021. There was an event in California in August 2020 where again, a weather system we weren't prepared for overwhelmed the sector.

In New England, California, and the southwest, we have issues around natural gas. That's mainly driven by infrastructure constraints at being able to deliver gas to loads.

In the winter assessment, which we published in December, we see issues everywhere. By issues, I mean risk that people need to be aware of. In the middle part of the country, MISO, SPP, and the Texas Interconnection, extreme weather is a concern that system operators need to be increasingly prepared for.

In New England, the southwest, and California, the issue around gas infrastructure looms large and larger in the winter than the summer. In the northwest where we've had a prolonged drought over the last several years, there's concern as to whether there'll be enough energy to transfer between areas, particularly under low hydro conditions.

With climate change-driven weather systems, we're seeing systems that are now more extreme in terms of higher or lower temperatures, longer duration, and important for the electric industry, wider areas of the country impacted. That's important because the electric industry has traditionally relied on neighboring systems to balance load and resources during times of stress. That's becoming increasingly difficult to do.

We've modified our analytical approach to account for those kinds of constraints and are pushing the industry toward energy planning, in addition to simple capacity planning, which has been the mainstay of the industry over time, to look at how the industry can perform under extreme conditions.

Given that extremes are weather driven, that also starts to affect fuel because the sun doesn't always shine. The wind doesn't always blow. When it's really cold, gas tends to be diverted and focused on serving residential heating loads as opposed to power generation.

In MISO, the main issue is a capacity shortfall, which every region is going to see at some point in the future, because you need to build new resources to meet that. Move forward two years from our last assessment and that's driven by retirements of resources.

Policymakers and states need to keep their eye on, are we adding enough resources behind these retirements to ensure we have a reliable supply of fuel?

The second issue is the concept of reserve margin and how much risk do you leave on the system. This is an important point because I've learned in this job there's no such thing as a worst-case scenario. There's always worse. The question is how much insurance do you buy through building new resources to protect against an extreme event?

MISO has almost fifty percent more generation in the ground than likely to need in the winter. That's a good situation for the region to be in.

However, when you look at the possibility of more extreme conditions, will the generation be able to operate when we want it to? Will the wind blow, will the sun shine? You can see quickly that even a fifty percent reserve margin under extreme conditions can decline to a shortfall. This is one of the issues that MISO and the system operators need to manage day in and day out.

CEO, ReliabilityFirst, Tim Gallagher: ReliabilityFirst is one of the six regional organizations that supports and enhances work that NERC does. The seam between the two largest electrical markets in the world runs right in the middle of my footprint and happens to run right along your eastern border.

Resource adequacy is a complicated topic and has a lot of participants with different roles. At the end of the day, unfortunately for you, it is a state issue. It is because it's the state ratepayers who are going to pay for this, feel the impacts of the siting, and look at what's built. It's the state ratepayers who are going to suffer if you don't have enough.

You're in a part of a large electrical market with centralized regional planning through MISO. Centralized regional planning is a superior approach to discreet sectionalized planning. But there are limits to what MISO can do in the role, especially when it comes to resource adequacy.

MISO can set targets, and can assess against those targets, which MISO does, and can report against those targets. MISO can also conduct limited capacity auctions to help meet those. But that's the extent of what MISO can do. Similarly, my organization in all the regions in NERC, there are limits to what we can do, and it's mostly pointing things out, assessing them, and making policymakers aware.

There's a specific carve out in the legislation that established NERC, the Energy Policy Act of 2005. It forbids Jim and I to advocate for, or to direct, the addition of any kind of resources to the bulk electric system. That was done to respect state's rights because, it's a state's issue.

The way things look now, MISO in aggregate may not meet its reserve requirements as early as 2024. You've read the reports. Indiana is in a bit better shape. The MISO analysis, our analysis at ReliabilityFirst and some state-directed analysis, all indicate the same thing.

That from a resource adequacy standpoint, Indiana's going to meet its reserve requirements through at least 2026. You're in a better spot. That's primarily because the demand for electricity is growing at a slow pace in your state.

That's about half of a percent, and new generation is planned to supplement your resource mix for the retirements that are anticipated. The good part about being in a large market and being as connected, as is Indiana, is that during times of shortfall, you can call upon your neighbors for support. The downside of that is they can call on you for support.

I see some significant retirements in your coal resources, but I see that offset by significant additions in your natural gas and your renewables, primarily solar. Your state resource projections over the next five years look like they're going to meet the targets that are established by them for MISO. That's based upon what we know today.

Retirements that happen outside your footprint, outside your state boundaries, can have significant impacts on Indiana. Unfortunately, electricity does not respect geographic or political boundaries.

There are plant retirements planned outside your state that are going to have an impact on your transmission system and your ability to move electricity through the transmission system, through your state at times. Just like decisions you make will impact your neighbors.

To deal with transmission constraints, new transmission can be added. There are a lot of challenges associated with adding new transmission.

Because MISO does centralized, regional planning on behalf of Indiana and all states in MISO, that's the best way to get to solutions, because there are always going to be winners and losers, those who pay, those who benefit, and those who have to look at the infrastructure running through their state. The best way to deal with those things is on a multi-state basis, which is what MISO can help with.

When I looked at what's planned for the next ten years in Indiana, I saw about thirty transmission projects. Almost all are what I call local reinforcements. They were projects that were reconfigurations for local businesses or local low growth pockets or to connect new generators discreetly to your electric system. I didn't see any that was regional transmission to be used to move massive amounts of power from outside Indiana, in or through or behind.

I know MISO is looking at some of those projects. I encourage you to stay open minded about that and to remember that transmission is also part of the solution here. It's not always generation.

Can what happened in Texas happen in Indiana? The answer is yes, it can happen. That doesn't mean it has to happen. There is a lot you can do to reduce the probabilities. I'm going to share some of what's already underway.

The biggest difference is in the electrical configuration of Indiana versus Texas. Texas is an isolated system with limited interconnections. Texas simply could not import power from their neighbors when that event happened. Indiana has strong inner ties with neighbors and operates in a market. You have access to a lot of help and support from neighbors.

Another factor that reduces the probability of this happening is you have a different kind of resource mix. There's a lot of diversity in the resource mix in and outside your state that you can draw on.

I can say with certainty that diversity is good for reliability. The more different types of resources you have, the better.