Guidehouse

Mackinnon Lawrence is a director in Guidehouse’s global Energy, Sustainability, and Infrastructure practice and the leader of Guidehouse Insights. He is responsible for overall strategy and operations.

Richelle Elberg is a principal research analyst overseeing Guidehouse Insights’ Energy Storage solutions. She also supports the Digital Innovations, Neural Grid, and AI and Advanced Analytics solutions.

For the past decade, Guidehouse and PUF have partnered on their annual Pulse survey of utility industry executives and stakeholders to better understand the key issues and opportunities shaping the industry.

In our 2025 installment, more than three hundred respondents describe an industry grappling with accelerating load growth, infrastructure vulnerability, and policy uncertainty — even as they continue to work toward clean energy goals and distributed resource integration.

A New Year, a New President, and New Challenges

The power industry faces multiple uncertainties in 2025. It remains unclear how the Trump administration’s ‘America First’ energy policy will impact existing incentives provided by the Inflation Reduction Act (IRA).

In 2024, Pulse survey respondents indicated this legislation would be remembered twenty years out for making clean energy resources the dominant energy source in the country, as well as for mainstreaming electrified transportation and accelerating T&D upgrades and system resiliency. Now it’s uncertain whether those incentives will persist, although several of these issues remain top priorities for survey respondents.

Also new in 2025 is the rapidly accelerating emphasis on AI and the energy demands of burgeoning data centers. What were murmurs in early 2024 have become shouts as utilities, balancing authorities, and regulators wrestle with the prospect of inadequate energy supply in parts of the country.

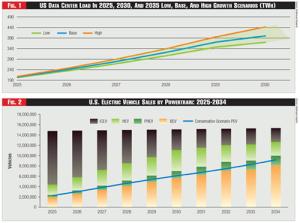

Figure 1 - US Data Center Load In 2025, 2030, And 2035 Low, Base, And High Growth Scenarios (TWh); Figure 2 - U.S. Electric Vehicle Sales by Powertrain: 2025-2034

Figure 1 - US Data Center Load In 2025, 2030, And 2035 Low, Base, And High Growth Scenarios (TWh); Figure 2 - U.S. Electric Vehicle Sales by Powertrain: 2025-2034

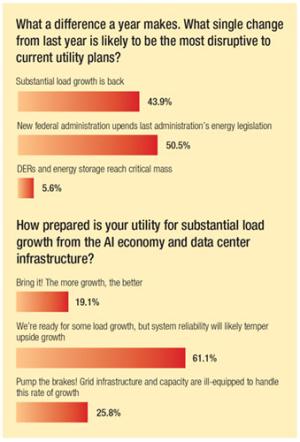

Nearly 95% of survey participants highlighted either the new administration’s pending policy changes or the resurgence of measurable load growth as the single most disruptive factor to their operating environment in 2025, with more than half citing new policy priorities as the most disruptive.

Fewer than 6% believed that rising DER and energy storage penetration will have a highly disruptive effect on utility plans. Long-term utility investments in renewables and storage are unlikely to change markedly in the near-term, given the lengthy approval processes, state mandates, and public support in many parts of the country. Utilities understand that, over the longer term, these clean resources will become an integral part of the energy mix regardless of who sits in the White House and are planning accordingly.

With respect to load growth related to AI and data centers, respondents were cautious. 61% indicated they are ready for some load growth but that system reliability issues will temper upside, while more than a quarter of respondents expressed concern that current grid infrastructure is inadequate to accommodate newly higher load forecasts. Just 13% of respondents were exuberant about the prospects of accelerating load growth.

Guidehouse Research analysis projects data center load in the U.S. to double by 2030, to ~400 TWh, or 8.7% of total U.S. load in its base case scenario, although the impact of new efficiency technologies and challenges around new generation and interconnection make it difficult to predict how the data center market — and associated load — will truly play out over the next decade.

What a difference a year makes. What single change from last year is likely to be the most disruptive to current utility plans? How prepared is your utility for substantial load growth from the AI economy and data center infrastructure?

What a difference a year makes. What single change from last year is likely to be the most disruptive to current utility plans? How prepared is your utility for substantial load growth from the AI economy and data center infrastructure?

See Figure One.

Resilience and Cybersecurity Return to the Fore

With the Biden administration’s emphasis on clean energy and the passage of the IRA, survey respondents in 2024 demonstrated greater enthusiasm for topics such as transportation electrification, clean hydrogen, and net zero energy systems. In 2025, by contrast, a new policy agenda in Washington has utility stakeholders refocused on core priorities — most notably, more resilient grid infrastructure and cybersecurity.

When asked which three energy transition priorities utilities would continue to support despite the regime change, more than 86% selected T&D upgrades and improved system resilience. 74% selected cybersecurity and digitization of the energy system, followed by 37% who chose clean power and renewables. Just 27% indicated ongoing prioritization of transportation electrification and charging infrastructure — compared with the 56% of 2024 respondents who believed this transition would be an enduring legacy of the IRA.

Guidehouse Research has lowered its EV forecasts for 2025, based on the federal policy uncertainty related to EVs which were previously driving the adoption.

Which energy transition priorities from the last administration are utilities most likely to continue supporting regardless of changes in federal policy (select three)? What is the most disruptive threat facing U.S. utilities and their communities? What infrastructure-of-the-future would you most like to see utilities build? Which of the following outcomes should utility infrastructure investments prioritize?

Which energy transition priorities from the last administration are utilities most likely to continue supporting regardless of changes in federal policy (select three)? What is the most disruptive threat facing U.S. utilities and their communities? What infrastructure-of-the-future would you most like to see utilities build? Which of the following outcomes should utility infrastructure investments prioritize?

See Figure Two.

Support for green hydrogen plummeted to less than 10% of respondents, as did net zero energy, a drop of more than twenty percentage points for both from the previous year’s survey. And carbon capture and reduction of industrial emissions garnered just 10% of respondents in 2025, less than half the share of respondents who saw it as important in 2024.

To some extent, these responses are likely a reaction to the uncertainty that currently exists around where federal energy policies will ultimately settle. Enhancing the grid’s resilience to physical and cyber threats is generally considered important. And state-level regulations will continue to play a role in how utilities prioritize clean energy investments — as demonstrated by this category’s third-place showing.

That said, Guidehouse Research has tempered its residential solar forecast for the U.S. in the near-term, based on homeowner uncertainty related to the job market and the threat to investment tax credits this year.

The More Things Change, the More They Stay the Same

Nonetheless, when asked to identify what they felt was the most disruptive longer-term threat facing U.S. utilities and their communities, this year’s respondents showed virtually no change over last year’s, with comparable shares citing aging infrastructure (40%), climate-related risks (35%), and inequity and rising costs (25%).

The risks from aging infrastructure are arguably increasing due to climate-related risks. As such, the need for more resilient infrastructure grows with more extreme climate threats. Combined, fully three quarters of survey respondents highlighted these concerns.

Also as in 2024, when asked how utilities can best serve customers in the face of these threats, a majority responded that utilities should lead by example and engage the public and regulators to innovate before problems increase. A smaller share (29%) said a more flexible, reactive approach would be preferred, but notably, less than 3% felt these threats are overblown.

Finally, with respect to what specific actions utilities should take in terms of prioritizing their infrastructure investments, nearly two-thirds of those surveyed would like to see a focus on increased flexibility and improving energy system resilience, compared with 24% preferring an acceleration in the deployment and integration of clean and distributed energy. Just 13% believe investments should prioritize equity and beneficial customer impact. These figures are also very similar to Pulse survey respondents’ 2024 answers.

Resilience First — for Now

In keeping with responses to the other questions in our survey, 62% of this year’s respondents said the “infrastructure of the future” they would most like to see utilities build was storm-hardened, self-healing, resilient grids capable of delivering 24/7 uninterrupted power — up from 57% in 2024.

Meanwhile, those interested in interactive and on-demand energy services platforms fell from 26% to 20%. Here too, we see a return to fundamentals while the policy landscape remains uncertain.

As of this writing, the new administration has only been in office for three months, and it’s been a period of transition for those working to continue or initiate investments in newer energy technologies. The agency cuts and tariffs have taken center stage — for now — but some clarity around energy policy should begin to emerge in coming months. The administration appears to be a strong supporter of AI and data centers, as demonstrated by its $500 billion Stargate data center project.

* * *

To achieve its goals for American leadership in the AI arena, the administration will have to address potential risks to energy supply, and new policies are no doubt in the works. In the meantime, utilities will continue to focus their attention on issues that everyone can agree on, like keeping the lights on, building resilience in the face of extreme weather, and preventing cyber breaches.