What goes up doesn’t always come down.

Ahmad Faruqui, Ryan Hledik, and Wade Davis are economists in the San Francisco office of The Brattle Group. Comments can be directed to Ahmad.Faruqui@Brattle.com.

In an earlier paper, one of us showed that inclining block rates (IBRs) could be used to promote energy efficiency by reducing energy consumption. That paper1 simulated the effect on energy consumption of moving from a flat rate to each of four different two-tiered IBRs. For all four of the rates that I (Ahmad Faruqui) had examined in that earlier paper, aggregate consumption went down. I had found also that the steeper the rise between the tiers, the more was the amount of energy conservation. Subsequent to the paper's circulation, some analysts concluded that the paper had arrived at a general conclusion: that IBRs were synonymous with energy conservation.

In this paper, which I have coauthored with two of my colleagues, we put that proposition to the test by running a reverse simulation.

In this instance, however, instead of dealing with a hypothetical utility, we provide case studies of two California utilities, Pacific Gas & Electric Company (PG&E) and Southern California Edison (SCE). And understand also that the state of California has a long history with IBRs, going back to the introduction of lifeline rates in the seventies. During those days, there were only two tiers and the differential between the tiers was around 20 percent. After the energy crisis of 2001-02, three additional tiers were introduced, to mitigate the effect of the rate hike on small users. Over time, all inflation that occurred was piled on to the upper three tiers and the differential between the tiers was accentuated.

A few years ago the five tiers were reduced to four. The utilities are now proposing to further reduce the number of tiers down to two and to flatten the differential between the tiers.

In this paper we simulate the impact of this rate change under a variety of assumptions about the price elasticity of electricity consumption and using three different methodologies for modeling customer response to price changes: average price, marginal price and tier-specific price. The first two methodologies required the use of individual customer data which we were able to get in the form of random samples of a few thousand customers. The third methodology can be carried out with aggregate data and was used in the prior paper.

Figure 1 - Current and Proposed PG&E Rates

Figure 1 - Current and Proposed PG&E Rates

Using these two utilities as a test bed, we find that the effect of flattening the rates on consumption is very small, ranging from an increase in consumption of 1 percent to a decrease of 1 percent. The reason for this paradoxical result is that consumption in the lower tiers faces a higher price and consumption in the higher tiers faces a lower price. When summed up, these countervailing effects tend to cancel each other out.

We conclude by noting that the answer depends on three things: the specifics of the rate design change, the nature of the evaluation methodology and the values of the assumed price elasticities. Of these, the specifics of the rate design change matter the most. Whether or not an IBR encourages consumption will depend on the distribution of customer usage across the tiers and the magnitude of the price changes across tiers. Paradoxically, if a large share of consumption is concentrated in the lower tiers that are going to face higher prices under a flatter IBR, then a revenue neutral rate change that "flattens" the tiers might lead to additional conservation.

Thus there is no general rule which says that IBRs will promote energy conservation, or that "de-inclining" IBRs (e.g., flattening the existing rate blocks) will lead to loss of conservation.

Analytical Approach

Figure 2 - PG&E Change in Consumption by Customer Segment

Figure 2 - PG&E Change in Consumption by Customer Segment

We use three methodologies to carry out the simulation. We refer to the first methodology as the Tier-Specific methodology. Under the Tier-Specific methodology, the price change in each tier is assumed to affect the consumption in that tier. Specifically, for each tier, the new price is compared to the old price. The percentage change in price is multiplied into an estimated price elasticity to obtain the percentage change in consumption in that tier. The change in consumption is added up across tiers to arrive at an estimate of the overall net change in consumption attributable to the rate design change.

This methodology was used in the prior Public Utilities Fortnightly article (see footnote 1) and subsequently it was used to predict the impact of moving from a flat rate to a two-tier rate in Xcel Energy's service territory for its utility subsidiary, Public Service Co. of Colorado (PSCo).2 Based on these predictions, the Colorado commission approved the rate design changes and they were carried out for all customers. The first tier was set at 4.6 cents per kWh and the second tier at 9 cents per kWh. The company had then measured the actual changes in consumption that occurred during the next three years and had found that they lined up well with the model predictions.

The second methodology we refer to as the Average Price methodology. This methodology assumes that customers are unaware of (or don't understand the complexity of) tier-specific prices, but instead respond only to changes in the average all-in price (i.e., changes in their total bill). Under the Average Price approach, each customer's bill under the new tiered rate is compared to its bill under the old tiered rate. The percentage change in the bill is multiplied by an estimated price elasticity to produce the percentage change in total consumption. Customers would increase their consumption if their bill decreased under the new rate, and vice versa. This calculation must be done at the individual monthly customer level, and the impacts are then aggregated up to the class level.

The general concept of the Average Price approach is supported by empirical research that has been conducted by economists at UC Berkeley's Haas School of Business (Professor Severin Borenstein and Koichiro Ito, who is now an Assistant Professor at Boston University). Dr. Ito's findings have been published in the American Economic Review, one of the top journals in the economics profession.3

Figure 3 - PG&E Change in Class Consumption for Price Elasticity Cases

Figure 3 - PG&E Change in Class Consumption for Price Elasticity Cases

We refer to the third methodology as the Marginal Price methodology. With this approach, the new price of each customer's marginal (i.e., highest) tier is compared to the old price of the marginal tier. The percentage change in prices is multiplied by an estimated price elasticity to estimate the percentage change in the customer's total consumption. The theory behind this approach is that customers respond to the price of the marginal tier, because this is the actual price that they avoid when reducing consumption (and vice versa).

The Marginal Price approach also includes an "expenditure" variable that accounts for the effect of spending money on electricity to reach the marginal tier. In other words, customers must spend money each month on lower-tiered electricity before they reach higher-tiered electricity. The inclusion of the expenditure variable is based on the notion that the amount of expenditure in all tiers except the final tier (i.e., the "intramarginal" tiers) is a significant share of customer income and that customers respond to this variable according to their income elasticity - the higher the bill, the less electricity will be consumed. The Marginal Price approach was first discussed by Lester Taylor in The Bell Journal of Economics in 1975 (in the context of declining block rates rather than inclining block rates, but the logic of his discussion is general and applies to both types of block rate structures).4 A variant of this approach has been utilized recently by economists at E3 in an assessment of BC Hydro's IBR (although that approach does not appear to account for the expenditure effect).5

Given the uncertainty about which price(s) customers actually respond to, we felt it prudent to carry out the analysis using all three methodologies.

Adding a Customer Charge. In the prior article, the customer charge did not play any role in the analysis. In our two California case studies, it is a key part of the rate changes being proposed.

Figure 4 - Current and Proposed SCE Rates

Figure 4 - Current and Proposed SCE Rates

PG&E does not currently have a customer charge and is proposing to introduce one. SCE is proposing to increase the customer charge from its current value of less than $1 per month. To account for the customer charge in our analysis, we divide the customer charge by each customer's first tier consumption to create a levelized charge (i.e., a cents per kWh charge), which is then added to the price of the first tier, creating an all-in rate. The reason for allocating the customer charge to the first tier is because all customers, large or small, will pay the customer charge and this approach captures the relative impact that the customer charge would have on each customer's bill. Ignoring the customer charge entirely would suggest that customers would not be aware of - or sensitive to - the impact of the customer charge on their bill, an assumption that we do not believe would be the case.6

Price Elasticity Assumptions. In the Tier-Specific analysis we assume a price elasticity of -0.13 in the first tier and -0.26 in all other tiers. These are the same price elasticity assumptions that were used in the prior Fortnightly article. Intuitively, the first tier price elasticity is lower than the "outer tier" elasticity because it is associated to some extent with basic, necessary end-uses that are less discretionary than consumption in the outer tiers.

While we are not aware of any studies that have estimated tier-specific price elasticities that would be consistent with the Tier-Specific simulation methodology (as described above), there is an extensive body of economic literature on residential average price elasticities, and our price elasticity assumptions are consistent with the range of price elasticities in those studies. For example, Dr. Koichiro Ito estimated a price elasticity of around -0.1 in his assessment of California's IBRs.7 In 2006, the RAND Corporation conducted a regional econometric study of price elasticities and estimated a short-run residential price elasticity for the Pacific Coast region of -0.188 and a long-run price elasticity of -0.254.8 The Electric Power Research Institute (EPRI) surveyed the literature on electricity price elasticities and found that residential estimates of short-run price elasticity ranged from -0.2 to -0.6, with a mean of -0.3, and found that long-run elasticities likely to be significantly higher.9 These are a few examples of the many studies dating back several decades that have analyzed the household price elasticity of demand for electricity.

The Average Price analysis requires a single average price elasticity that is not differentiated by tier. To establish this price elasticity for PG&E and ensure consistency across methodologies, we calculated the consumption-weighted average of the tier-specific price elasticities described above. This technique results in an average price elasticity for PG&E of -0.18.10 For SCE, we were able to rely upon an econometric assessment of average price elasticity that the utility had conducted using a roughly 15-year history of billing data from its service territory. The study differentiated elasticities between CARE and Non-CARE customers as well as "low users" (with less than 600 kWh of average monthly consumption) and "large users" (with greater than 600 kWh of average monthly consumption). The price elasticities for these SCE customers were as follows:

- CARE low users=-0.23

- Non-CARE low users=-0.14

- CARE large users=0 (not statistically significant)

- Non-CARE large users=-0.18.

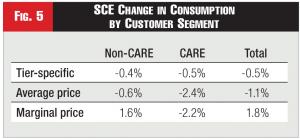

Figure 5 - SCE Change in Consumption by Customer Segment

Figure 5 - SCE Change in Consumption by Customer Segment

(Note: California's "CARE" program - "California Alternate Rates for Energy" - denotes a public assistance program for low-income customers that offers rate discounts on retail utility bills for electricity and natural gas, in the range of 30-35 percent, for qualifying and enrolled customers.)

We note that the average price elasticity across all of the residential customers in SCE's sample was -0.17, which is very close to our price elasticity assumption for PG&E of -0.18 (and provides further confirmation that these price elasticity assumptions are reasonable for the two utilities in our paper).

The Marginal Price analysis distinguishes between the price elasticity of customers whose marginal tier is the first tier, and the price elasticity of customers whose marginal tier is the other tiers.11 For customers in the first tier, we use the same first tier price elasticity of -0.13. Since the price elasticity is applied to each customer's entire consumption, for customers in the outer tiers, we use a class consumption-weighted average of the tier specific price elasticities (-0.13 and -0.26) to arrive an outer tier price elasticity of -0.18 for PG&E and -0.19 for SCE.

The Marginal Price analysis also requires an assumption for income elasticity. For PG&E, we were able to rely upon an income elasticity estimate developed by the company's load forecasting group. This income elasticity is +0.16, meaning that for a 10 percent bill increase in the inframarginal tiers (a decrease in income) the customer's electricity consumption would decrease by 1.6 percent. For SCE, we relied upon a survey of income elasticities in the academic literature on the topic. There is a wide range of income elasticity estimates in the literature, generally ranging from 0.1 to more than 1.0.12 To avoid overstating the conservation effect and to remain roughly consistent with PG&E's income elasticity estimate, we chose a value near the lower end of this range of +0.15 for SCE. Note that, as described above, the change in the customer's bill is based only on consumption and prices in the inframarginal tiers (i.e., all tiers before the marginal tier).

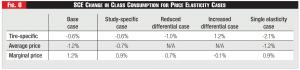

Figure 6 - SCE Change in Class Consumption for Price Elasticity Cases

Figure 6 - SCE Change in Class Consumption for Price Elasticity Cases

We also conducted sensitivity analysis around these price elasticity assumptions, which we discuss later in our article.

The PG&E Study

PG&E provided us with 12 months of consumption data from calendar year 2011 for a sample of 6,929 residential customers.

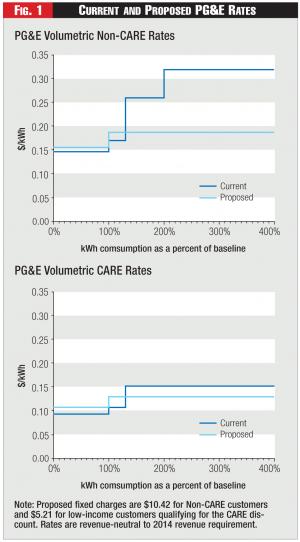

Rate Proposals. PG&E's proposal includes the following changes to the current rate design:

Pricing Tiers. The proposal would collapse the number of rate tiers to two. For the current four-tier Non-CARE rate, by 2018, tiers two, three, and four would be combined to create a new, blended second tier with a single price. For the current three-tier CARE rate, by 2018 tiers two and three would be combined into a single tier.13

Customer Charge. The proposal would introduce a revenue-neutral customer charge. PG&E's rates do not currently have a fixed monthly customer charge. The new rate proposal includes a monthly customer charge of $10.42 for Non-CARE customers and a similar $5.21 charge for CARE customers in 2018.

CARE Discounts. PG&E is proposing to reduce the CARE discount, as specified in Assembly Bill 327. The resulting increase in revenue from CARE customers is partially offset by a rate decrease for residential Non-CARE customers. However, since the CARE discount is paid for by all customers, including non-residential customers, the reduction in the residential Non-CARE rate accounts for only a portion of the increased revenue.14

PG&E provided us with rates that are consistent with its proposal, as well as various "intermediate" rate designs that allow me to incrementally estimate the impact of each of the three changes to the rate described above. Due to slight differences in revenue generated by these rates for the specific sample of customers for which we had consumption data, we applied a small proportional adjustment to the prices in each tier to ensure revenue neutrality across the rate designs. This ensures that we are only analyzing changes to the rate design and not capturing the effect of any differences in rate level. The rates are illustrated in Figure 1.

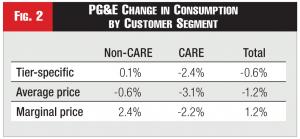

Consumption Impacts. We estimate that PG&E's annual residential consumption will decrease by 0.6 percent using the Tier-Specific methodology and by 1.2 percent using the Average Price methodology. It will increase by 1.2 percent using the Marginal Price methodology. In other words, two of the three methodologies predict a modest increase in conservation attributable to PG&E's proposed rate changes. Due to the proposed reduction in the CARE (i.e., low income) discount, CARE customers are likely to reduce consumption by a larger percentage than Non-CARE customers. Results of the analysis by customer segment and simulation methodology are summarized in Figure 2.

Price Elasticity. There is uncertainty in the literature about price elasticities. We tested four different cases to assess the sensitivity of our results to our assumptions about price elasticity:

- Study-Specific Case.

- Reduced Differential Case.

- Increased Differential Case.

- Single Elasticity Case.

For the first case, the "study-specific" case, we relied upon the elasticity estimates from the studies in which each of the three simulation methodologies were originally developed. For the Tier-Specific approach, we continue to use elasticities of -0.13 for the first tier and -0.26 for the other tiers, because these were the original price elasticity estimates developed for that approach.15 For the Average Price approach, we use an average price elasticity of -0.1 as this was the estimate developed by Koichiro Ito in his 2014 article in the American Economic Review.16 For the Marginal Price approach, we used the price elasticities that E3 estimated in their assessment of BC Hydro's IBR. They estimated an elasticity of 0 for customers in the first tier and -0.1 for customers beyond the first tier. For the income elasticity, we used an assumption of +0.1, which is consistent with the original research of Lester Taylor.17

For the second case, the "reduced differential" case, we reduced the difference in price elasticity between the first tier and the outer tiers, given that there is uncertainty around the extent to which price elasticities differ by tier. To explain, recall that for the Tier-Specific approach, as noted above, we had reduced the price elasticity in the outer tiers from -0.26 to -0.20 and had kept the first tier price elasticity at -0.13. And so we used this same tier-specific assumption here, in the second case, which brought the weighted average price elasticity for customers reaching the outer tiers down from -0.18 to -0.16. We did not modify the income elasticity. In the Average Price approach, we did not modify the price elasticity because that approach does not account for tier-differentiated price elasticities.

Regarding the third case, the "increased differential" case, some experts might feel that the differential between tier-specific elasticities is even greater than the estimates of -0.13 and -0.26 as in our base case. To address their concerns, here we have modeled the -0.01 and -0.20 elasticity estimates as a sensitivity case.

We have also considered a sensitivity case for our fourth case, the "single elasticity" case, win which we use a single composite price elasticity of -0.18 for all approaches (this is the class consumption weighted average of -0.13 and -0.26).

The results of these four cases are fairly consistent with the results presented earlier in the paper. Across all four of the cases, the largest predicted decrease in consumption is 2.1 percent and the largest predicted increase is 1.2 percent. The results of all cases for all three methodologies are presented in Figure 3.

The SCE Case Study

SCE provided us with 12 months of consumption data for 8,213 randomly-selected residential customers for calendar year 2013.

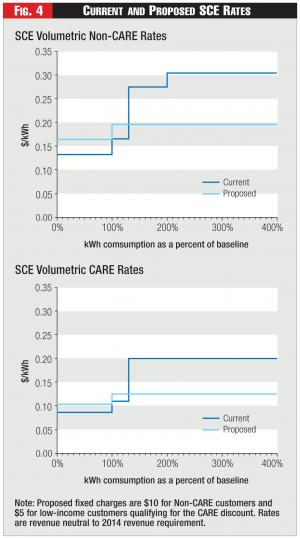

Rate Proposals. SCE is proposing the following rate design changes effective in 2018:

Pricing Tiers. Like PG&E, SCE is proposing to collapse the number of tiers in both the CARE and Non-CARE rates to two, with a price ratio between the two tiers of 1.2-to-1.0.

Customer Charge. SCE currently has a very small monthly customer charge of $0.94 for Non-CARE customers and $0.73 for CARE customers. SCE proposes to increase the monthly customer charge to $10 for Non-CARE customers and $5 for CARE customers.

Baseline Allowance. Currently, SCE's baseline is based on 53 percent of average use. This baseline provides the basis for the quantity threshold of each tier. For example, tier one applies to usage that is between 0 and 100 percent of the baseline, tier two applies to usage that is between 101 and 130 percent of baseline, etc. In its new rate proposal, SCE is proposing to reduce the baseline to 50 percent of average use.

As in the PG&E analysis, SCE provided us with rates that are consistent with its proposal, and we made minor adjustments to ensure revenue neutrality for the sample of customers that we analyzed. The rates that we used in our assessment are illustrated in Figure 4.

Consumption Impacts. As was the case in the PG&E analysis, two of the three methodologies predict a modest increase in conservation (i.e., a decrease in consumption) attributable to SCE's proposed rate changes. Under SCE's new rate proposal, we estimate that annual residential consumption will decrease by 0.5 percent using the Tier-Specific methodology and by 1.1 percent using the Average Price methodology, and will increase by 1.8 percent using the Marginal Price methodology. Results of the analysis by customer segment and simulation methodology are summarized in Figure 5.

Price Elasticity. For the SCE case study we employed the same four price elasticity cases as for the PG&E study. The results of the price elasticity sensitivity cases for SCE are generally consistent with the results presented previously for PG&E and with the case described above for SCE. Across all four of the SCE sensitivity cases, the largest predicted decrease in consumption is 2.2 percent and the largest predicted increase is 1.7 percent. The results of all cases for all three methodologies are presented in Figure 6.

Study Findings

Regardless of the methodology that we use to estimate the impact of PG&E's and SCE's rate proposals on residential electricity consumption, we conclude that the overall consumption impact will be modest. For both utilities, two of the three methodologies predict a modest decrease in consumption attributable to the new rate design, and the third methodology predicts a modest increase in consumption. This prediction is driven by the fact that well over half of class consumption is concentrated in the tiers that will experience a price increase under the IOUs' proposals. This generally offsets the effect of the price decrease in the outer tiers of the rate.

These findings are consistent across a reasonable range of price elasticity assumptions. In the base case, we account for the notion that first tier consumption is likely to be less price-responsive than higher tier consumption, and our price elasticity assumptions are consistent with the extensive literature on household price elasticity of demand for electricity. We then tested sensitivity cases that modify the differential between tier-specific price elasticity estimates, and also relied upon price elasticities established in the original studies. Our conclusions remain consistent across these price elasticity cases.

We also conclude that the introduction of a customer charge is not likely to have a material impact on consumption. When incrementally analyzing the impact of introducing - or in SCE's case, increasing - the customer charge, we find that it will change class consumption by less than one percent across all three simulation methodologies. The customer charges proposed by the IOUs are relatively modest as a share of the typical customer's total bill. Further, considering that customers are likely to respond, at least to some degree, to overall changes to their bill (as opposed to being focused only on the marginal price), then it is not surprising that the introduction of a customer charge accompanied by an offsetting reduction in the volumetric charge would have a relatively modest impact on overall consumption.

The major conclusion of the paper is that there is no general rule that applies to the predicting the impact of IBRs. The specifics of the rate design matter enormously, such as the number of tiers, the width of the tiers, and the heights between the tiers, and how these vary between the current rate and the proposed rate. Thus, IBRs can just as easily raise usage as they can reduce usage.

Endnotes:

1. "Inclining Toward Efficiency," by Ahmad Faruqui, Public Utilities Fortnightly, August 2008, p. 22.

2. Direct Testimony of Ahmad Faruqui, RE: The Tariff Sheets Filed by Pub. Serv. Co. of Colorado with Advice Letter No. 1535-Electric, Docket No. 09AL-299E, May 1, 2009. And personal correspondence with Scott Brockett of Xcel Energy dated July 9, 2013.

3. Koichiro Ito, "Do Consumers Respond to Marginal or Average Price?" American Economic Review, Vol. 104, Issue 2. 2014, pp. 537-563.

4. Lester Taylor, "The Demand for Electricity: A Survey," The Bell Journal of Economics. Vol. 6, Spring 1975, pp. 74-110. See especially the discussion on the top of page 80. Taylor says that the correct way to model customer usage is to relate it to "[t]he marginal price, which refers to the last block consumed in, and to the average price consumed up to, but not including the final block.' He adds that "the total expenditure on electricity up to the final block can be used in place of the average price. Whichever quantity is used, the variable will measure the income effect arising from the intramarginal price changes, thus leaving the price effect to be measured by the marginal price." He provides guidance on how to interpret the coefficient that would be attached to the variable that measures the consumers' expenditure on electric usage on the inframargainl tiers: "The coefficient on total expenditure up to the final block should be equal in magnitude, but opposite in sign, to the coefficient on income."

5. Ren Orans, et al. "Inclining for the Climate," Public Utilities Fortnightly, May 2009.

6. Note that we consider this approach to be quite reasonable for modeling customer behavior, because it accounts for the impact of the fixed charge on customer bills, an important factor in customer decision making. However, this approach is not also applicable for ratemaking purposes - when establishing the tier prices of the new rate, the fixed charge and volumetric charges should be considered separately since they are designed to recover different types of costs. In other words, we do not think it is reasonable to set the tier prices based on an assumption that the customer charge is allocated to the first tier, because this is not reflective of the underlying costs on which the rate is based.

7. Koichiro Ito, "Do Consumers Respond to Marginal or Average Price?" American Economic Review, Vol. 104, Issue 2. 2014, pp. 537-563. Dr. Ito characterizes this as a medium-long run price elasticity.

8. M.A. Bernstein and J. Griffin, "Regional Differences in the Price-Elasticity of Demand for Energy," Rand Corporation subcontract report for National Renewable Energy Laboratory, February 2006.

9. EPRI, "Price Elasticity of Demand for Electricity: A Primer and Synthesis," EPRI white paper for the Energy Efficiency Initiative, January 2008.

10. [(Tier 1 usage) x (-0.13) + (Tier 2, 3, and 4 usage) x (-0.26)] / (Total usage)=(-0.18)

11. The basis for this is the BC Hydro study, which analyzed a two-tiered IBR and found differences in price responsiveness for customers in the first tier versus the second tier.

12. See Taylor (1975), p. 101 and Ito (2014), p. 548. Taylor found one outlier study with a negative income elasticity of -0.2, suggesting that consumption and income are inversely correlated. Excluding this anomaly the lower end of the range of estimates is otherwise clustered around +0.1.

13. CARE customers get a discount on their electric rates based on their income level.

14. Residential Non-CARE sales account for roughly 30% of PG&E's total sales, so the Non-CARE rate is reduced by 30% of the increased revenue associated with the reduction in the CARE discount.

15. Ahmad Faruqui, “Inclining Toward Efficiency," Public Utilities Fortnightly, August 2008.

16. Koichiro Ito, "Do Consumers Respond to Marginal or Average Price?" American Economic Review, Vol. 104, Issue 2. 2014, pp. 537-563.

17. Lester Taylor, "The Demand for Electricity: A Survey," The Bell Journal of Economics, Vol 6. Spring 1975, pp. 74-110. To avoid overstating the conservation effect we use an estimate near the low end of the range of income elasticities in the survey. In other words, we err on the side of estimating an increase in consumption rather than a decrease in consumption.