DR design flaws create perverse incentives.

Robert L. Borlick is an independent energy consultant with more than 30 years of industry experience, formerly with the Brattle Group, Putnam Hayes & Bartlett and Hagler Bailly. He advises the Midwest Independent System Operator regarding the design of its demand response products.

A debate that started about 10 years ago turns around the question of how much a retail customer should be paid for not consuming electricity—i.e., how much are the customer’s negawatt-hours worth? Further adding to the debate, the Federal Energy Regulatory Commission (FERC) recently proposed a rule that would require all independent system operators (ISOs) and regional transmission operators (RTOs) sponsoring economic demand-response (DR) programs to pay the energy market price for demand reductions.1 The FERC based its proposal on the assumption that a MWh of DR (i.e., a negawatt-hour or NWh) has the same economic value as a megawatt-hour of energy.2

The FERC’s assumption is wrong. Economic demand response isn’t a sale of energy; rather, it’s a sale of a call option on energy. Although the market price of energy contributes to the economic value of a negawatt-hour, it doesn’t completely determine that value.

Economic Rationale

Economic theory treats price-sensitive DR as a downward sloping demand curve (see Figure 1). This economic principle is observed in action in everyday life—as the price of a good or service increases, consumers buy less of it. Unfortunately, this principle isn’t fully operative in wholesale power markets because most consumers buy their electricity through fixed-price retail tariffs, which effectively isolate them from wholesale market prices. Although sloped demand curves still represent how these consumers value electric energy, their consumption decisions are based on their fixed retail tariff prices.

The economic rationale for wholesale economic demand programs is to provide retail customers on fixed-price tariffs with incentives equivalent to those provided by dynamic retail prices that directly reflect the hourly wholesale market prices. Many large industrial and commercial customers are served through such dynamic tariffs, and thus don’t require any additional incentives to make economically efficient consumption decisions. If allowed to participate in economic DR programs, these customers will be grossly overcompensated for their demand reductions.

Ten years ago, DR generally was viewed as a retail activity outside the jurisdiction of the FERC. That changed during California’s electricity meltdown when FERC realized that a modest amount of DR could have eliminated the rolling blackouts and produced substantially lower wholesale market electricity prices.3 In 2001, FERC asserted jurisdiction over wholesale market DR, stating:

These transactions are considered wholesale when they involve the sale for resale of energy that would ordinarily be consumed by the reseller. These transactions can occur in several ways. An aggregator can line up retail load to acquire enough negawatts to resell in a manner similar to what aggregators do when they sell power to retail load under retail choice programs.4

Today, almost all ISOs and RTOs administer economic DR programs along with other programs through which DR provides capacity and ancillary services. The New York ISO and ISO-New England implemented economic DR in 2001 and were closely followed by the PJM Interconnection in 2002.5 The Electric Reliability Council of Texas implemented several economic DR programs in late 2003 that allowed limited load participation through their respective retail electricity providers (REPs). The Midwest ISO and the California ISO implemented economic DR programs somewhat later and currently have proposals before FERC for expanding these programs to accommodate the participation of third-party aggregators of retail customers (ARCs).6 The Southwest Power Pool currently has no economic DR program as it operates only a real-time energy balancing market.

The current interest in wholesale economic DR programs has obscured the fact that they are poor substitutes for the best solution, which is to fix the retail tariffs. Anyone who doubts their second-best status need only contemplate the substantial transaction costs these programs introduce, such as those incurred by ARCs in recruiting retail customers, developing and aggregating the customers’ price offers, communicating load interruption instructions to them, estimating their response to these instructions and paying them for the estimated load reductions. In addition, the sponsoring ISOs/RTOs incur higher costs in settling these transactions and in recovering the payments made to ARCs from other wholesale market participants. Virtually none of these costs would exist if those same retail customers had the ability to respond directly to wholesale market prices (i.e., through smart meters combined with dynamic, hourly rates) rather than relying on ARCs to coordinate the interruption of their loads.

In addition to high transaction costs, economic DR programs must rely on statistical techniques (i.e., measurement and verification) to indirectly estimate what each customer would have done but for the payments received through the program. The measurement and verification activity is the Achilles’ heel of these programs, because it not only introduces unavoidable measurement errors but also creates opportunities for DR providers to game the system to get paid for demand reductions never delivered.7

For example, in New England, DR providers were offering nominal amounts of DR into the market at low prices to ensure that their offers would be accepted in order to exclude their actual consumption for that day from calculations updating their consumption baselines. By selectively repeating this strategy, a provider could maintain an inflated consumption baseline and thereby get credit for demand reductions that it never delivered. In February 2008, ISO-New England countered this scheme by indexing the minimum DR offer to the price of natural gas, which increased the minimum offer price from $50/MWh to approximately $100/MWh, and thus limited the number of hours when such gaming activity could occur.8

Last, all of the existing economic DR programs ignore the benefits of building off-peak loads when wholesale market prices—and production costs—are low and sometimes even negative. Such load-building activities will become increasingly important as power systems accommodate increasing amounts of wind, solar and other variable energy resources.

While it’s possible to design economic DR programs that include appropriate incentives for efficient consumption in all hours, doing so would increase the difficulty of measurement and verification and potentially create additional gaming opportunities. In contrast, dynamically indexed retail tariffs provide customers with just the right incentives for adjusting their consumption in all hours of the day or night.

Recognizing the shortcomings, PJM envisages and actively supports the replacement of its economic DR programs with price-responsive demand achieved through dynamic retail rates.9 Notwithstanding their shortcomings, properly designed wholesale DR programs can provide a valuable service until cost-reflective, dynamic retail tariffs become widespread. On the other hand, programs that aren’t properly designed in accordance with sound economic principles might do more harm than good.

DR as a Resource

Classic economic theory treats DR purely as a demand-side effect. In contrast, economic DR programs treat DR as an equivalent supply-side resource. This latter treatment has given rise to much confusion.

Because retail customers see only the fixed tariff price, they consume electricity regardless of wholesale market prices in peak and off-peak hours (see Figure 2). If the same customers were exposed to real-time wholesale market prices, their consumption patterns would change, producing economically efficient wholesale market clearing prices. These efficient market solutions would equate each retail customer’s marginal value of electric energy with the marginal cost of producing and delivering the energy to that customer. However, when served through fixed-price retail tariffs, the customers will over-consume electricity in a peak hour and under-consume in an off-peak hour.

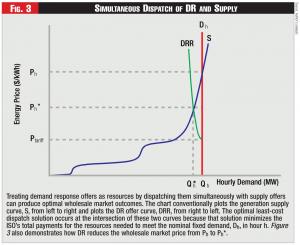

A properly designed economic DR program can provide an ISO with a useful tool for approximating economically efficient market outcomes in the peak hours by treating DR as a resource equivalent to generation. In such a market, the optimal least-cost dispatch solution occurs at the intersection of the generation-offer and DR-offer curves, because that solution minimizes the ISO’s total payments for the resources needed to meet the nominal fixed demand in a given hour, and reduces wholesale prices (see Figure 3).

In practice, however, the dispatch software employed by an ISO doesn’t clear the energy market as described above; instead, it comingles the generation supply offers with the DR offers to produce a composite supply curve, which the ISO treats in the same manner as a supply curve consisting solely of generator offers. The composite supply curve produces the same market outcome as that described in Figure 3.

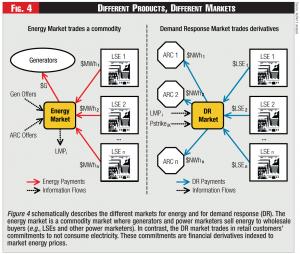

Unfortunately, such a composite supply curve creates the illusion that generation and DR are equivalent energy resources, rather than equivalent balancing resources. From there it’s easy (and incorrect) to conclude that both types of resources deserve to be paid the same energy market price. The fallacy occurs in assuming that DR and energy trade in the same market. In fact, these fundamentally different resources trade in separate and distinct markets that are linked by the requirement that the sum of the resources clearing in their respective markets must equal the power system’s nominal demand (Dh in Figure 3).

The energy market is a commodity market where generators and power marketers sell energy to wholesale buyers (e.g., LSEs and other power marketers). In contrast, the DR market trades in retail customers’ commitments to not consume electricity (see Figure 4). These commitments are financial derivatives indexed to market energy prices.

Incenting Value-Based Offers

The least-cost solution illustrated in Figure 3 will yield an economically efficient market outcome only if the DR offer curve (DRR) accurately reflects the economic values (i.e., opportunity costs) that participating retail customers respectively would forego by reducing their electric energy consumption. If that condition is fulfilled, the marginal value of consumption will equal the marginal cost of producing and delivering the electricity consumed, resulting in the efficient market outcome (P*, Q*, illustrated in Figure 2). A properly designed economic DR program will include economic incentives to achieve this outcome.

The DRR offer curve aggregates the individual price offers of the retail customers represented by ARCs; consequently, the way ARCs compensate their customers affects the prices at which those customers will offer their load reductions. One way to influence how an ARC compensates its customers is to pay it the same prices it should pay its customers for their load reductions.

Ideally, an ARC will pass through to each customer the full price it receives for the customer’s load reduction and will recover its costs and profits through fixed monthly subscription fees that minimally distort the customer’s consumption decisions. If the customer also is selling capacity into the wholesale market, the ARC can deduct the subscription fee from the customer’s capacity payments. While this too may be distortive by discouraging investment in the needed metering and communications infrastructure, it likely will be less so than a recurring disincentive to fully respond to energy market price signals.

The economically efficient price a retail customer should be paid is its offer price minus the price in its retail tariff at which it would have purchased the curtailed energy, i.e., its marginal foregone retail rate (MFRR).10 In contrast, if the customer is paid its full offer price, it will submit offers that net off the MFRR from the marginal productivity values, resulting in offer prices that are too low, thereby causing the ISO to dispatch excessive and inefficient amounts of DR.

Consider an example in which a retail customer, whose MFRR is $50 per MWh, decides to offer one MWh of load reduction in hour h. Assume the customer places a value of $300 on the product that MWh would produce. By consuming that MWh, the customer would gain an economic benefit of $300 but would pay its LSE $50 for the energy, for a net gain of $250. Thus, the customer would want to be paid at least $250 for its load reduction. If the customer knows it would be paid the market energy price for its curtailed energy, it rationally would offer $250, which obviously is less than the productive value of the energy. If that offer clears the market, a generator somewhere in the system would be backed down even if it could have delivered the energy at a cost lower than the productive value of the curtailed energy. Clearly, this is inefficient and someone would bear the $50 loss. Who bears that cost depends on how the ISO recovers its payments to the customer’s ARC.

To motivate a retail customer to offer prices reflecting the full economic value of its associated energy reductions, the ARC should pay the customer the energy market price less the customer’s MFRR. Knowing that its MFRR would be netted off the payments it receives, the customer would have a strong incentive to offer prices that fully and accurately reflect the productive values of the associated energy reductions.

Paying a retail customer the energy market price less its MFRR, produces the same net result as paying the customer the energy market price for the energy it “resells” to the wholesale market through its ARC and requiring the customer to purchase that energy from its LSE under its retail tariff. FERC initially adopted this sale-for-resale paradigm as the basis for declaring jurisdiction over retail customer DR, but no longer relies on it.11

In reality, neither the retail customer nor its ARC injects energy into the transmission grid when the customer reduces its load in response to an incentive payment. Thus, DR isn’t the typical sale-for-resale in which energy is purchased by one entity and simultaneously resold to another entity. What the retail customer sells through its ARC isn’t physical energy, but rather a call option on energy.

Defining a Negawatt-hour

A retail tariff endows the customer with call options to purchase energy in any hour at a strike price equal to the marginal energy price in its tariff, i.e., at the customer’s MFRR. By reducing its energy usage in some hour in return for a payment from an ARC, the retail customer effectively sells to the ARC a call option that matures in that hour. The ARC then resells the option to the ISO which, in turn, resells it to one or more wholesale buyers. All of these purchases and sales trade financial products, not energy.

Because an ISO is revenue-neutral, the amount it pays the ARC for a call option must equal the amount it collects from wholesale buyers. One obvious beneficiary of such a call option is the load-serving entity (LSE) serving the retail customer that originated the call option. This is because the option, if retired unexercised, relieves the LSE of the obligation to purchase the option’s underlying energy at the market price in the hour of maturity and sell the energy at a loss to the retail customer. Thus, the LSE voluntarily will pay up to the market price minus MFRR for the option, at which price it will be indifferent to whether the demand reduction occurs.

Obviously, the LSE would prefer to free ride by enjoying the benefits derived from its customers’ demand reductions while letting someone else pay for those reductions. Such free riding can be avoided if the ISO recovers the DR payments from the LSE whose retail customers provided the DR. For example, assuming a given ARC’s customers all were served at retail by one LSE, the targeted recovery scheme fully would recover the ARC’s DR compensation from that LSE (see Figure 4). Similarly, a second ARC DR payment would be recovered from a second LSE, etc. This analysis assumes a one-to-one correspondence between ARCs and LSEs only to simplify the explanation; actual ISO settlement systems can accommodate ARCs representing the customers of multiple LSEs.

Targeted recovery avoids the cross-subsidies and inefficient pricing distortions that accompany the socialized recovery of DR payments across multiple wholesale buyers. Socialized recovery also increases revenue uncertainty for the LSEs involved, and thus increases the risk premiums they need to charge their retail customers.

Another potential buyer of DR might be a coalition of retail customers on dynamic, wholesale market-based retail tariffs that want to use DR to lower wholesale market prices in order to reduce their electric bills.12 During times when a significant surplus of generating capacity exists, over-stimulating DR in this manner would benefit these customers, but also would constitute the exercise of market power on the demand side. The immediate effect would be to deny generators a fair opportunity to recover fully their past investments and to discourage future investments in new supply resources, including renewables. In the longer term, capacity prices would have to increase, burdening future consumers who would also have to bear the inflated payments for DR. The primary result would be to transfer wealth from residential and small business customers to the large commercial and industrial customers selling the negawatt-hours. All these reasons argue for prohibiting the exercise of demand-side market power.

Implementing ARC Compensation

As discussed, a negawatt-hour of DR is a call option on energy, which economic value partly is determined by the wholesale market energy, i.e., the relevant LMP, and partly by the rates in the DR provider’s retail tariff, i.e., its MFRR. This suggests a natural decomposition of ARC payments into two transactions that ISO settlement systems easily can accommodate using information provided from external sources regarding the relevant MFRRs.

The information needed to determine MFRRs necessarily will be complex and detailed because retail tariffs are complex and detailed. For this reason, MFRRs are best quantified at the retail level, then applied at the wholesale level. It’s no coincidence that all FERC-jurisdictional ISOs and RTOs with economic DR programs have proposed settling their DR purchases using some variant of this two-transaction approach.13

Ultimately, the adoption of smart meters combined with dynamic, cost-reflective retail tariffs will eliminate the disconnect between wholesale market rates and retail rates, obviating the need for economic DR programs. Meanwhile, the industry should avoid overpaying DR providers for their negawatt-hours.

Endnotes:

1. Demand Response Compensation in Organized Wholesale Energy Markets, Docket No. RM10-17-000, Mar. 18, 2010 (FERC).

2. Id., at 15.

3. Massey, William L., “At the FERC, a Strong Commitment to Demand Response,” Remarks by FERC Commissioner Massey, Peak Load Management Alliance 2002 Spring Conference, Dallas, Texas, Apr. 25, 2002, at 2.

4. Order Removing Obstacles to Increased Electric Generation and Natural Gas Supply in the Western United States, Docket No. EL01-47-000, Mar. 14, 2001, at 11 (FERC).

5. NSTAR Services v. New England Power Pool, Docket No. EL00-83-005, ISO New England, Docket Nos. ER00-2811-005, ER00-2937-003, EL00-62-023, and ER00-2052-010, Order Accepting for Filing Proposed Market Rule Changes, May 18, 2001 (FERC); New York Independent System Operator, Order on Tariff Filing, Docket Nos. ER01-1740-00 and ER01-1740-001, May 16, 2001 (FERC); and PJM Interconnection, Order Accepting Tariff Sheets as Modified, Docket No. ER02-1326-000, May 31, 2002 (FERC).

6. Midwest Independent System Operator, Docket No. ER09-1049-002; Re Aggregators of Retail Customers, Oct. 2, 2009 (FERC); and California Independent System Operator, Docket Nos. RM07-19-000 and AD07-7-000, Compliance Report of the California Independent System Operator, Apr. 28, 2009 (FERC).

7. Gaming behavior has occurred in all of the Eastern ISOs’ economic demand response programs. See, Letter Order to New York Independent System Operator, Docket No. ER04-1188-000, Oct. 29, 2004 (FERC); ISO New England, Docket No. ER08-538-000, Filing of Changes to Day-Ahead Load Response Program, Expedited Comment Period and Consideration Requested, Feb. 5, 2008 (FERC); and PJM lnterconnection, Docket No. ER08-824-000, Revisions to the PJM Open Access Transmission Tariff and the PJM Operating Agreement, Apr. 14, 2008 (FERC).

8. Id., ISO New England.

9. PJM Interconnection, Statement of Terry Boston, president and CEO, on behalf of the PJM Board of Managers, Demand Response in the PJM Markets, June 26, 2009.

10. This definition is taken from the Midwest Independent System Operator’s proposal for implementing ARC participation in its energy markets. See, Midwest Independent System Operator, Id., 6, at 13-16.

11. EnergyConnect Inc. Docket Nos. ER09-1307-000 & ER09-1307-001, Order Conditionally Granting Market-Based Rate Authorization and Providing Guidance, Jan. 19, 2010, (FERC).

12. An attorney representing a group of industrial customers advocates this scheme. See, Donald J. Sipe, “Defining the Product,” Attachment A to Comments of the Consumer Demand Response Initiative, Submitted in FERC Docket RM10-17-000, Demand Response Compensation in Organized Wholesale Energy Markets, May 13, 2010.

13. Comments submitted in FERC Docket RM10-17-000, Demand Response Compensation in Organized Wholesale Energy Markets, by ISO-New England, New York Independent System Operator, PJM Interconnection, Midwest Independent System Operator, and the California Independent System Operator.