Developing a leadership role for utilities in alternative technologies.

Andrew Kosnaski previously was vice president of system planning for the Tennessee Valley Authority. Ramesh (“Rudy”) Shankar previously served as TVA’s chief technology advisor and vice president of technology innovation. This article represents their views and not TVA’s.

The American economy is undergoing rapid change, with innovation and technology bringing goods and services most Americans could only have dreamed about decades ago. Witness the replacement of telephone land lines with cellular access with larger bandwidth for new and varying content. The electric utility industry isn’t immune to these forces. Advancements in almost every area of power generation are changing how we do things, from removing harmful pollutants from emissions streams to providing new ways of giving end users choices in how they use electricity in their homes. Advancements in the areas of nuclear technology, from the development of the next generation AP1000 reactor design, to the emergence of small modular reactors as plug-and-play options for nuclear generators, exemplify the way technology has affected traditional generating sources in our industry.

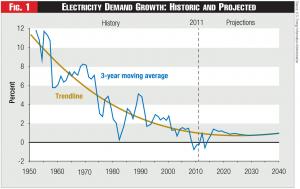

However, in addition to these evolutionary technological changes, which enhance the traditional utility business, there are other, revolutionary technological changes that could fundamentally affect the very foundations of that business model itself, by giving consumers the choice to bypass the grid and the local utility itself. An alarmist interpretation suggests that revolutionary technology could throw the sector into a death spiral where customer migration off the grid results in higher rates for those customers remaining – first creating a cross subsidy from wealthier to poorer customers, and eventually fueling a self-perpetuating cycle of further erosion as rising costs drive more customers to seek off-grid alternatives. With electricity growth projected to remain flat (see Figure 1) or even to decrease through the next several decades, utilities will be hard pressed to balance expenses with revenues unless new channels are opened to pursue revenue opportunities.

One logical solution to this dilemma is to prepare for the transition by positioning to take advantage of it. To accomplish this, utilities would establish an early presence in several key, potentially revolutionary technologies for distributed generation. Moreover, utilities’ mission would broaden from providing electricity to customers over wires, to powering electric devices for consumers whether over wires or at the customer’s site.

Regaining Leadership

A long-term trend of decreasing investment in research and development by utilities might account for their skittishness about new technologies, but players like Google and Microsoft with their deep pockets might have signaled that the game has forever changed. But instead of ceding leadership to new market entrants from Silicon Valley or elsewhere, utility companies should consider developing partnership roles where they bring operational expertise in managing the supply and demand for stable and secure energy future.

Power company planners annually develop a cost-based planning framework to develop a portfolio strategy with the goal of serving load at the lowest possible cost. However, such an approach can’t be relied upon to support investments in nascent technologies since many of those technologies will initially be higher cost than alternatives. The rub is that forward-thinking entities who recognize the strategic importance of a specific technology can gain a first-mover advantage that will be difficult for the incumbent player to overcome. Instead, utilities need to make a strategic decision to invest in technologies that might not be strictly least cost, but that represent the greatest promise of becoming disruptive technologies in the future as experience, scale economies, and other factors make those technologies competitive with grid electricity (i.e., reach the point of grid parity).

Figure 1 - Electricity Demand Growth: Historic and Projected

Figure 1 - Electricity Demand Growth: Historic and Projected

A utility has a choice of pursuing technology based on the location of the generating asset. It can invest in technology under the traditional grid model (for example, investing in the development of small modular nuclear reactors) or it can invest in technology that’s closer to the end user (distributed model), and of course, it can also pursue both simultaneously.

New generation technologies are getting financial boosts from new business models. For example, Sungevity, a solar service provider, has removed the financial barrier of up-front capital requirements to a model that allows amortizing those costs over time with a power purchase agreement (PPA) that provides service at a lower cost than traditional grid power.1 These novel financing schemes offer a win-win proposition to the consumer and vendor, leaving traditional utilities out of the mix.

In a recent study, Deloitte found that 35 percent of the companies it surveyed were generating at least some of their own electricity, up from 21 percent in a 2011 study. Another 17 percent reported plans for future on-site generation – nearly triple the number (6 percent) that reported such plans just one year ago.2 Some of the most creative inroads are made behind the consumer meter in energy management, customer aggregation using the power of the Internet where today traditional utilities aren’t participating. Clearly the business world is taking notice of the promise of distributed generation, the ability to manage customer relationships with new technologies and apps, and the ability to deliver less carbon-intensive electricity. It’s time for utilities to do the same through a deliberate, measured investment in several key technologies.

At least two of the technologies most likely to have a disruptive effect in the next decade are fuel cells and rooftop solar. Both of these technologies likely will revolutionize consumers’ choices in electricity providers. We recommend that utilities begin formulating a forward-looking business model that can evolve in a way that best facilitates the integration of these technologies into their portfolios and rate designs. A deliberate response includes not only moving forward with identifying and working with key partners, but in re-examining rate structures to be sure customers who make more use of end-use generation can’t free-ride on the utility system without bearing their share of the costs. In any case, utilities will need to work very closely with their distribution customers – similar to the way some utilities work with customers to improve energy efficiency – making them partners in developing the strategic response to disruptive technologies.

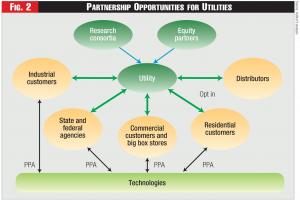

Figure 2 - Partnership Opportunities for Utilities

Figure 2 - Partnership Opportunities for Utilities

With many utilities enjoying very healthy balance sheets, such a strategic response provides the opportunity to deploy capital in a way that allows utilities, and not competitive suppliers, to meet the end-use generation needs of their customer base.

Fuel Cell Strategies

Most fuel cells can be thought of as a type of continuously fueled battery with several critical advantages over central station technologies, including very low emissions (including CO2), significantly better thermal efficiency (80 percent and above compared to less than 50 percent for coal and gas plants), no transmission and distribution losses, and reduced exposure to reliability problems caused by extreme weather. The Bloom Energy Server, which was the subject of a pilot program with several utilities,3 is an example of a solid oxide fuel cell (SOFC).

Prospective fuel cell customers aren’t waiting for their incumbent utilities or others to commercialize fuel cells. Instead, many companies are jumping in and making significant investments in fuel cells. Both Apple and eBay recently announced significant investments in Bloom Energy Servers; Apple planning a 5-MW installation at its data center in Maiden, N.C., and eBay, a 6-MW installation in Utah. In both instances, Bloom Energy Servers will be powered by biogas. Further, as part of an agreement to build a manufacturing center in Newark, Del., Bloom also will add 30 MW of power to the regional power grid by installing 300 of its Bloom Energy Servers at two Delmarva Power substations. The deal will be funded through a rider added to Delmarva customer bills, which is expected to average between $1.30 and $1.40 per month. Not only does the deal help Silicon Valley-based Bloom to establish a manufacturing presence on the East Coast, it also allows it to demonstrate the value of its servers in a traditional utility setting, while also enhancing its manufacturing economies of scale.

Interestingly, Bloom recently developed an innovative product called Bloom Electrons that offers 10-year contracts for metered electricity at 5 percent to 20 percent below the utility rate in California. The product is well-funded, with over $100 million in funding from Credit Suisse Group and Silicon Valley Bank. It also receives federal grants of up to 30 percent of what it pays Bloom for the fuel cells it leases to customers. Bloomberg New Energy Finance puts the production costs at under $0.14 per kWh for a 10-year product, with state and federal subsidies getting the effective rate below $0.07 per kWh.

FuelCell Energy (FCEL) is an integrated fuel cell company based in Danbury, Conn. The company claims its stationary fuel cell power plants produce electricity at a simple 47 percent to 70 percent rate of efficiency that goes as high as 90 percent when used in a combined heat and power (CHP) application. The potential to enhance fuel cell economics represents a significant opportunity for growth in fuel cell deployments, particularly when combined with an intermediation model that finances infrastructure upgrades at low upfront costs to the consumer. FCEL’s Direct FuelCell (DFC) power plants use either natural gas or biofuels as a fuel source, and the company says that with some adjustments, the cells can operate on a wide range of alternative fuels, including ethanol and propane.

Fuel Cell Energy’s near term objective is to reach a levelized cost of electricity in the $0.09 to $0.11 per kWh range, which judging by its declining installed cost per kilowatt since 2003, doesn’t appear outside the realm of possibility. Based on FCEL’s internal projections of scale economies, the company’s systems will reach grid parity in 2015.

Given the imminent threat of commercialization of fuel cell technology, utilities should undertake an assessment of the long-term prospects for both Bloom Energy and Fuel Cell Energy, and make a commitment to investing in their technology in return for exclusive rights to market the technology to end users in their service territory. Ideally companies will begin to roll out broad pilot programs beginning in fiscal 2014. To the extent possible, utilities should encourage CHP applications to maximize the economic benefits to the end user and optimize the efficiency of the conversion process.

Rooftop Solar Technologies

Rooftop solar technology’s ability to disrupt the central generating station model is emerging as one of the industry’s greatest threats. For one, consumer choice is maximally manifest in such a choice. The Deloitte study referenced above also found that the percentage of consumers willing to pay a premium of as much as 2 percent of their monthly bill to support investments in renewable technology was 62 percent, and remained at one-third of customers for premiums as high as 6 percent of the monthly bill. At the lower level, one could assume that nearly one third of customers in the Southeast U.S. – where only one state has enacted renewable portfolio standards (RPS) – would support renewable technologies like rooftop solar. Such funds, if invested in partnership with DOE’s existing SunShot Incubator Program, could give utilities and their customers preferred access to technologies before they were made widely and commercially available to others.

Rooftop solar costs will come down, that much is certain. According to Bloomberg New Energy Finance, after remaining almost unchanged at between $3.50 and $4.00 per watt between 2004 and 2008, solar panels have fallen 77 percent since then, and currently stand at just over $0.86 per watt, which is well below the $1.00 per watt point commonly cited as marking the achievement of grid parity for PV. The University of Tennessee is participating in DOE’s Rooftop Solar Challenge with the ultimate goal of giving residents of Knoxville, Franklin, Nashville, and Memphis access to residential solar permits through an over-the-counter, same-day review process, greatly streamlining the administrative burden of installing rooftop solar.4

Another motivating factor referenced earlier involves financial models that reduce or eliminate up-front costs for rooftop solar installations. The economics are simple. Why should consumers have to invest $7,000 to $10,000 on solar panels with payback periods ranging from five to 10 years? Consumers don’t need to own a gas pump to fuel their cars or buy box seats to attend a single Atlanta Braves baseball game. Markets have developed specifically to provide customers only what they actually need from an economic transaction – gasoline, not the pump – and they’re beginning to develop in the power markets. One company in particular is taking this established wisdom and turning it on its head, creating a very valuable and fast growing business that threatens some of the fundamental relationships traditional utilities have long maintained with their customers.

For example, Solar City, a company based in San Mateo, Calif., describes its business model as the integration of sales, engineering, installation, monitoring, maintenance, and financing of distributed solar energy systems, which allows them to offer long-term energy solutions to residential, commercial, and government customers. Solar City’s customers buy renewable energy for less than they currently pay for electricity from utilities, with little or no up-front costs. Solar City often bundles these services with its energy efficiency offerings, creating a one-stop shop for managing the end-user’s total energy consumption. The company has been at the forefront of taking the distributed generation model from a technology focus to a financial intermediation focus, bringing investors and customers together for mutual benefit. The investor earns a return on a pool of investments (diversified from a credit risk perspective), which are used to fund the purchase of distributed solar that’s installed at the end-user’s site (typically a small residential or commercial customer) with the end result being a lease or PPA structure that, on a levelized basis, beats the cost of grid power purchased from the incumbent utility.

Solar City, which ended 2009 with 27 MW deployed, grew to 201 MW deployed by the first half of 2012, for a compound annual growth rate of almost 80 percent over the period. Solar City has customers in 14 states, and has a stated intention to expand its footprint internationally, operating in every market where distributed solar energy generation is a viable economic alternative to utility generation. Clients range from the small residential customers to larger commercial entities such as Wal-Mart, eBay, and Intel, and government entities like the U.S. Department of Defense. The company’s lease customers pay a fixed monthly fee with a production guarantee, whereas PPA customers pay a rate based on the amount of electricity the solar energy system actually produces. The company attributes some of its success to the existence of high-quality recurring customer payments, investment tax credits, accelerated tax depreciation, and other incentives that are monetized and shared with customers by reducing the price they pay for electricity.

Utilities are uniquely positioned to move into a role of intermediation by providing flexible financing arrangements for customers who would like to install PV systems on their homes and other buildings. At this point, the production of PV has commoditized, and market share will be driven by continued cost reductions as well as creative financing opportunities designed to match the costs of PV installations with the benefits received. By reducing or eliminating switching costs, utilities have the opportunity to make a significant difference in the adoption of PV, which will benefit the nation as a whole by contributing to greater economies of scale and driving costs lower. We recommend that utilities work to create a portfolio of financial products that focus on intermediating providers of capital (investors) with those that need capital (retail customers) to finance the installation of PV infrastructure at their sites, whether by individual homeowners or small commercial and industrial customers (Figure 2). In the process, utilities should identify best-in-class technology providers as potential partners in providing a complete solution, including financing as well as technology.

Leadership Steps

Several specific action steps will allow utilities to assert leadership in alternative technologies and get ahead of the competition.

• Action 1: Develop a coherent and deliberate strategy for technological deployment. Since end-use generation reduces demand at the meter, sales of traditional grid power will be reduced, but new revenue streams and customer relationships will be unlocked that could replace lost revenues with other sources of value to utilities.

• Action 2: Launch efforts to support fuel cell technologies by exploring opportunities for strategic investments and early deployment of systems. Opportunities for CHP should be a primary focus when using systems that produce substantial amounts of waste heat that can be captured to improve operating efficiency.

• Action 3: Develop a portfolio of financing products to facilitate customer adoption of residential and small commercial solar PV by utilizing the utility’s balance sheet to the benefit of its retail customers. The opportunity to intermediate between technology providers and retail customers could open up a new source of earnings for the utility without dramatically changing the nature of the credit risk being borne. Further, innovative financing techniques (i.e., securitizing pools of assets) can be deployed to make participation in solar PV an even more attractive value proposition, with benefits being shared by customer and utility alike. Utilities also should explore partnering with select technology providers, including negotiating favorable bulk equipment agreements with those technology partners, with the benefits of such arrangements shared with end users. The utility adds value to this business line by utilizing its purchasing scale, but also through its role as a financial intermediary. To share risks, equity investors could be solicited to create asset pools. First steps would include development of financial products and contract terms to include leasing (customer owned) and PPA agreements. Initially, utilities should partner with environmentally aware, larger industrial and manufacturing customers to launch the effort, with solar potentially coupled with fuel cells as a source of back up or supplemental power. Such installations would partially serve the customer’s requirements, with the remainder provided by grid power. Utilities also could leverage such programs into attractive economic development tools by utilizing them to incentivize certain types of large customers (i.e., server farms) to locate in the utility’s service territory.

The eventual provision of low cost, clean and renewable energy through a distributed solar model now seems inevitable, and utilities have a responsibility to their customers, as well as their shareholders, to respond proactively such that the transition to a distributed energy future can be managed in terms of value to shareholders and reduced risk for customers and regulators alike – most notably, through the reduction of the risks of stranded costs.

• Action 4: Undertake a comprehensive review of rate structures to ensure they’re designed to fairly support the development of end-use generation without subjecting non-participants to an unfair share of reliability costs due to customer bypass. It’s imperative that end-use customers adequately compensate utilities for providing firm backup reliability. If end-use customers (whether fuel cell or solar) can remain connected to the grid and draw power on demand (to deal with a local equipment failure for example, or when dense cloud cover reduces the productivity of a solar installation) then the fixed costs of making that capacity available should be borne by all customers, and not just those that remain full-requirements customers of their local power companies. An intelligent rate design can provide the incentive and mechanism for deployment of end-use generation, but it must also ensure that free riders aren’t permitted to benefit from utility plant paid for by non-participants.

• Action 5: Develop a prospectus for the creation of a technology fund through a partnership with traditional investment vehicles (private equity) as well as non-traditional investment vehicles to fund research and commercialization.

• Action 6: Public power entities like the TVA and BPA should continue experimenting with the living lab concept to support the development and demonstration of nascent technologies on their systems to assess their performance in realistic field conditions. As a public service this will provide real-world data on how new technologies will function in a legacy system, and will encourage and provide valuable experience from lessons learned.

Endnotes:

1. See The Secret to Solar Power, The New York Times Magazine, Aug. 12, 2012.

2. See Deloitte Center for Energy Solutions. Deloitte reSources 2012 Study: Insights into Emerging Trends of Energy Customers. 2012. Interestingly, 79 percent of respondents also noted a belief that the cost of carbon should be factored into the use of traditional electricity sources, further favoring carbon-efficient sources like distributed generation and rooftop solar.

3. http://www.bloomenergy.com/

4. As much as 40 percent of the total cost of rooftop PV systems is made up of permitting, installation, design, and maintenance costs.