PJM would minimize risk, but so did regulation.

David Bellman is Founder and Principal for All Energy Consulting, and appeared in Public Utilities Fortnightly last October as the author of the article, ‘EPA’s Clean Power Plan – An Unequal Burden.’ Former Managing Director for Strategic Planning at AEP and a recognized Energy Market Analyst. Contact him at dkb@allenergyconsulting.com.

As we learn from the great Roman historian Tacitus, "The desire for safety stands against every great and noble enterprise." And so today, some 20 centuries on, we see a trend in many power markets to add "safety" measures as a result of perceived market failures.

PJM, a regional transmission organization (RTO) covering a large part of the Midwest and Eastern U.S., filed a proposal last December with the Federal Energy Regulatory Commission (FERC) to modify its current capacity market structure. PJM's proposal is similar to the one that FERC had approved for ISO-New England some six months earlier. The changes envisioned in these two efforts call for ever more structured markets, further reducing the scope of the competitive landscape from which RTOs arose, and to which they presumably remain dedicated. These changes evoke a desire to create a competitive market place in the generation sector of the power market, while preserving the safety that the regulated market brought. However, this desire may produce a system that is actually more costly and less innovative than regulation. Free markets by their very nature are evolutionary, requiring trial and error. But the RTOs are preventing evolution to the point that we might best go back to regulation.

Where Are We Today?

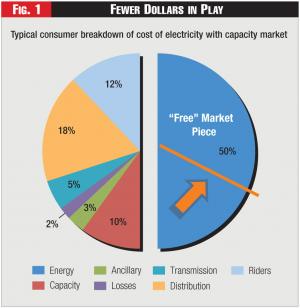

By the time you pay your bill, there are several components for which you are paying. If you reside in a deregulated region, the only portion representing the competitive market is the energy piece. Your Retail Electric Provider (REP) can offer you savings only on the energy piece of your bill. All the other pieces are essentially fixed, so that any attempt to shop for a lower price on other categories of service will not drive further savings.

In order to prevent a price shock in the move to deregulation many markets placed a price cap on the power price. This very move creates a hole in the movement to a true deregulated framework. Do we limit cell phone prices or even gasoline prices? The PJM price cap is currently $1000/MWh.

Unlike other goods and services sold, power requires a perfect balance between supply and demand, or else all parties can lose access to power through a brownout or blackout. In the regulatory construct, an excess buffer of generation was built and paid for by the ratepayer to avoid this potential outcome. This generation may never run for many years. This "free" market model with a price cap results in economic losses for the generator supplying this buffer. Case in point: if a simple-cycle gas unit cost about $85 million dollars for 85 MW and runs only 40 hours in the year, in order to have a payback in 3 years without any discounting you would need prices to average over $8300/MWh - PLUS variable cost during those 40 hours. Variable cost can top $100+/MWh, given the likely rise in fuel prices in extreme times. Many markets did not want to budge on the price cap so they had to create additional revenue for generator units to be available during those limited hours. The answer - the tweak chosen by RTOs and their regulators - was the capacity market.

Figure 1 - Fewer Dollars in Play

Figure 1 - Fewer Dollars in Play

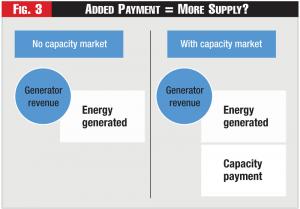

In a capacity market, the generator owner will get paid for having capacity regardless whether the unit was needed that year - assuring some revenue for the generator owner. An outside power analogy would be a line item on everyone's cell phone bill for Apple to assure they overbuild their production facility in order to meet the demands of the next iPhone. With this additional revenue, the theory would be that Apple would be willing to overbuild/plan their facilities from their typical business plans. The simple margin on selling their goods was not enough to ensure adequate supply. Clearly having the latest iPhone is not on par with having electricity - but perhaps that's why electricity was regulated in the first place.

The theory of capacity markets is easy to explain: the additional revenue payment ought to create more supply. The real issue, though, is assigning a value to capacity. The PJM capacity market - aka RPM (Reliability Pricing Model) - is not a typical auction-based system. Rather, it is calculated based on the available supply bid in by generators, the estimated load, and an added administrative calculation of the cost of a new entrant unit. Each year the auction results are posted and each vintage auction (the Base Residual Auction, or BRA) offers supply three years forward, as may be adjusted through a series of incremental auctions held between the date of the BRA and the eventual delivery year. There have been continuous tweaks to the capacity market since its inception, from adding a Minimum Offer Price Rule (the MOPR, to prevent low-ball offers from utility generators who can call on a risk-free revenue stream via rate base) all the way to the recent proposal, which increases the stringency of what may qualify as capacity. It would take a Ph.D dissertation to fully explain the math and the process. But note how this RPM process generates significant consulting fees.

Adding the capacity market also takes dollars out of play from the truly competitive structure - the day-ahead energy market - given that the capacity cost is essentially regulated and socialized within the region. The retail electric provider (REP) will still have multiple options available to acquire energy, but will have no real alternative, other than the regulated capacity market, to meet its imposed requirement for resource adequacy. It's a zero-sum game. The greater the share that the capacity market takes out of total delivered energy cost, the smaller is the piece remaining to the "free" market. Each additional change to the capacity market has typically increased the cost of capacity. The cost of capacity is expected to continue to grow as a percentage of the total cost of electricity. In addition, transmission and distribution charges are also rising. Potentially the competitive piece of electricity could be less than 30 percent of the final bill. All these tweaks and the complexity of the capacity market bring into question the value over a regulated market structure.

By contrast, consider one deregulated market that operates without capacity payments. It's ERCOT, the Electric Reliability Council of Texas. In order to drive generation builds, ERCOT has increased its power price caps from $2,500/MWH (2011) to $9,000/MWH (2015). Interestingly enough, ERCOT has tens of thousands of megawatts in planning and interconnection proceedings. The ERCOT market may still be imperfect, but a consistency and simplicity in not introducing a convoluted capacity market has allowed people to do individualized workarounds and a robust competitive landscape occurred.

What Changes in Store?

Figure 2 - Coal Units Not Winterized

Figure 2 - Coal Units Not Winterized

The new rules at PJM will add significant constraints to participation in the capacity auction plus add more penalties. These restrictions include having the ability to serve both winter and summer requirements along with incentives for dual-fuel capabilities. PJM in its studies notes that additional costs will arise as part of this modification. As expected, the projections show a nominal $2-$3 cost increase per household. However, this math includes the energy savings from having more capacity available to limit price spikes. This energy savings is what the competitive landscape uses to be competitive. The revenue has just moved from a pocket that could compete to lower cost to a pocket that ensures a fixed cost. How much different is this from regulation?

In general, all the utilities are supporting this move. They are trying to lower the penalty cost which are higher than previous design. This new layer of RPM will essentially give existing generation a huge boost in earnings. As soon as the proposal was released many utilities received ratings upgrades. The rules will no doubt add more reliability in the system.

What's Driving these Changes?

The most peculiar aspect of this proposal is the driving force and the interpretation of that driving force. As stated in PJM filing (FERC Docket No. ER15-623-000,filed Dec. 12, 2014), there are concerns the current resource adequacy construct will fail to provide adequate incentives for resource performance. There is discussion of forced outage rates rising over time and the impact of the 2014 polar vortex.

PJM quickly blames the current construct of the capacity market as the root of the issue. It notes that the last 10 years have seen an increase of EFORd (Equivalent Forced Outage Rate - Demand). That should be expected, however, given the market transition from regulation to deregulation and the associated fall in power prices. If power prices were to increase, then the value to maintain and operate the plant to minimize EFORd would naturally occur.

Figure 3 - Added Payment = More Supply?

Figure 3 - Added Payment = More Supply?

The polar vortex event of January 2015 also was pointed out by PJM as a demonstration of all that had gone wrong:

"[I]nadequate incentive[s] to improve generation resource availability, the challenges under the current RPM rules to recover firm gas transmission costs or other investments and expenses associated with improving resource performance and availability, and an increasing reliance on gas-fired resources, were starkly illustrated by the poor resource performance in the PJM Region in January, 2014," according to PJM.

The current RPM is not designed to be focused on winter events. However the energy market forces should be sufficient if given the opportunity to work. The whole concept of deregulation is competition and allowing the price of the market to drive that competition. The energy markets did respond in the polar vortex and several units that could not generate lost a significant revenue opportunity. AEP ended with record profits during the first quarter of 2014, almost doubling those during the first quarter of 2013.

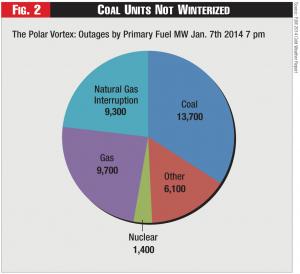

The issues leading to the polar vortex generation supply crunch resulted from an immature competitive market not fully understanding weather-related risk events. In reviewing the plant-related outages, note the largest plant outage block was from coal units, not gas units. The overall outage levels were quite large. Most of it can be explained by appreciating what has occurred in the market place over the past few years.

For the past two years, PJM observed relatively mild winters. In addition, in each of those two years, the low natural gas price eroded the energy share of coal generation. For most of 2013, you had the natural gas price forward prices below $4/MMBtu throughout the winter of 2013/2014. Low gas prices also led to low power price expectations. In addition, 2012 and 2013 were not good years for any generators, in particular coal generators, due to the low power prices. It would be very reasonable to expect a senior commercial operations manager to question the budget for winterizing coal units to run in the winter time leading into the 2013/2014 winter. Based on two years of history, one could see that coal plants did not run significantly, yet required a fixed cost for operations and management that was not being recovered. In my estimate, many took the gamble to cut the maintenance allocation for winterizing the coal units. The data potentially shows this to be the case. However, given the missed opportunity for energy revenue, I strongly believe that today's senior manager is not questioning the budget request from the coal plants or for that matter any units with minimal cost to winterize for the next few winters. The manager can get fired for making the mistake twice, but he/she won't get fired for spending more fixed cost on a unit that may not run this winter given the value left on the table demonstrated in 2014.

In addition, any outages caused by interruptions in natural gas fuel deliveries, can also be attributed partially to the past and the natural evolution of the free market. Typically, in earlier years, gas units had not run very much, particularly in the western Pennsylvania and Ohio regions. And utilities can always choose to purchase firm gas capacity. But because the units historically didn't run much, fixed costs would translate to a much higher gas bidding cost, which in turn would lead to even less running of the gas plants. When I was at AEP, I was promoting buying firm capacity and selling the capacity to various counter parties during low usage time periods to mitigate some of the cost. However as many know well, change is very hard for utilities. There is more risk than reward in changing behavior. Even though generation is now deregulated for many utilities, it still takes time to change the culture. It will change. But one shouldn't expect it to change within only a few years. Given that gas prices have been competitive for multiple years and even for last year's winter event, gas generators should have learned the value of buying firm capacity. I am confident firm gas transport is being purchased now and will grow in the future. Sometimes, the market needs time to learn from first-hand experience - and not just from the advice of others.

Outlook

RTOs were created as a result of deregulation. And deregulation was going to offer reductions in cost, as utilities were perceived to be poorly run and inefficient. Free market competition for power generation would eliminate poor decisions and streamline cost, saving money for consumers. Yet the constant market tinkering and continued growth in the cost of capacity is eroding free-market principles. Free markets need to learn from the market - not to be coddled by additional monetary mechanisms - or else the system becomes more costly and complex than regulation. This new capacity construct adds to more uncompetitive cost structure. It will produce a safe environment for reliability - but so did regulation. PJM will be creating a system of limited downside risk with all the upside rewards. Case in point: at AEP Ohio, historical earnings for 2014 Q1 would have been shared back across the system in a regulated framework.

Instead, PJM might do well to think about raising the price cap - and not just temporarily, as during last winter's polar vortex event, but permanently. Limited price caps require a costly and potentially complex capacity market. ERCOT is able to attract large amounts of generation with no capacity market. There should be a happy medium in between. If we want to keep it "safe" then let us go back to regulation or let the market learn its lesson and come up with a more market based solution so we can create something great and noble.

Related: See PJM’s Three-Way Proposal: A re-defined capacity product, revised parameters for generator performance, and a new role for demand response, by Bruce w. Radford.

Lead image © Can Stock Photo Inc. / GeraKTV