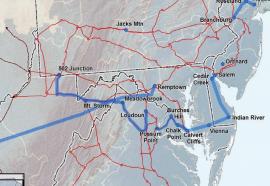

ITC Shareholders Approve Entergy Acquisition

Submitted by aburr on Sun, 2013-04-28 20:08ITC Holdings shareholders approved the proposed acquisition of Entergy’s transmission business. The transaction is expected to close by the end of 2013, subject to regulatory approvals and closing conditions.